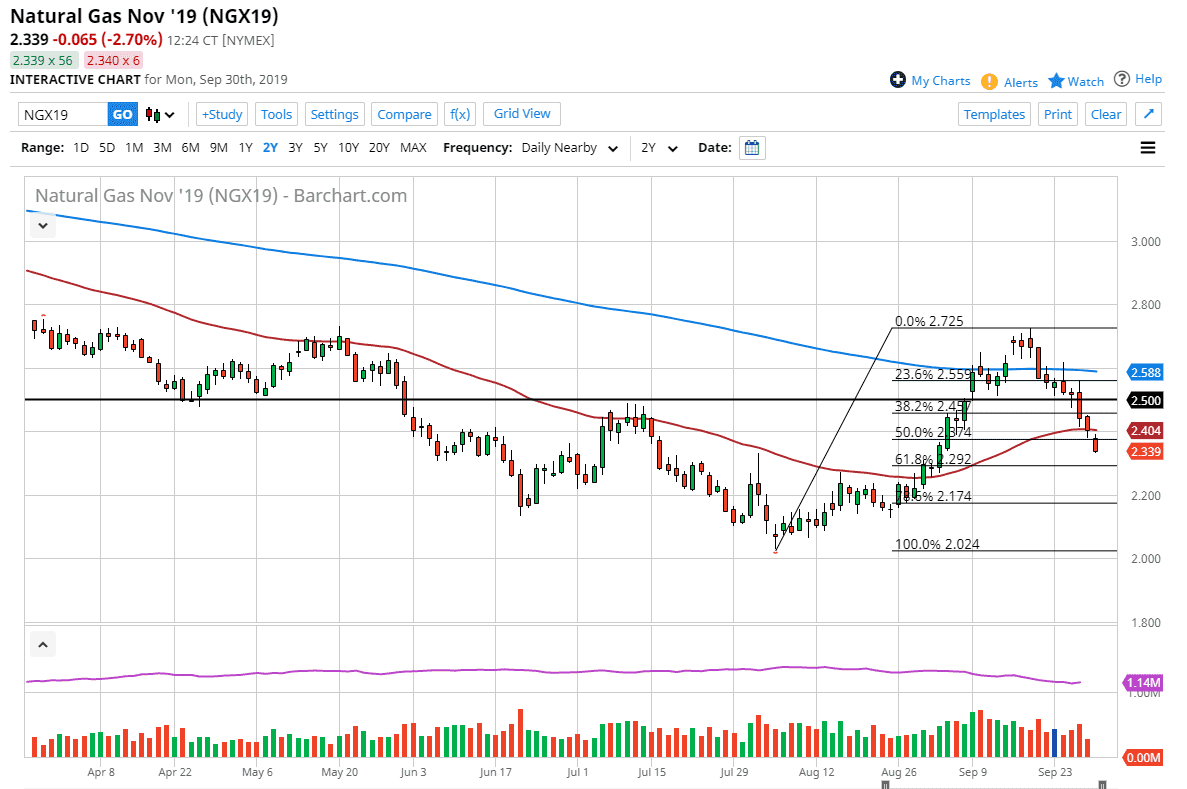

Natural gas markets gapped lower to kick off the trading week on Monday, but then turned around to fill that gap before falling yet again. This is obviously a very negative turn of events but quite frankly it’s probably only a matter of time before buyers come back into the marketplace. This is because of the massive demand that will flood the marketplace in the next couple of months, so therefore it’s likely that the market will turn around and go much higher given enough time.

Just below at the $2.30 level we have the 61.8% Fibonacci retracement level. This obviously will attract a lot of attention, but now that we are below the 50 day EMA we may even drop below there. The $2.25 level should offer structural support, so I think it’s only a matter of time before the buyers return. However, we are in the beginning part of the “Winter pop”, as we have rallied a bit recently. By pulling back, this offers a bit of value that you will be able to take advantage of, especially if you are a CFD trader, meaning that you can hang onto that trade for quite some time. It’s not uncommon to see the market rally from some time from late October into the beginning of January.

With all that in mind I’m waiting for a buying opportunity but I’m going to base upon the daily candle stick. Short-term traders may continue to try to short this market but it will more or less have a “rip your face off rally” sooner or later. Because of this I will be waiting for an opportunity and therefore have to be very patient.

Recapturing the 50 day EMA would be huge, but I suspect we probably have some short-term pain ahead for natural gas buyers as well. That being said, I think we are much more likely to see a bit of a hammer at a lower level or something along those lines in order to get an opportunity. Because of this, I am going to be as patient as possible but I will certainly let you know here at Daily Forex when I see the reversal signal and start putting money to work. Again, I have no interest in shorting this market because it is only a matter of time before turns around and takes off to the upside based upon the cyclicality of the market.