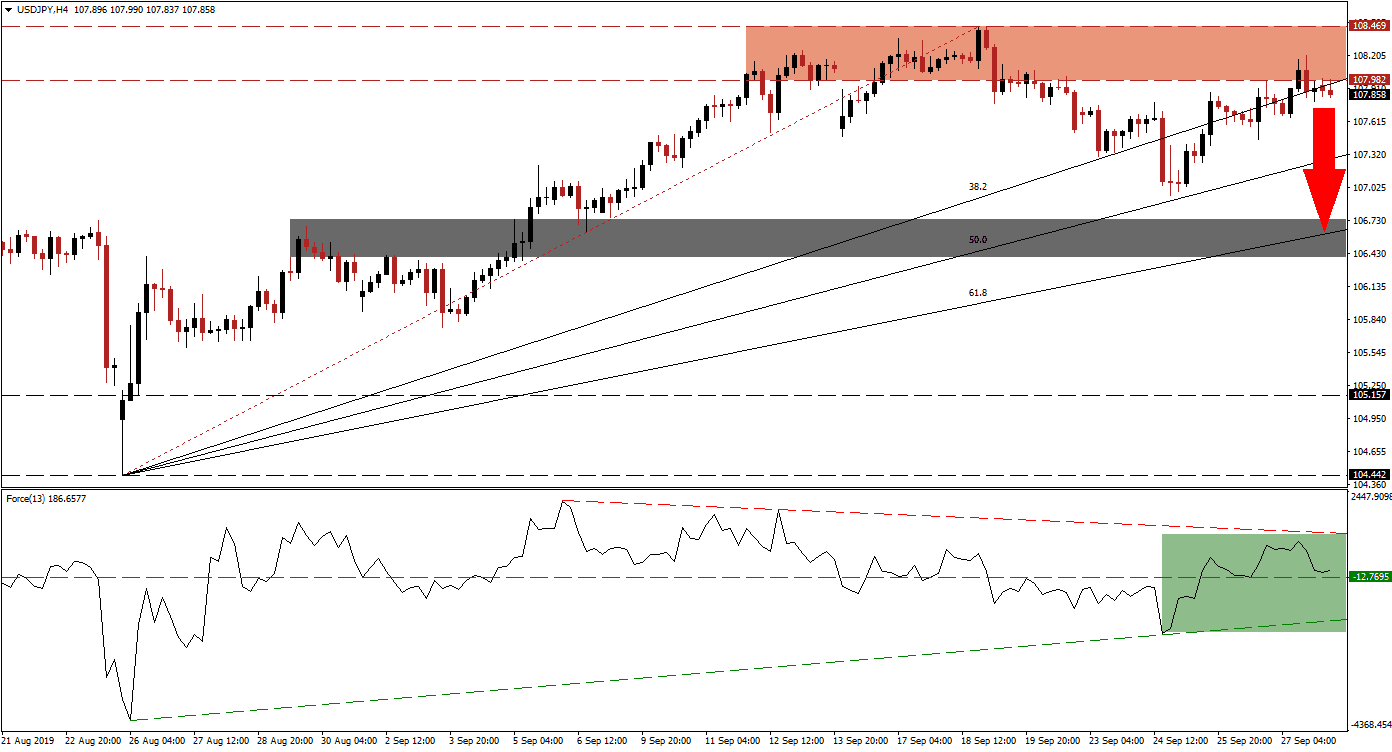

Weaker-than-expected economic data out of Japan prevented the USD/JPY to start a reversal, but bearish pressures are on the rise which kept price action hovering just below its resistance zone. The 38.2 Fibonacci Retracement Fan Support Level just crossed the bottom range of the resistance zone and this currency pair move below it, turning it from support to resistance. This added to bearish pressures which are likely to increase as forex traders seek safe haven currencies amid the rise in tensions between the US and China; both are expected to meet in Washington on October 10th.

The Force Index, a next generation technical indicator, remains in positive conditions and above its horizontal support level which suggests that bulls are still in control of price action. The descending resistance level is approaching and has rejected further upside which resulted in a loss in bullish momentum; this is marked by the green rectangle in the chart. A move below its horizontal support level is likely to result in the addition of new net short positions in the USD/JPY and force more downside. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

With the rise in bearish pressures, the intra-day low of 107.656 should be monitored. This level represents the low of the previous push above 38.2 Fibonacci Retracement Fan Support Level which led into a brief move into the resistance zone before reversing. The resistance zone is located between 107.982 and 108.469 which is marked by the red rectangle. As the Fibonacci Retracement Fan sequence is starting to pass through the resistance zone, the USD/JPY is becoming vulnerable to a quick sell-off. While Japanese economic data has delayed such a move, it will be trumped by trade developments between the US and China.

A move below the 107.656 level, if confirmed by a contraction in the Force Index into negative territory and below its horizontal support level turning it into resistance, is expected to lead to a series of breakdown below the Fibonacci Retracement Fan sequence. This would turn it from support to resistance and the USD/JPY is expected to challenge its next short-term support zone which is located between 106.398 and 106.743 as marked by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level is nestled inside this zone. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

USD/JPY Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 107.900

- Take Profit @ 106.500

- Stop Loss @ 108.250

- Downside Potential: 140 pips

- Upside Risk: 35 pips

- Risk/Reward Ratio: 4.00

Should the Force Index reverse and push through its descending resistance level, the USD/JPY could attempt a breakout above its resistance zone. A fundamental catalysts would be required, but the current scenario favors a correction in this currency pair. Any potential breakout is likely to remain limited to its next short-term resistance zone which is located between 108.981 and 109.307.