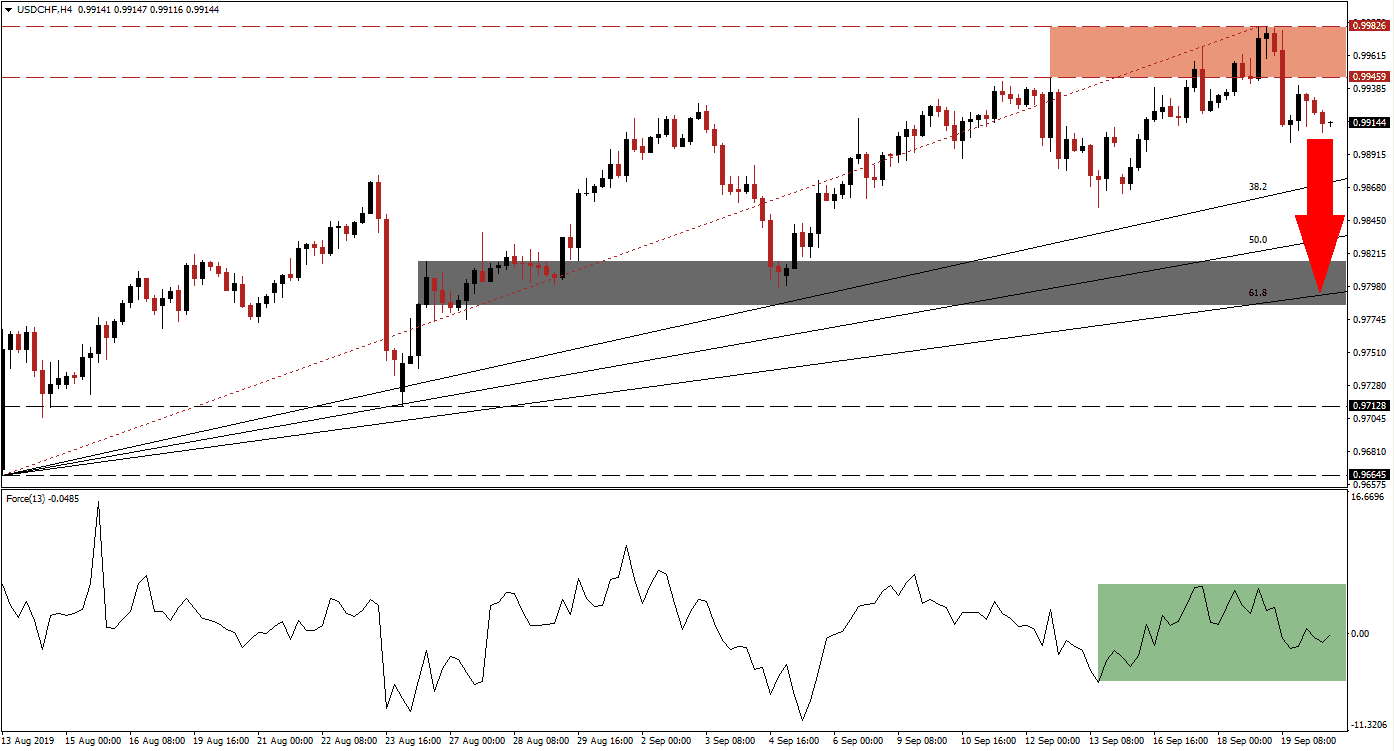

Selling pressure in the USD/CHF has increased as a risk-off sentiment is accompanying the end of the trading week. The breakdown below its resistance zone has added bearish momentum as price action is now approaching its 38.2 Fibonacci Retracement Fan Support Level. Trade jitters between the US and China are flaring up again which is adding to capital inflow into the Swiss Franc, considered a safe haven currency. The most recent rally in this currency pair, which originated from its intra-day low of 0.96645, resulted in a series of five higher lows and was well supported by the 38.2 Fibonacci Retracement Fan Support Level.

The Force Index, a next generation technical indicator, has confirmed the last three higher lows with a series of higher lows of its own. As the USD/CHF recorded its current intra-day high of 0.99826, the Force Index formed a shallow negative divergence; this occurs when the underlying technical indicator doesn’t record a new high to confirm the move in price action. A breakdown below its resistance zone followed and the Force Index moved into negative territory, putting bears in control as marked by the green rectangle. A violation of the uptrend could result into a bigger sell-off and take the USD/CHF into its next short-term support zone. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

In order to violate the current uptrend, price action needs to sustain a move below the intra-day low of 0.98998 which represents the fifth higher low of the uptrend. A confirmed breakdown should take the USD/CHF into its 38.2 Fibonacci Retracement Fan Support Level and if the Force Index will slide deeper into negative territory, more downside should be expected. The next key price level to watch out for would be the intra-day low of 0.98539 which would take this currency pair close to its 50.0 Fibonacci Retracement Fan Support Level.

The rise in bearish momentum may result in a wider sell-off, especially if the Force Index will record a lower low as part of the expected breakdowns. This will bring the next short-term support zone into play which is located between 0.97855 and 0.98157, marked by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level is currently passing through this support zone. A new fundamental catalyst would be required in order to push price action into its next long-term support zone which is located between 0.96645 and 0.97128. A reversal in the Force Index could lead to a retracement back into its resistance zone, from where a breakout is unlikely given the current fundamental as well as technical picture. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

USD/CHF Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 0.99150

Take Profit @ 0.98000

Stop Loss @ 0.99450

Downside Potential: 115 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 3.83

A sustained reversal in the Force Index could lead to a retracement of the breakdown below its resistance zone which is located between 0.99459 and 0.99826, marked by the red rectangle. Upside potential is limited to its intra-day high of 1.00139 which represents a short-term breakout above its resistance zone from where a previous sell-off originated.

USD/CHF Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 0.99500

Take Profit @ 1.00000

Stop Loss @ 0.99250

Upside Potential: 50 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 2.00