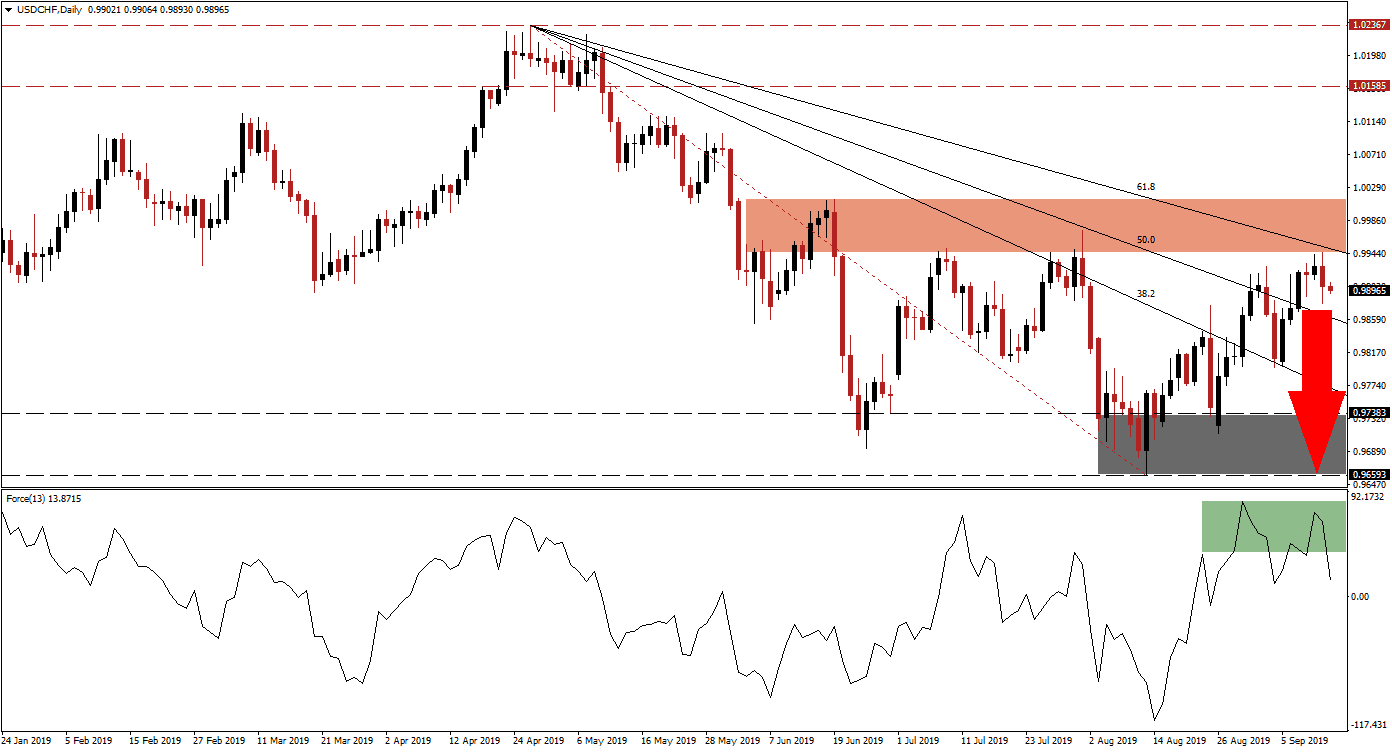

The USD/CHF accelerated to the upside as the rise in risk-off sentiment resulted in forex traders rotating out of the safe-haven Swiss Franc. In a slowing global economy, Switzerland has provided a rare bright spot which added to the capital inflow into the currency. Following positive news flow surround the US-China trade war, the USD/CHF accelerated to the upside with a breakout above its support zone located between 0.96593 and 0.97383, marked by the grey rectangle. Bullish momentum further pushed price action above its 38.2 Fibonacci Retracement Fan Resistance Level as well as above its 50.0 Fibonacci Retracement Fan Resistance Level, turning both of them into descending support levels. The rally stalled at the 61.8 Fibonacci Retracement Fan Resistance Level where bullish momentum started to deplete.

