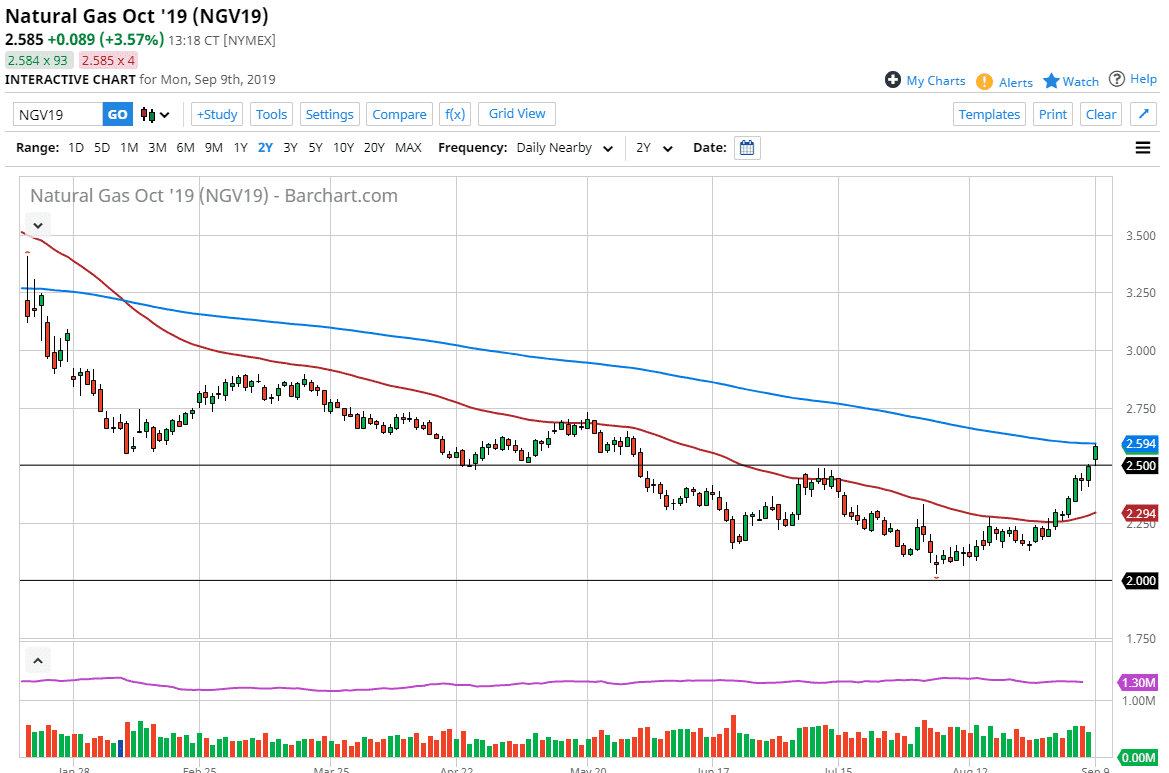

Natural gas markets rallied a bit during the trading session on Monday, reaching towards the vital $2.60 level, which is not only a large, round, psychologically significant figure. Beyond that it is also the scene of the 200 day EMA which should attract a lot of attention. Looking at this chart, it seems as if we are trying to enter the winter rally, but it is a bit early for that. We have been forming a bit of a base recently though, so having said that it’s likely that we are trying to get things going for the cold months in the United States and Europe.

Every year, we will spike several dollars in the natural gas markets as demand explodes to the upside. This is because heating is likely to drain reserves in the short term. Longer-term though, it’s very unlikely to see this stick as natural gas is so oversupplied that it’s not even funny. I believe that it’s a cyclical play that you can take advantage of, but it is a bit much to think we are going to go straight up from here.

Short-term pullbacks from here make quite a bit of sense but I’m not willing to sell them anymore and will be looking for buying opportunities on these pullbacks. The 50 day EMA could come into play, which is painted in red on the chart. Beyond that, the $2.25 level should also offer plenty of support. To the upside, I’m not sure how far we go, because these are so impulsive that it’s difficult to gauge. It’s simply a “in the moment” type of trade. A short-term pullback is a buying opportunity from what I see, and therefore I think it should offer a bit of a bounce that traders will be looking to take advantage of. That being said, it is going to be very noisy as per usual, as a natural gas markets can be this time of year. We are still trading the October contract, so we aren’t necessarily in the “high season”, but we are certainly getting closer. Even though I expect this market to pull back from here I’m not necessarily looking to sell, because the 50 day EMA had been so resistive in the past, and it’s very likely that it should now be supportive based upon the “market memory” aspect of technical analysis.