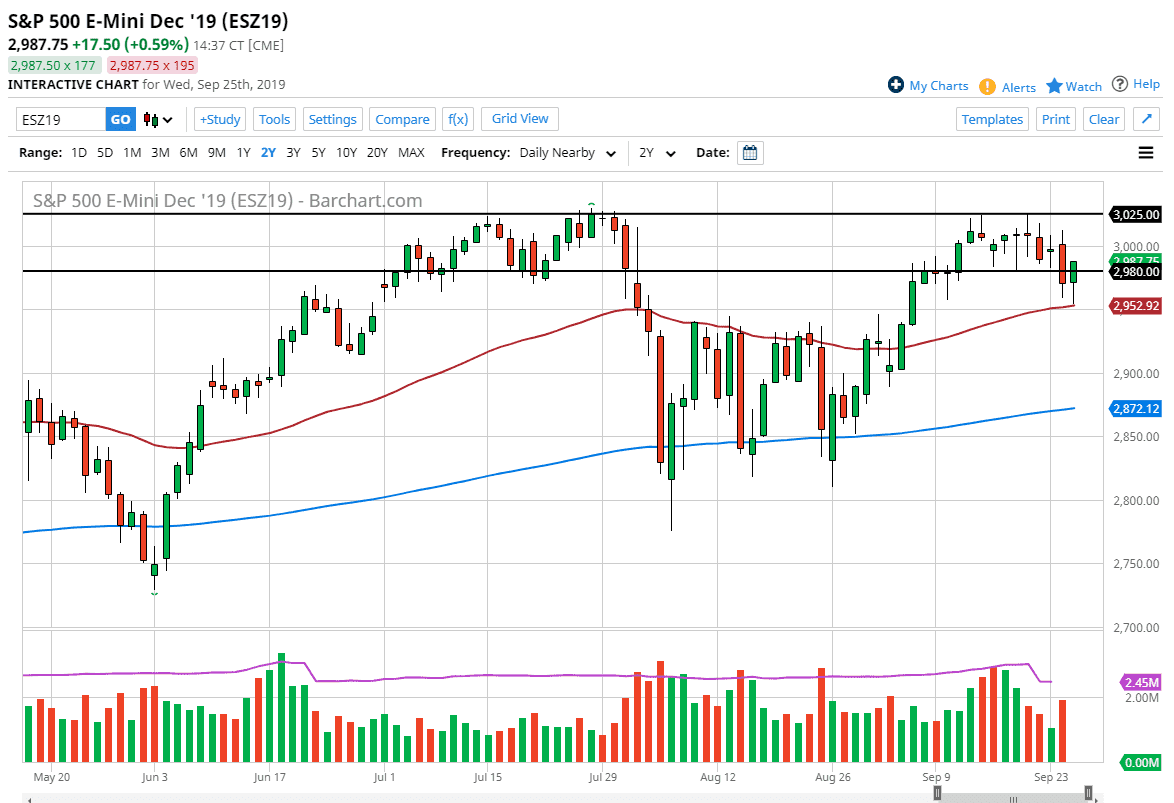

The S&P 500 initially fell during the trading session but found enough support near the 2950 level to turn around and form a rather bullish candle stick. That is also the scene of the 50 day EMA, which of course has a significant influence on the marketplace, and therefore it looks as if the uptrend has been maintained after all of those impeachment fears. The pullback was rather brutal, but when you look at the last couple of days, it’s essentially a hammer. It looks as if we are trying to find some type of momentum to continue to go higher, breaking above the recent highs. If we do that, then it’s very likely she continues to go much higher.

The alternate scenario of course is that we break down below the 50 day EMA, and if we do then it’s likely that we go down to the 2900 level. However, there’s also a lot of noise between here and there so I think it’s going to be difficult to do so, and I would think that there is only a matter of time before the buyers come in to pick up a bit of value in this market as it has been in and uptrend for so long.

Beyond that, we had formed a bit of a huge W pattern”, and therefore it’s likely that the buyers will continue to jump in. After the recovery during the trading session and not only the S&P 500 and the NASDAQ 100, I think it’s only a matter of time before the buyers return. I believe at this point it’s very likely that the short-term traders will be looking for opportunities to take advantage of a little bit of short-term weakness. If we were to break out to the upside then the target would be roughly 3100, as based upon the measured move from the previous consolidation area, and the longer-term uptrend lines that make up the up trending channel. All things being equal, I do think we get there but it’s going to be very noisy on the way up. Short-term traders will continue to look for bits of value and take advantage of them, especially if we can remain above the 50 day EMA on the daily chart. At this point, I don’t have any interest in shorting this market, as it is showing the resiliency during the day.