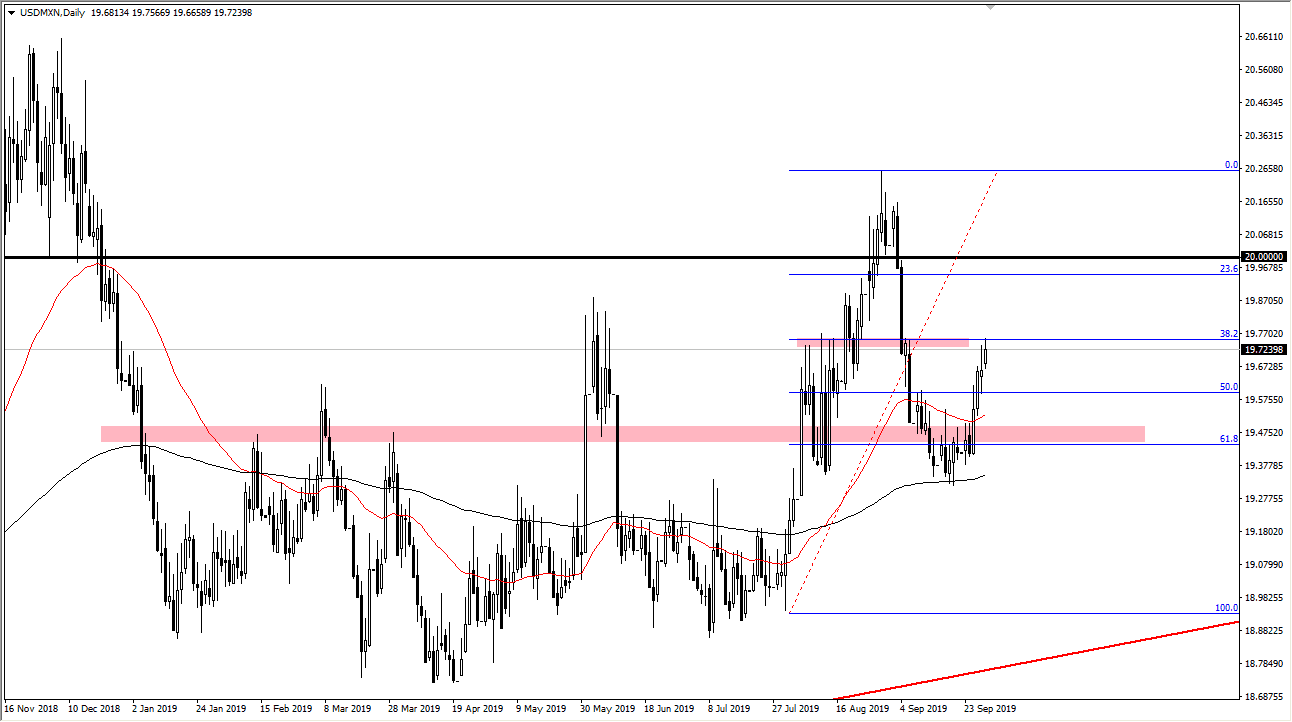

The US dollar has been grinding higher for several days against the Mexican peso now, and Monday of course wasn’t any different. The miter barrier at the 19.77 MXN level has caused a bit of a pullback later in the day, but one thing that should be noted is that we have broken above the top of a very bearish looking candle stick from the previous session. That of course suggests that the buyers are going to continue to be aggressive, and it looks like they are trying to break out to the upside.

Further driving home the bullish scenario is that we have pulled away from the 61.8% Fibonacci retracement level, broken above the 50% Fibonacci retracement level, and now find the market testing the 38.2% Fibonacci retracement level. Although most traders look for a pullback to one of those levels to start trading, I have noticed over the years that quite often the marketplace will pause at each level on the way back up. Because of this, and the fact that there was so much resistance in July and into early August near the 19.77 MXN level suggests that we have a little bit of a fight on our hands. However, it currently looks as if any pullback will more than likely be met with buying pressure.

What this means is that clearing the 19.77 MXN level allows for the market to continue going higher. At that point I would anticipate that the market would probably grind its way towards the 20 MXN level, an area that obviously will attract a lot of attention due to the fact that it is a large, round, psychologically significant figure. Beyond that, another thing that could drive this pair higher is a bit of a “risk off” trade as money flows north into the United States and away from riskier Latin American projects.

To the downside, I would fully anticipate that the 19.55 MXN level should offer plenty of support, and of course the 50 day red EMA which is just below that level as well. I believe buying pullbacks at this point should continue to offer a nice opportunity, as it represents value in one of the most favored currencies right now. Unless we get some type of major “risk on” move, the Mexican peso will probably struggle. Beyond that, if the crude oil markets break down further, that also puts upward pressure here.