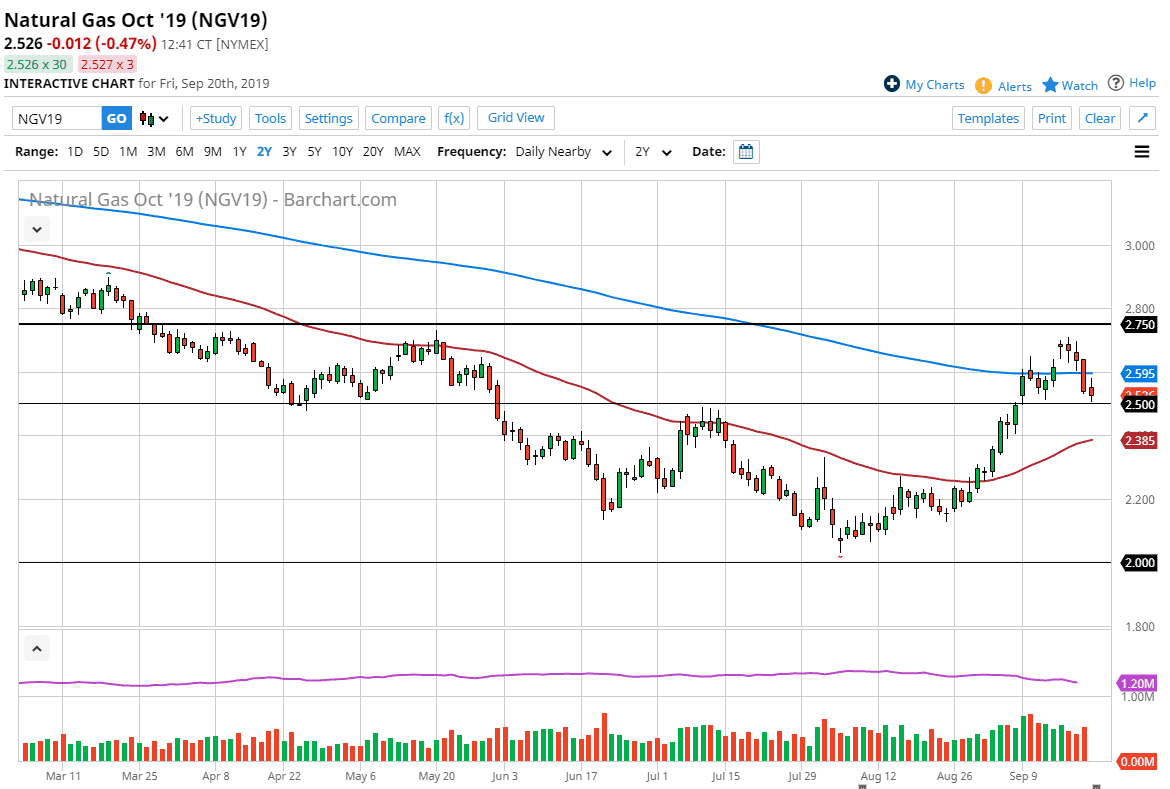

The natural gas markets went back and forth during the trading session on Friday, testing the significant $2.50 level. This is an area that should attract a significant amount of attention due to the fact that it already has shown as support and resistance. The pullback during the week has been relatively significant, after the gap from the Monday session, but we now have a significant amount of calm entering the market.

The $2.50 level should be a significant area of interest due to the psychology of every $0.50 in this market. However, what’s more important is the fact that we have recently broken above the bullish flag that had formed into the 200 day EMA, and now are testing that same area for support. Below there, we also have the 50 day EMA that should show plenty of support near the $2.40 region level. At this point in time it’s likely that the market will eventually find plenty of buyers, as the $2.75 level above should offer the next target based upon the historical charts. Beyond all of that though, the bullish flag measures for a move towards the $3.00 level, and therefore it’s very likely that we will at least move in that general vicinity.

Natural gas typically will move higher starting this time of year anyway, as the market focuses on the fact that the Americans and the Europeans are going to need to heat their homes for the winter. At this point in time it’s likely that the market will focus on the fact that temperatures will be dropping soon. As we get more demand, markets will drive quite a bit higher, but then fall early in January. This is a market that has the same cyclical move every year, so it’s likely that we will see the dips continue to be bought as the market is decidedly bullish over the last couple of weeks, signaling the cyclical trade. As far as selling is concerned, I am not interested in doing so anytime soon although I do recognize that lots of noise back and forth will continue to be one of the potential pitfalls for buyers. Looking forward, this is a market that is possibly going to go looking towards the $3.50 level, maybe even the $4.00 level by the time we end the cyclical run. Using short-term charts to build a core position and then add as the market goes in your favor is the best way to trade this market.