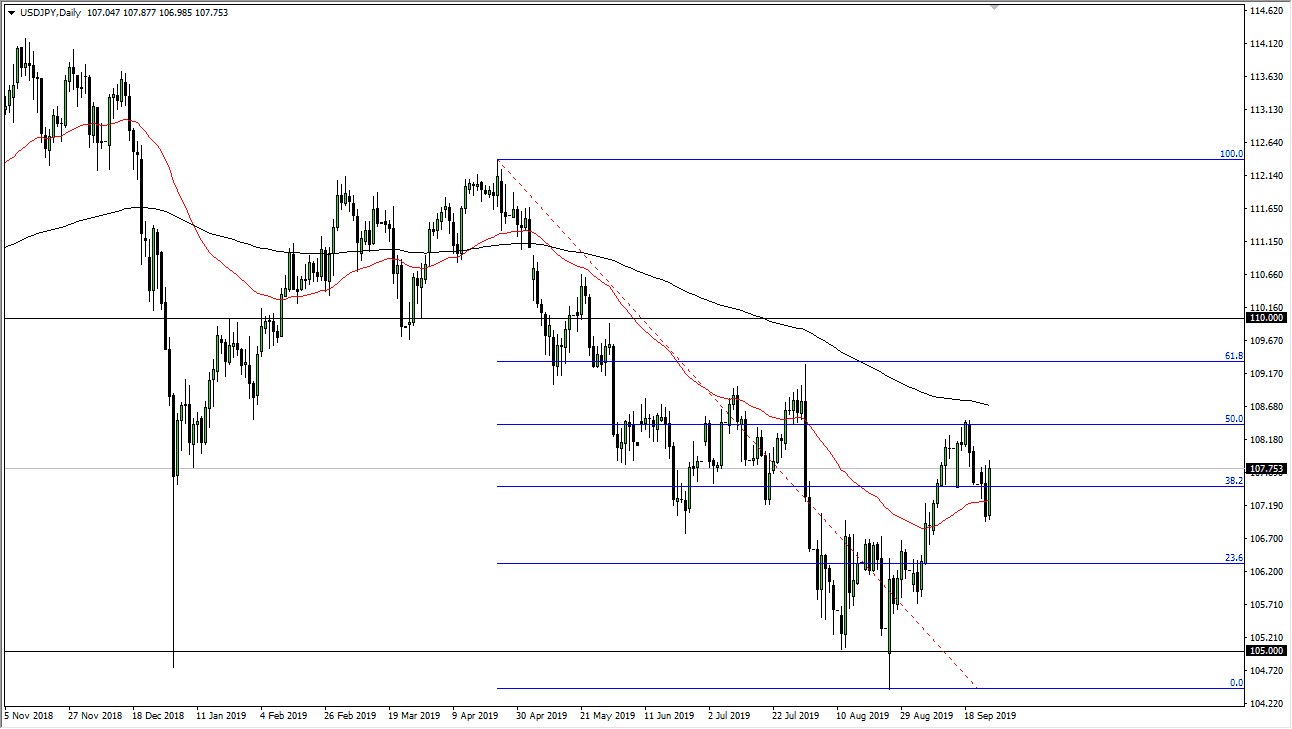

The US dollar has shown signs of strength during the trading session on Wednesday, breaking back above the 50 day EMA as we continue to dance around that significant technical indicator. At this point, the market looks likely to see a reach towards the 200 day EMA again, which would be simply revisiting the highs that we had made just a few trading sessions ago.

Keep in mind that the USD/JPY pair is very sensitive to the risk appetite of the markets in general, so at this point it’s very likely that the market is going to continue to follow right along with what the S&P 500 does in general. That being said, it is worth paying attention to how risk is spread around the world, and we did see a bit of a turnaround when it came to the S&P 500 after an initial selloff. This shows the resiliency of the market right now, and therefore I anticipate that we will see a lot of back-and-forth but ultimately the S&P 500 is going to be your secondary indicator for this market in general.

Looking at the candle stick, it’s especially impressive considering that if you were to make the last two days a “48 hour candle”, it would essentially form a massive hammer. By wiping out the entire selling pressure from the previous session, that of course is a bullish sign. The question now is whether or not we can break above the 200 day EMA, or the 50% Fibonacci retracement level? While I do think that’s possible, the reality is that it’s going to take a certain amount of momentum to make that happen, so we would obviously need to see some type of major catalyst for a larger move. With that in mind, I believe that the market is going to be very noisy in general but for those who are short-term day traders, then this could be a very nice trading range between the 50 day EMA and the 200 day EMA. I suspect that we are going to continue to see a lot of choppiness, and confusion on an almost daily basis. It does look like we are trying to form some type of major bottoming pattern, but we have quite some way to go before that actually kicks off as it would also involve breaking the 200 day EMA.