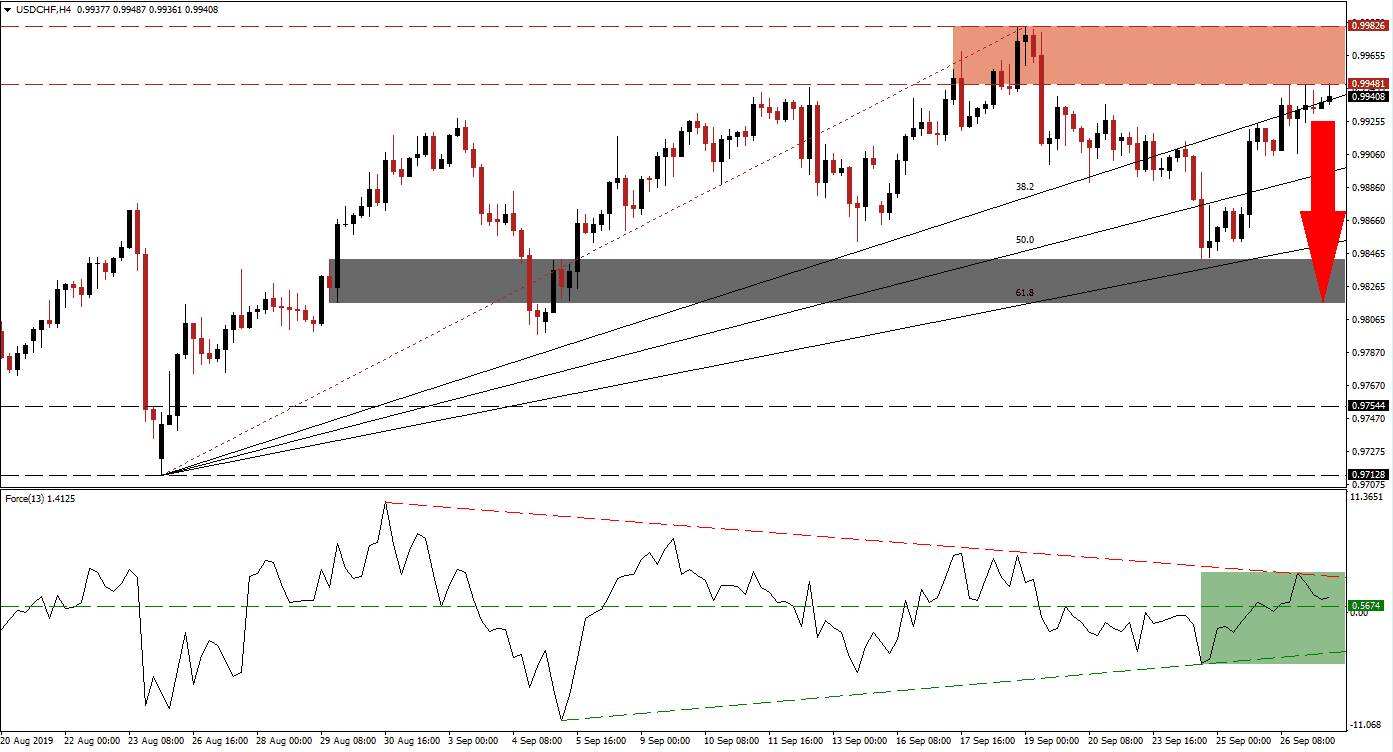

Following a contraction into the top range of its support zone, the USD/CHF reversed direction and accelerated to the upside. Price action is now trading above-and-below its ascending 38.2 Fibonacci Retracement Fan Support Level which is located just below the bottom range of its resistance zone. Bullish momentum started to weaken as bears make their stand and the Trump impeachment inquiry which was launched on Tuesday is further enforcing the resistance zone. A breakdown below the Fibonacci Retracement Fan Support could follow , especially if economic data out of the US will disappoint.

The Force Index, a next generation technical indicator, confirmed the loss of bullish momentum as its was unable to push above its descending resistance level. Downside pressure is now likely to force this technical indicator below its horizontal support level which will turn it into support. The contraction in the Force Index as a result of its descending resistance level is marked by the green rectangle. More net sell orders are likely to follow a contraction below its horizontal support level which is expected to take the Force Index into negative territory, placing bears in control of price action. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

As the USD/CHF is being pressured into a correction by its resistance zone, located between 0.99481 and 0.99826 which is marked by the red rectangle, forex traders should monitor the intra-day low of 0.99066. This represents the current low since the bottom range of the resistance zone started to reject a further advance in price action. A move below this level, confirmed by a breakdown in the Force Index, is expected to result in a contraction below the ascending 50.0 Fibonacci Retracement Fan Support; this would turn it into resistance and clear the path for more downside to follow.

With bearish momentum on the rise, a sell-off in the USD/CHF back into its short-term support zone cannot be ruled out. This support zone is located between 0.98174 and 0.98435 which is marked by the grey rectangle. The Swiss Franc may benefit from an inflow of safe haven capital as forex traders await more developments on the trade front between the US and China as well as the events surround impeachment developments out of the US. The technical scenario favors a price action reversal into its support zone, especially if the Force Index completes a breakdown. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

USD/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.99400

Take Profit @ 0.98250

Stop Loss @ 0.99750

Downside Potential: 115 pips

Upside Risk: 35 pips

Risk/Reward Ratio: 3.29

A recovery in the Force Index could reignite bullish momentum if this technical indicator can complete a breakout above its descending resistance level. A fundamental catalyst, such as an upside surprise in today’s economic data out of the US, would be required to extend the rally in the USD/CHF. A breakout above its resistance zone is not expected given the fundamental scenario. The next resistance zone is located between 1.00978 and 1.01196.

USD/CHF Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.00100

Take Profit @ 1.01000

Stop Loss @ 0.99800

Upside Potential: 90 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 3.00