What is the Fibonacci Retracement Fan?

The Fibonacci Retracement Fan is a different visualization of the Fibonacci retracement sequence which outlines important support and resistance levels in technical analysis. Those levels warrant a closer look and offer entry and exit levels for trades together with other aspects of the analysis.

The Force Index, a next generation technical indicator, advanced with the three breakouts which took the USD/CHF from its support zone above its 50.0 Fibonacci Retracement Fan Resistance Level. Following this move, price action moved further to the upside but the Force Index started to contract, marked by the green rectangle. This created a negative divergence which preceded yesterday’s reversal from its intra-day high of 0.99459, touching its 61.8 Fibonacci Retracement Fan Resistance Level and accompanied by an increase in bearish momentum.

What is the Force Index?

The force index is considered a next generation technical indicator. As the name suggests, it measures the force behind a move. In other words, forex traders will get a better idea behind the strength of bullish or bearish pressures which are driving price action. The indicator consist of three components (directional change of the price, the degree of the change and the trading volume). This creates an oscillator which in conjunction with other aspects of technical analysis provides a good indicator for potential changes in the direction of price action. It subtracts the previous day closing price from today’s closing price and multiplies it by the volume. Strong moves are supported by volume and create the most accurate trading signals.

The intra-day high of 0.99459 also represents the bottom range of its resistance zone with a top range defined by another intra-day high of 1.00139, marked by the red rectangle. The negative divergence in the Force Index has resulted in a sharp drop in this technical indicator and while it remains in bullish territory, the magnitude of the correction is expected to result in a move below the 0 center line. This would put bears in control of price action and is expected to result in a breakdown in the USD/CHF below its descending 50.0 Fibonacci Retracement Fan Support Level. The failure of preceding rally to push above its 61.8 Fibonacci Retracement Fan Resistance Level kept the long-term downtrend intact and another breakdown is expected to follow.

What is a Breakdown?

A breakdown is the opposite of a breakout and occurs when price action moves below a support or resistance zone. A breakdown below a resistance zone could suggest a short-term move such as profit taking by forex traders or a long-term move such as a trend reversal from bullish to bearish. A breakdown below a support zone indicates a strong bearish trend and the extension of the downtrend.

Forex traders should now monitor price action as it approaches the 50.0 Fibonacci Retracement Fan Support Level as well as the Force Index. The US economy continues to print data which suggests more weakness ahead and with more easing expected by the US central bank, the US Dollar is likely to face more downside pressure. Coupled with overly optimistic expectations for next month’s trade talks between the US and China, the USD/CHF is perfectly set-up for a full retracement of its rally with a series of breakdowns until price action can challenge its intra-day low of 0.96593 which marks the bottom range of its support zone

What is a Support Zone?

A support zone is a price range where bearish momentum is receding and bullish momentum is advancing. They can identify areas where price action has a chance to reverse to the upside and a support zone offers a more reliable technical snapshot than a single price point such as an intra-day low.

USD/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.99000

Take Profit @ 0.96600

Stop Loss @ 0.99750

Downside Potential: 240 pips

Upside Risk: 75 pips

Risk/Reward Ratio: 3.20

In order for the USD/CHF to extend to the upside a fundamental catalyst would be required which is currently unavailable and unexpected. Downside momentum in the Force Index is on track to push it into bearish territory below the 0 center line which is most likely to coincide with a breakdown below the 50.0 Fibonacci Retracement Fan Support Level. Despite the absence of an upside catalyst, forex traders should always monitor developments closely as unexpected events will have an impact on price action. Any potential upside move is expected to be contained to the upper range of its resistance zone at 1.00139.

What is a Resistance Zone?

A resistance zone is a price range where bullish momentum is receding and bearish momentum is advancing. They can identify areas where price action has a chance to reverse to the downside and a resistance zone offers a more reliable technical snapshot than a single price point such as an intra-day high.

USD/CHF Technical Trading Set-Up - Breakout Extension

Long Entry @ 0.99350

Take Profit @ 1.00100

Stop Loss @ 0.99000

Upside Potential: 75 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 2.14