SP 500 likely to look for support just below.

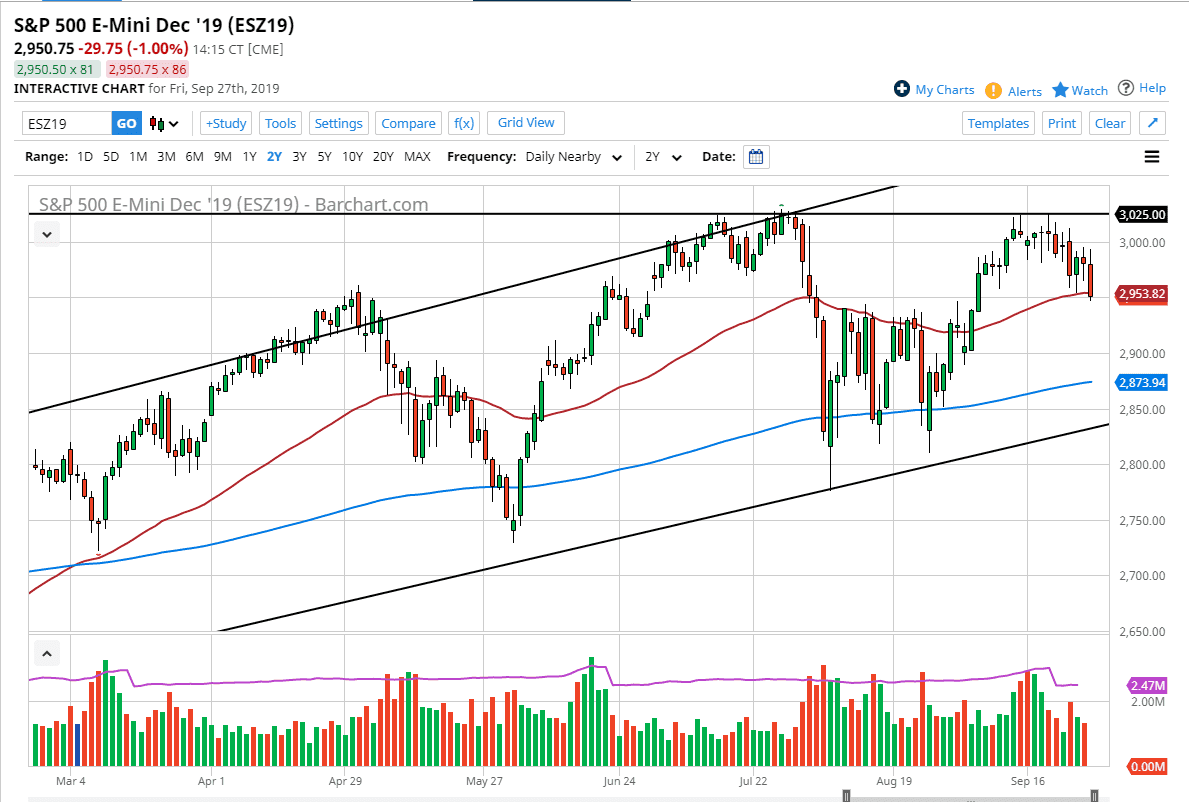

The S&P 500 initially tried to rally during the trading session on Friday but then broke down significantly just below the 3000 handle. At this point, the market reached down towards the 50 day EMA, which of course is an area that attracts a lot of attention. Beyond that, the 2950 level which was previous resistance is now offering support as well, so at this point we have at least two reasons to think that this area is probably going to continue to attract a certain amount of attention.

Towards the end of the day, it was noted that the United States was looking into options when it comes to preventing capital from flowing into China, so that could be a sign that the tensions are going to ratchet up again. That being said though, this is a market that has been extraordinarily resilient so it’s difficult to see this market breaking down drastically unless something happens over the weekend, which of course is quite possible. Looking at this market, it’s likely that value hunters will return rather soon, but if we were to break significantly below the 2950 handle, then the market could go down to the 2900 level next, followed by the 200 day EMA which is colored in blue.

I forcefully, we are in a scenario where computers are trading based upon headlines, so it’s a completely risk on/risk off type of scenario we find ourselves in. It’s all or nothing, and algorithm driven. Recently, it seems as if we have a huge fight every time we dip and at this point so far it has offered value. I suspect that during next week we should see a bit of bullish pressure, unless of course something truly stupid happens which we of course cannot rule out. It would only take the wrong words by a politician somewhere to send this market plummeting to the downside. Having said that though, they can also send it higher, as the markets have shown themselves (thank you computerized trading) to be fully complicit in being manipulated by politicians. A simple statement can send the markets into disarray every time it happens. Because of this, one can expect more of the same until the politicians are taught that they cannot control the markets. Until the algorithms are change, expect a lot of volatility going forward. All things been equal though we are still in and uptrend.