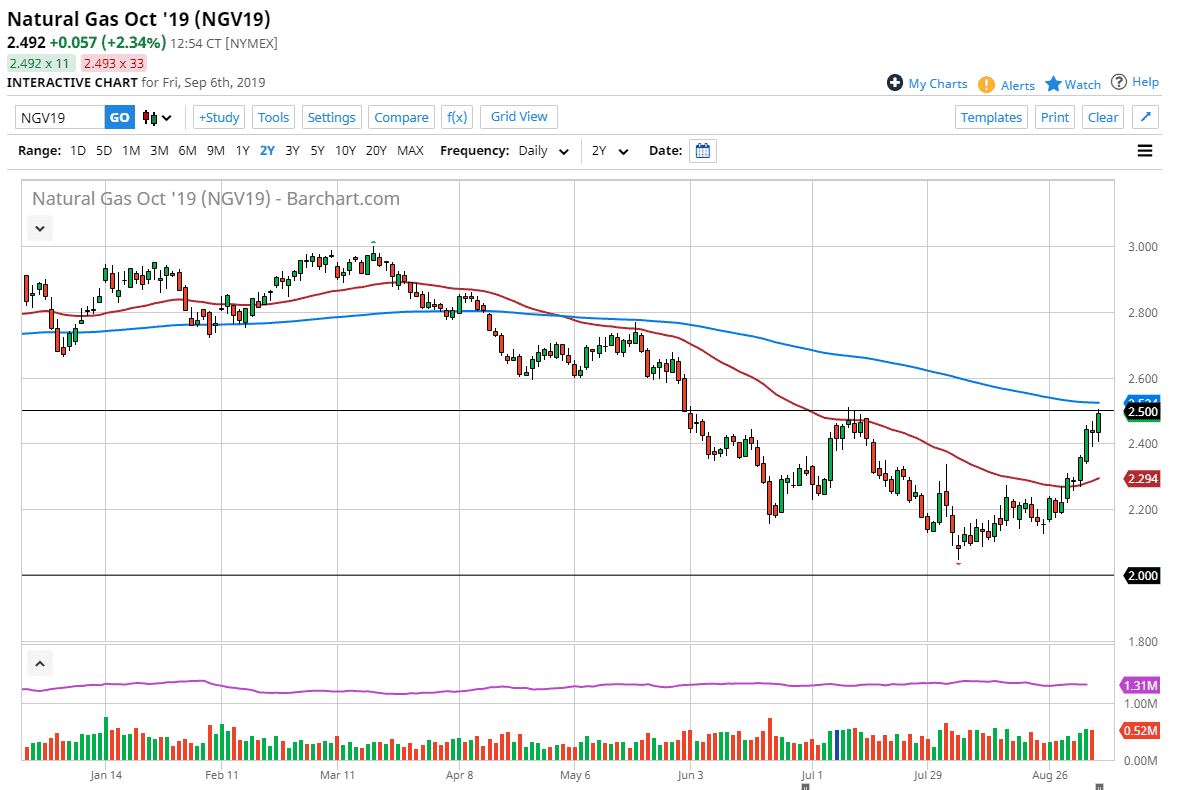

Natural gas markets initially pulled back during the trading session on Friday but found enough support at the $2.40 level to turn around and rally towards the $2.50 level. This is a very strong level of resistance and it makes quite a bit of sense that we could pull back from here. That being the case though, I do think that we have seen a seismic shift in the attitude of the market. This makes sense considering what time of year it is and the fact that quite often this time a year we will see buyers jumping in and taken advantage of colder temperatures in the United States.

Recently, there has been higher temperatures forecasted for the United States, so that could drive up demand temporarily for natural gas. As soon as we get cooler temperatures forecasted in the United States it’s likely that we will pull back, but I think we have already broken down below the trend line, so it’s very likely that what we will see next is a pull back to test for support. All things being equal, it’s very likely that the 50 day EMA underneath will attract a lot of attention which is painted in red.

The market typically will rally sometime during the month of October, perhaps November as there is so much in the way of demand for natural gas in the United States and of course the European continent. Ultimately, it’s likely that pullbacks will attract a lot of people trying to get out of short positions, which will mean that they need to buy back their trade. The $2.00 level underneath could the absolute floor for the year, and I think it’s more likely than not at this point. If we do break above the 200 day EMA I am a bit cautious, because I think we will have gotten a bit parabolic a little too early in the year. All things being equal I think there is a bottoming pattern being filled out, and this is a market that is very likely to build up the inertia necessary for that parabolic move we see every year. I will be looking closer to the 50 day EMA for signs of a bounce or some type of hammer to get involved with. Most certainly, my short-term bias has changed and now I’m looking for value.