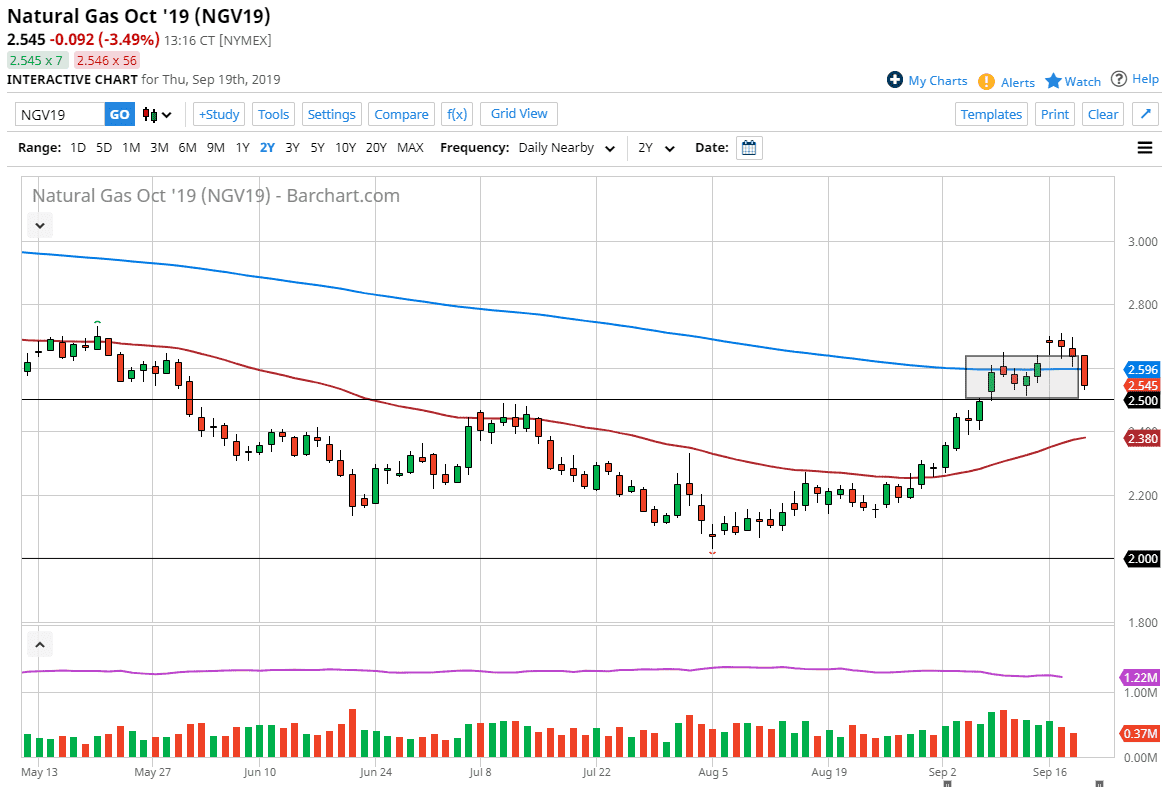

Natural gas markets tanked a bit during the trading session on Thursday after a bearish inventory number came out. However, we are getting close to the cyclical move that we get every year, and therefore it’s a matter of waiting for some type of value/support to come back into the fray so that we can take advantage of increased demand this time of year.

As the futures market front contract is November, it makes sense that natural gas markets have been rising as it is the beginning of the colder temperatures in the United States and Europe, which of course is a huge consumer of natural gas to heat homes. That being said, the market is very likely to find support at a multitude of levels below, including the $2.50 level. At this point, the large, round psychological importance of that figure will be paid attention to, but beyond that there is also the 50 day EMA underneath near the $2.38 level. With that being said, we are currently dancing around the 200 day EMA, which of course attracts a lot of longer-term traders as well. If we get a bounce above there in continue to go higher, it’s very likely that this market will continue the winter rise that we normally see.

Beyond that, we had recently broken above the top of a potential bullish flag, so this correction could take advantage of that measured move which means that natural gas could be going as high as $3.00 given enough time. Before the winter is over, I fully anticipate that this market will probably go to an even higher level, perhaps somewhere closer to the $3.50 level, as the low from this year was lower than the previous year, so I anticipate that the high will probably be lower than the one from the previous year as well. Don’t get me wrong, this is a market that will probably pull back violently at times, but when you look at the historical charts they always tell you the same thing this time a year, that we are probably going to rally until early to mid-January, when the market start focusing on March and beyond. I’m the first to admit that the candlestick is rather negative for the trading session on Thursday, but it’s only a matter of time before value hunters jump back in.