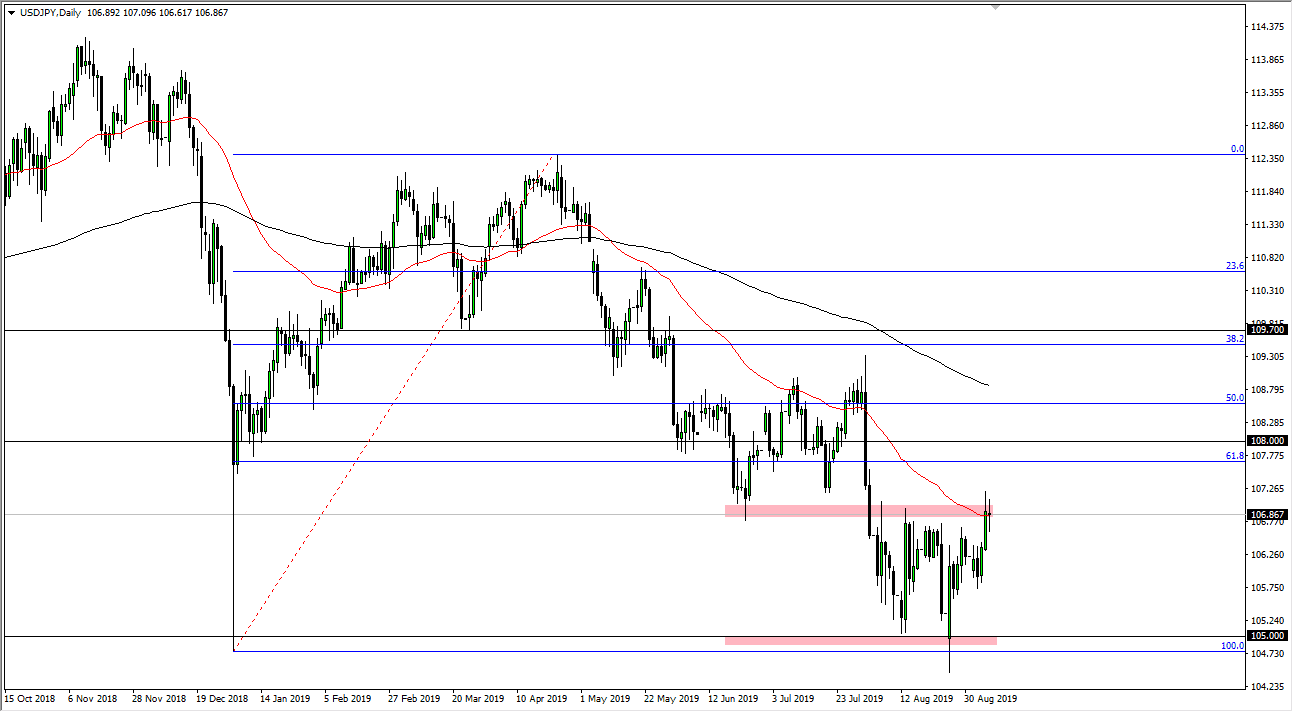

The US dollar has gone back and forth during the trading session on Friday against the Japanese yen as the jobs number came out slightly lower than anticipated. We are currently trading at the ¥107 level, an area that has been resistance more than once. Beyond that we have the 50 day EMA, which of course is attractive for longer-term trading. At this point in time it’s very simple trade for me, I’m willing to sell on a break down below the bottom of the candle stick as it shows that we are going to return to the consolidation area.

Ultimately, if we break above the highs from the Thursday session, it’s likely that we could go to the ¥108 level, and then possibly even the ¥109 level. The 200 day EMA is just below the ¥109 level, so pay attention to that as well. Ultimately, this is a market that should continue to show signs of exhaustion eventually, but we may have gotten a bit ahead of ourselves to the downside.

Keep in mind that the pair is highly sensitive to risk appetite, and risk appetite has gotten a bit of a shot on the arm lately due to the fact that the US and China are starting to talk again. That’s a good sign for risk appetite and therefore risk assets such as the stock market, which has a very high correlation with this market. This is especially true when you’re talking about the S&P 500, so pay attention to both markets simultaneously. Ultimately, this market only have so far it can go to the upside, because quite frankly there are more than enough problems out there to keep this market on its heels. It’s only going to take one negative headline coming out of either Donald Trump or Beijing to throw uncertainty back into the marketplace and send this pair lower. Beyond that, the Japanese yen of course is the most “safety currency” out there, so even if the US dollar gets a bit of a bid it could be different here. Ultimately, I like the idea of fading a rally if we do break out but will have to keep an open mind as it’s more about what the markets going instead of what I’m thinking. Currently, it looks like we could get that’s a short-term break out but longer-term I still think we have problems.