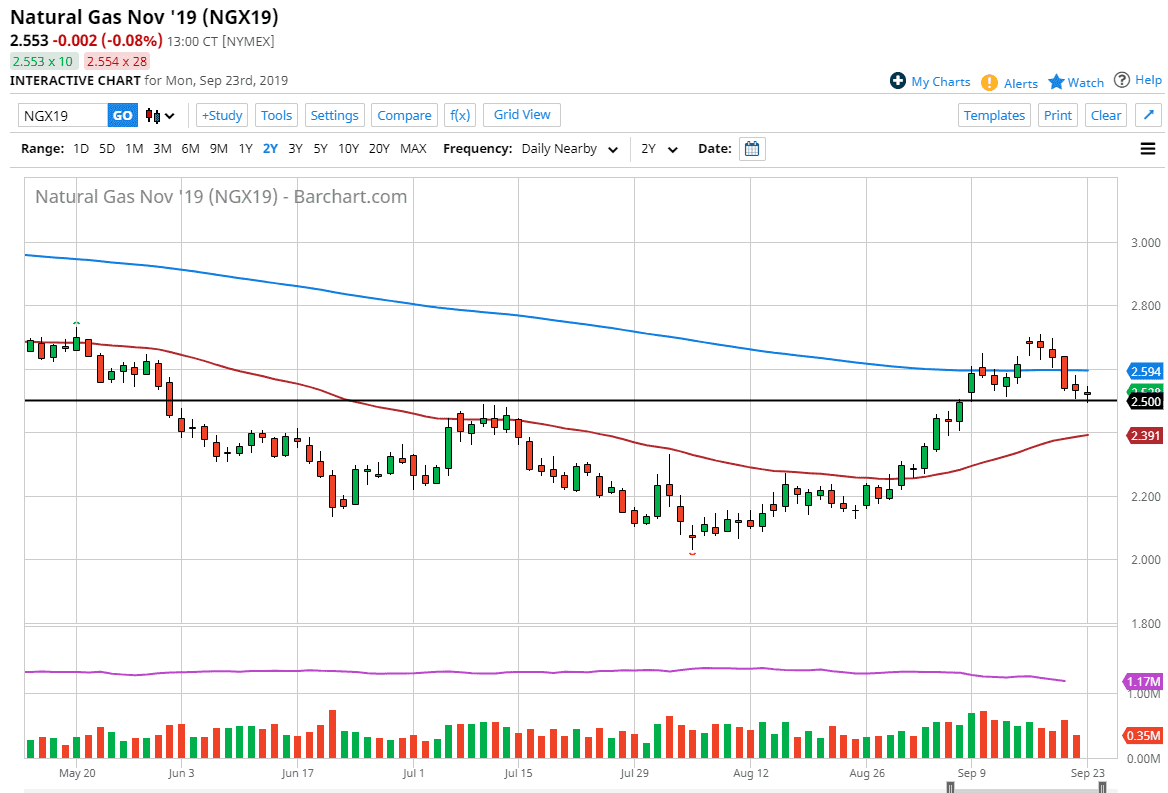

Natural gas markets fell initially during trading on Monday to kick off the week but ended up finding a bit of support at the $2.50 level which of course is a large, round, psychologically significant figure. With that being the case, it makes sense that there would be a certain amount of buyers in that general vicinity. With that in mind I believe that the market is going to continue the overall run to the upside.

We have recently formed a nice bullish flag that measures for a move to the $3.00 level, so that will be my next target. At that level, one would expect a lot of psychological resistance anyway, as it is a large, whole, figure. This area has caused the lot of noise back and forth, and of course it’s very likely that the market will see volatility. However, if you been reading these articles for some time you understand that there is a significant cyclical trade just waiting to happen this time of year. Because of this, I believe that colder temperatures coming to the United States and Europe will be a main driver going forward.

The 50 day EMA sits below current trading at roughly $2.40, so it makes sense that we would see a significant amount of buying pressure there as well. The candle stick for the trading session on Wednesday is fairly bullish, as it shows that the buyers will continue to come in and pick up value when it shows itself. The 200 day EMA sits just above and below, and if we can clear that level, it’s likely that we can continue to go much higher and reach towards that $3.00 level.

Even though the market looks bullish and certainly has the seasonal trade on its side, the reality is that the move won’t necessarily be straight up in the air and therefore it makes sense that it’s going to take the occasional pullback to build up the momentum to go to the upside. That being said though, this is the November contract that we are trading in the futures market so it makes sense that we take advantage of pullbacks for value and look for buying opportunities only. Selling this market is all but impossible to do at this point in time and it’s likely that short-term traders will continue to jump in and pick up the market every time they can.