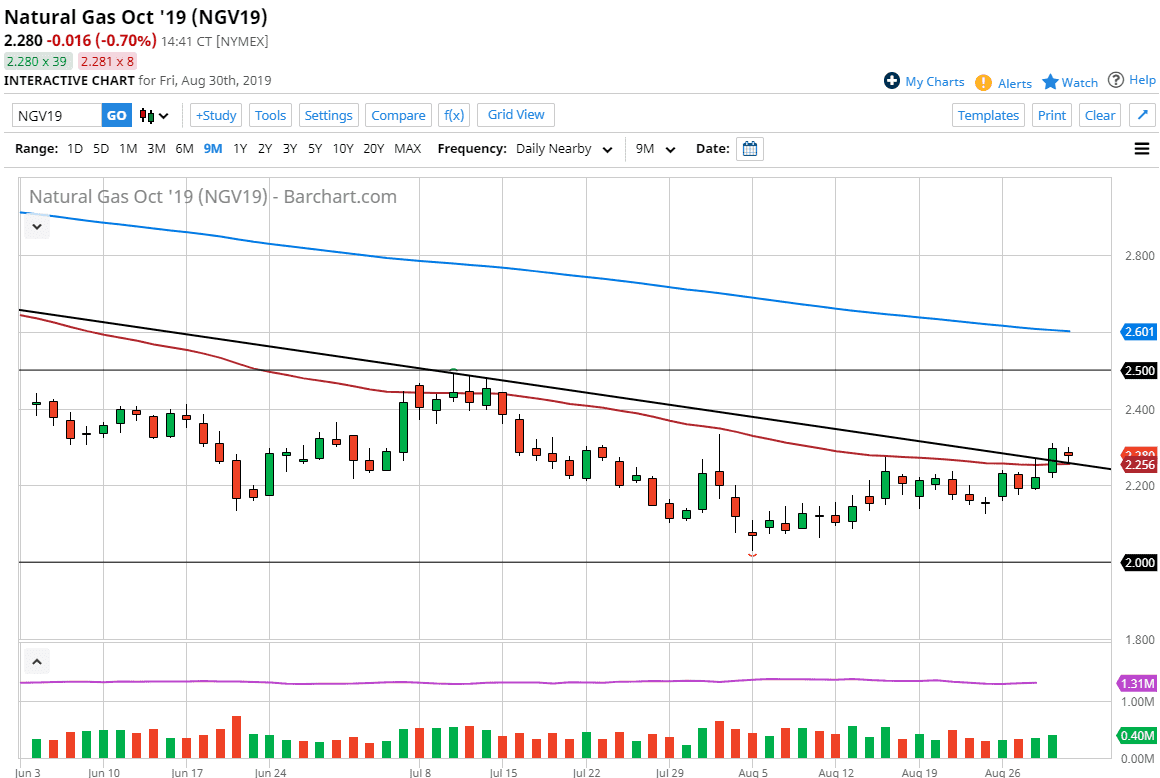

The natural gas markets went back and forth during the trading session on Friday, reaching down towards the 50 day EMA before bouncing slightly. What’s even more interesting about this is that we are sitting on top of the downtrend line, so it’s very likely that the market could turn things around and continue to go higher. If that’s going to be the case, the market could go as high as the $2.40 level. At this point, I think that the market could go that high but then I would expect to see some sellers come in.

With that being the case, it’s very likely that any pop higher at this point will probably drop from here. That being said though, the natural gas markets have a big problem when it comes to demand and of course the massive supply. The $2.20 level underneath is support, so if we were to break down below the 50 day EMA it’s likely that we test that area. Otherwise, if we break down below there it’s likely that the market goes down to the $2.10 level followed by the $2.00 level. With that being said, it does look like we are trying to form some type of basing pattern which is something to pay attention to.

The natural gas markets will start to look towards the colder months in, and when they do it’s very likely that they will rally significantly. If that’s going to be the case it’s very likely that we will see a massive move higher once we get a lot of demand for heating in the United States and Europe. It’s only a matter of time, but I think we are going to see a lot of volume come into this market towards the end of the month as we start to trade the November contract. Ultimately, we do get that yearly pop higher which can be quite drastic. With all that being said I think that it’s only a matter time before we get that move but I think we are a bit away from that time, so therefore I fully anticipate that we get yet another pullback. If we were to somehow break down below the $2.00 level, then we could go much lower, but right now I don’t think that’s likely to happen. Short term, I think selling works, but longer-term we are starting to see a basing pattern.