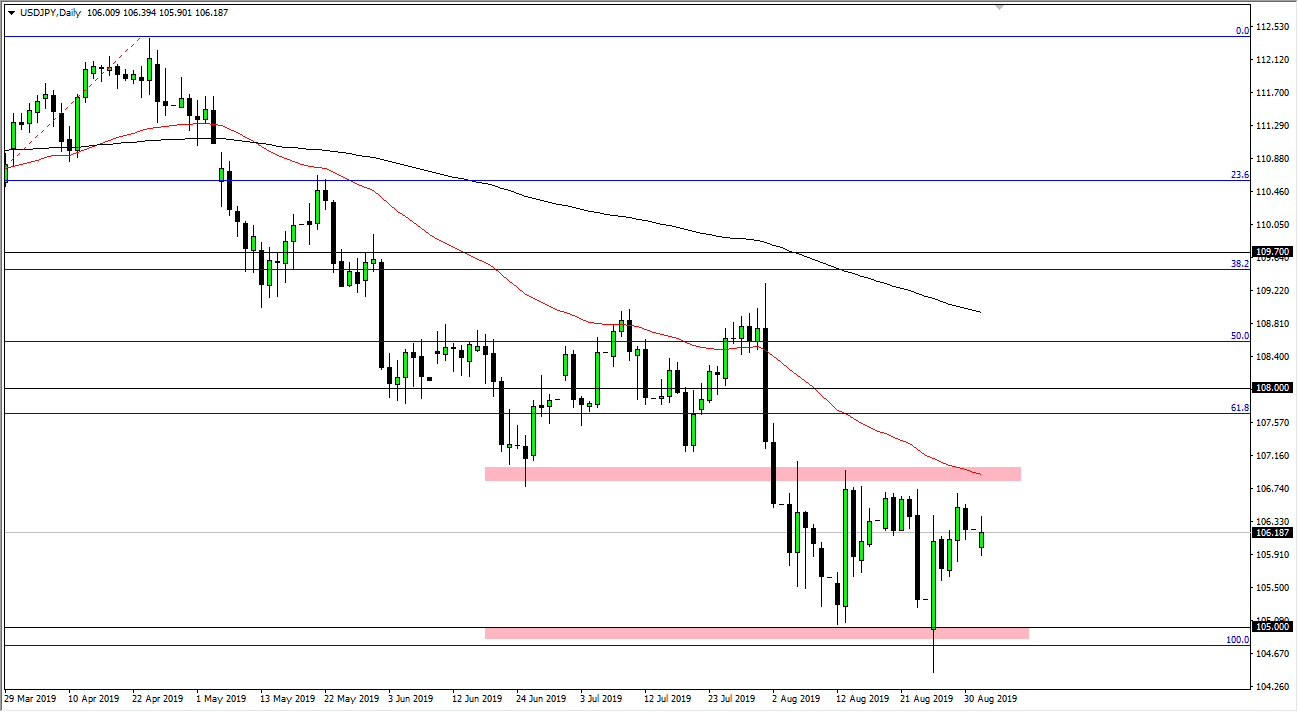

The US dollar gapped lower to kick off the week, as traders were concerned about the United States and China adding more tariffs upon each other, so it makes quite a bit of sense that we haven’t been able to break out of the range that we have been in for some time. The ¥107 level above is resistance, just as the 50 day EMA is crossing it. With that being the case, it’s very likely that the market will stay within this range that we have been in for some time. That means that the ¥105 level should continue to offer support, and as the jobs number comes out on Friday it’s very likely that we will continue to see a lot of back-and-forth.

That being said though, if we did break above the 50 day EMA on a daily close, that could send the USD/JPY pair towards the ¥108 level. All things being equal though, we are well below the 61.8% Fibonacci retracement level and have already tested the 100% Fibonacci retracement level. If that gets broken to the downside, meaning roughly ¥104.75, then we could continue to go much lower. At that point I would suspect that a move to the ¥102.50 level, and then possibly the ¥100 level.

I think at this point though the next couple of days will probably continue to see a lot of back-and-forth, as the jobs number on Friday will probably be the biggest mover of the markets, barring some type of Tweet or headline out of China. It certainly looks as if we are kicking off the week on the back foot, so it’s likely that the Japanese yen will continue to attract a certain amount of attention.

Short-term rally should be nice selling opportunities, perhaps reaching selling opportunities above that could continue to offer value in the Japanese yen. Ultimately, with the geopolitical issues out there and the trade war going on it makes quite a bit of sense that traders continue to prefer the safety of the Japanese yen. Remember, this pair tends to follow risk appetite in general, so therefore you can probably watch the stock markets for a bit of a hint, as the market uses the USD/JPY pair as an expression of risk appetite overall. While the US dollar is considered to be a safety currency, it’s a relative situation and therefore plays second fiddle to the Japanese yen.