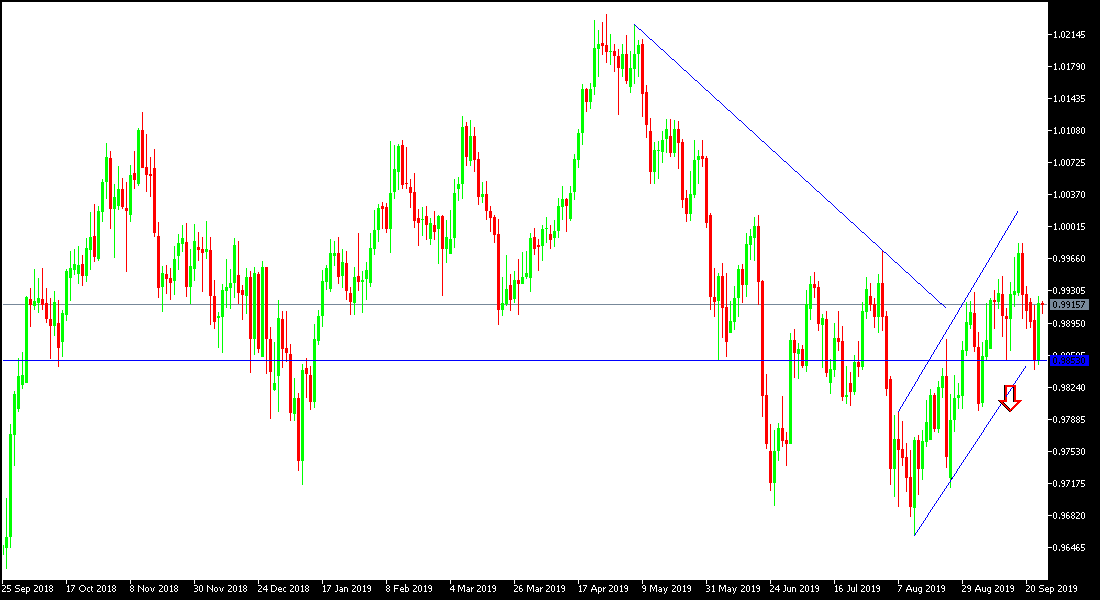

Since the beginning of this week, the USD / CHF is in a bearish correctional range, pushing it towards the 0.9843 support level, its lowest level in nearly three weeks. The return of optimism and risk appetite, pushed the pair up again to the 0.9224 resistance, before settling around 0.9915 at the time of writing. The 0.9900 level is still neutral and at the same time supports a bullish correction, as opposed to 0.9800 support. According to Fibonacci levels, the price is already testing the 50% level at 0.9915, which lines up with a previous support zone. A larger correction may continue until 61.8% at 0.9930 or a broken wedge bottom at the simple psychological level of 0.9950. On the other hand, the 100 SMA remains below 200 SMA in the long term, indicating that the strongest trend is still down.

The RSI is moving lower from the overbought zone to indicate that sellers are selling and buyers are taking a break for some time. Likewise, Stochastic is in overbought territory indicating that bears may control the performance. USD / CHF could reach as low as 9845 or below and breach the 0.9800 support, thus erasing the upside expectations.

The US dollar has gained momentum against other major currencies. Against the backdrop of Trump's remarks, where he pointed out that a trade deal with China could occur “sooner than originally thought” although this comes after his remarks that the US would not accept a “bad deal” for the American people.

As for the economic data, the US dollar will be greatly affected by the release of GDP figures, jobless claims and pending home sales today. Tomorrow will have the announcement of the Durable Goods Orders report, personal spending and income figures. Few members of the Federal Open Market Committee are due to make statements today.

There are no major catalysts for the CHF, but it should be noted that traders are generally aware of this currency because the ECB has already eased monetary policy. Keep in mind that the SNB is keen to keep the EUR / CHF rate at a certain level and will not hesitate to intervene in the forex market if they believe that the value of the pair drops very quickly.