Investors' appetite for safe havens increased, supporting stronger USD/JPY losses, pushing it towards 106.95 support level before settling around 107.35 at time of writing. US consumer confidence deteriorated more-than-expected in September. Consumer confidence fell to a reading of 125.1 in September from a revised 134.2 in August. Economists had expected the consumer confidence index to fall to 133.0 from 135.1, which was originally announced the previous month. Growing tensions regarding tariffs in late August appear to have angered consumers. Economists believe that confidence may remain hovering around current levels for months to come. The larger than expected decline in the Consumer Confidence Index reflects significant declines by both the Current Status Index and the Expectations Index.

The Japanese yen is ready to make further gains if global trade and geopolitical tensions increase.

In the morning, BOJ board member Takako Masai said the BOJ is ready to take additional easing measures if it loses momentum towards the inflation target. Masai told Mei business leaders that the bank will carefully study the risks to foreign economies and carefully assess how these risks affect Japan's economic activity. He expressed concerns about developments in foreign economies - the speed of approaching Brexit deadline and US-China trade issues.

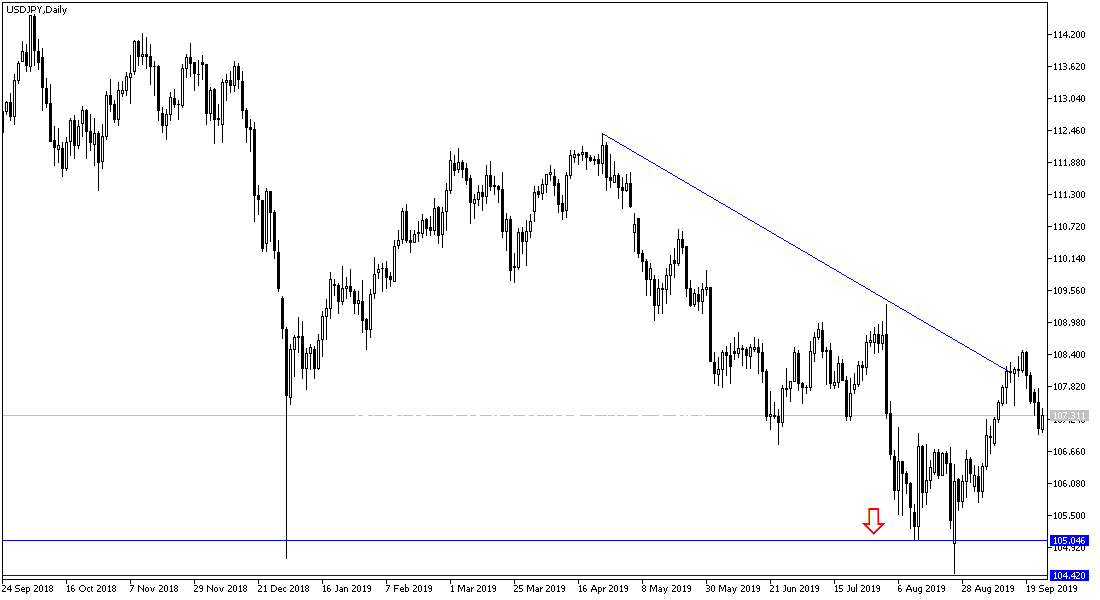

According to the technical analysis of the pair: as shown on the daily chart, any move of USD / JPY below the 107.00 support level will increase the bearish momentum and negatively affect the recent expectations for a correction higher, especially as the pair failed to break the 108.47 resistance level last week. Currently, the closest support levels are 106.90, 106.20 and 105.45, which confirm the strength of the collapse. In case of an upward correction, the pair will be on a mission to breach the 107.85 and 108.50 resistance levels that support the move to target the psychological top at 110.00, which remains the key to the pair's bullish strength. I still prefer to buy the pair from every bearish level.

On the economic data front: The economic calendar today includes the announcement of new US home sales and oil inventories as well as remarks by some members of the Federal Reserve's monetary policy and any shift in the future of the bank's policy may affect the US dollar.