The Labor Day holiday on Monday will keep electronic trading in the S&P 500 a bit muted, unless of course we have some type of headline coming out of the weekend which at this point I would almost be willing to bet money on. Because of this, it’s almost impossible to give you honest analysis other than the technical analysis of this chart.

The situation between the United States and China will continue to take front and center stage, and it’ll be interesting to see whether not Donald Trump continues with the tariffs this weekend, and whether or not the market cares. After all, the Chinese have already said that they are not likely to retaliate, at least not now. That makes sense, considering that they have a lot to deal with in Hong Kong at the moment, so I don’t think they are looking for an escalation in this tension as well. That being said though, looking at the technical analysis I think you will more than likely continue to see the same type of action.

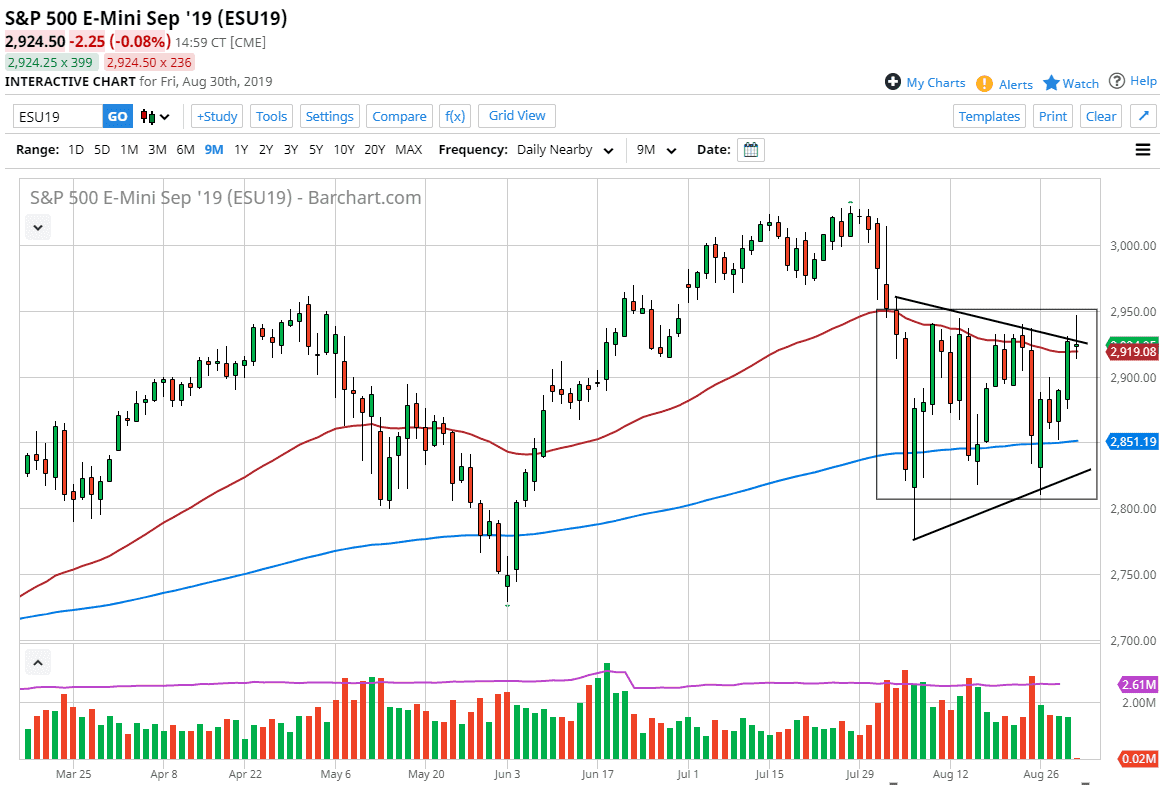

Looking at the chart, we are in a triangle, and it does look like we are going to break down based upon the shooting star. If we break down below the bottom of the Friday session I think will probably grind down to the 2900 level, and then possibly the 200 day EMA which is closer to the 2850 level. This being the case, I think that the market will be very noisy, and I think that there is no end of the volatility in sight. The fact that we have Labor Day on Monday and nonfarm payroll on Friday, this week is going to be more noise and trouble.

If we do break above the 2950 level though, we could go higher, perhaps reaching towards the 3200 level. The alternate scenario is that we break down below the 2800 level and unwind quite drastically. All things being equal though, I don’t think we are likely to see any type of clarity over the next several sessions so it’s more likely that we fall than rise based upon the chart. That being said, I wish I could tell you what’s going to come out of the mouths of leaders. At this point the market is simply trading on that type of motion more than anything else.