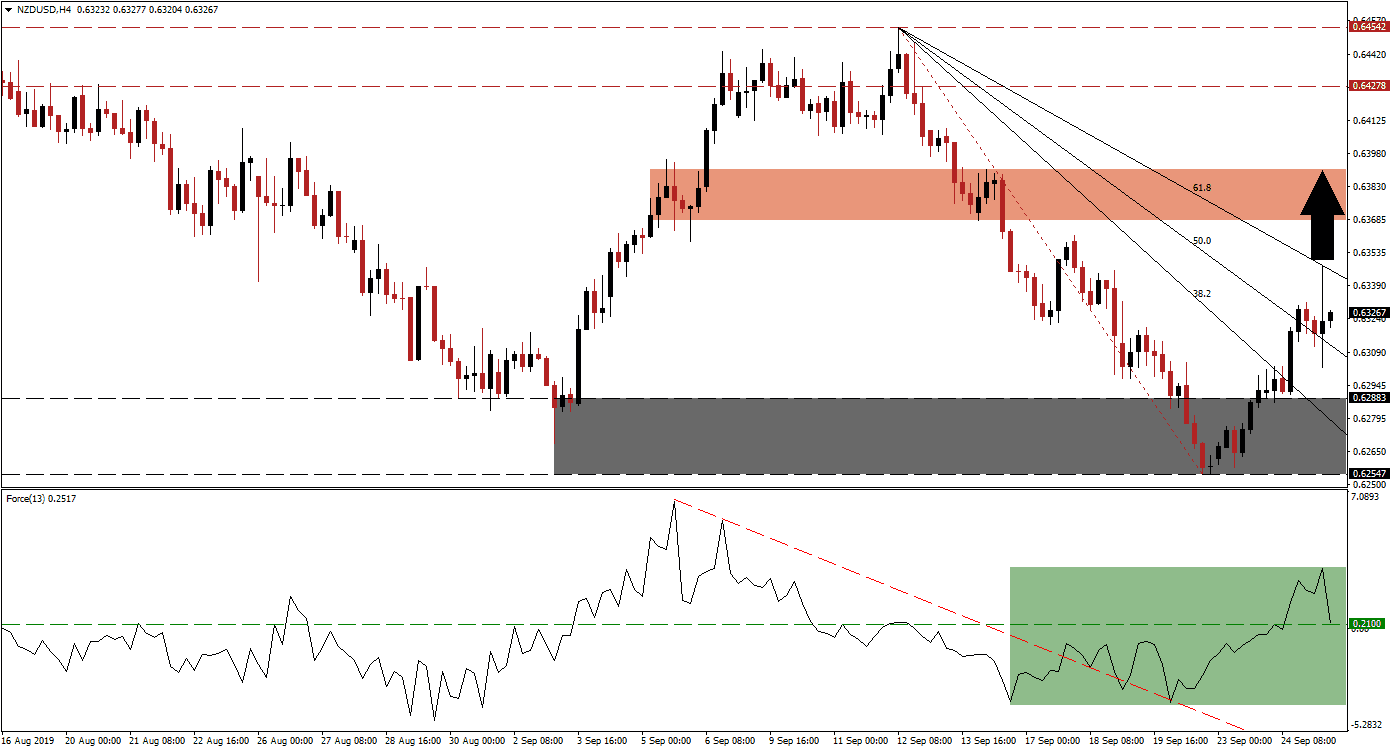

The Reserve Bank of New Zealand kept its interest rate unchanged at 1.00% in a move which was largely priced into markets. Volatility in the NZD/USD spiked following the announcement, but the bullish mood which accompanied the series of three breakouts prevailed. Price action is currently located between its steep, descending 50.0 Fibonacci Retracement Fan Support Level and its 61.8 Fibonacci Retracement Fan Resistance Level. The price spike following the interest rate decision briefly took this currency pair into its 61.8 Fibonacci Retracement Fan Resistance Level before retreating.

The Force Index, a next generation technical indicator, formed a large negative divergence which led to the intra-day high of 0.64542 from where a strong sell-off emerged. The NZD/USD was pushed into a new multi-year low of 0.62547 before recovering. During the sell-off, this technical indicator move above its descending resistance level which signals that bearish momentum is losing steam. The three breakouts were then confirmed by a recovery in the Force Index above its horizontal resistance level, turning it into support. This is marked by the green rectangle and the Force Index has retreated back to support following the volatility in price action. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

After the NZD/USD recorded its most recent intra-day low of 0.62547, which marked the bottom range of its support zone with the top range set at 0.62883 as marked by the grey rectangle, bullish momentum increased. This led to a breakout above its support zone and the close proximity of the 38.2 Fibonacci Retracement Fan Resistance Level resulted in a breakout above it as well, turning it into support. The preceding sell-off created a steep Fibonacci Retracement Fan sequence with all in a narrow range which makes the sequence prone to a series of quick breakouts. The move above its 38.2 Fibonacci Retracement Fan Resistance Level pulled the Force Index through its horizontal resistance zone and turned it into support.

This resulted in a further build-up in bullish momentum and a breakout above its 38.2 Fibonacci Retracement Fan Resistance Level followed prior to the RBNZ interest rate decision. Bullish sentiment has increased and the NZD/USD should be able to complete one final breakout above its 61.8 Fibonacci Retracement Fan Resistance Level which can take price action back into its short-term resistance zone. This zone is located between 0.63680 and 0.63906 which is marked by the red rectangle. The intra-day high of 0.63478, the high recorded during the most recent price spike, should be monitored closely together with the Force Index. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

NZD/USD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 0.63250

Take Profit @ 0.63900

Stop Loss @ 0.63000

Upside Potential: 65 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 2.60

A confirmed breakdown below its 50.0 Fibonacci Retracement Fan Support Level by the Force Index with a breakdown of its own, could led the NZD/USD back down into its support zone. The downside potential is limited and any reversal by this currency pair into its support zone should be considered a good, long-term buying opportunity. The NZD/USD is fundamentally oversold and the technical picture currently points towards more upside.

NZD/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.62900

Take Profit @ 0.62600

Stop Loss @ 0.63050

Downside Potential: 30 pips

Upside Risk: 15 pips

Risk/Reward Ratio: 2.00