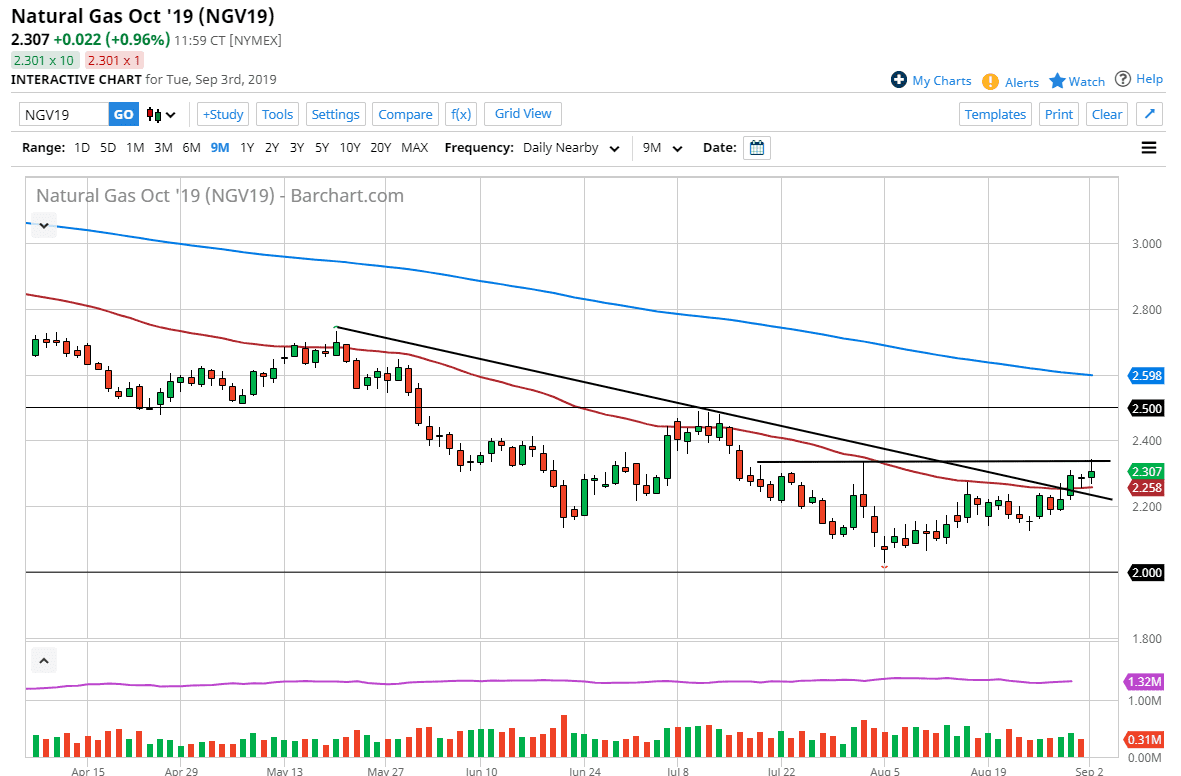

Natural gas markets have rallied a bit during the trading session on Monday, but keep in mind that these trades were done in a very thin market. The Americans were celebrating the Labor Day holiday, so therefore it’s likely that the action can only be taken so seriously. At this point, we have given back a bit of the gains, but I do see that we are trying to form some type of bottoming pattern.

We had been showing signs of strength as we have broken above the downtrend line and just as importantly the 50 day EMA over the last couple of days. Now we are pulling back towards the 50 day EMA and I think it could offer a bit of support. However, I don’t think it’s necessarily time to start buying quite yet. I think we will continue to see a lot of volatility, with a short-term emphasis on negativity. We could probably drop down to the $2.20 level rather quickly, and then perhaps even lower than that. However, the $2.00 level underneath offers enough support to end up being a “floor” in the market.

The alternate scenario would be breaking above the $2.35 level, opening up the door towards the $2.50 level. Remember, this time a year we do tend to have a bit of a pop higher rather soon as people will start to focus on that winter months in the United States and Europe. This drives up demand for natural gas, and therefore it of course will drive up price. Beyond all of that we also have hurricane Dorian hitting Florida and the Gulf of Mexico, and that could cause major issues and disruptions with the natural gas industry in the United States. However, this will be a short-term effect, so at this point it’s very likely that any rally at this point has a pullback in its short-term future. I don’t think that we can short this move for the longer-term move, but maybe a short-term selling opportunity will present itself. I still think that the big money will eventually be made buying dips at extraordinarily low levels. We are trying to form that base for the winter, and as we are trading the October contract, it makes quite a bit of sense we will see an impulsive weekly candle soon that will kick off the buying season.