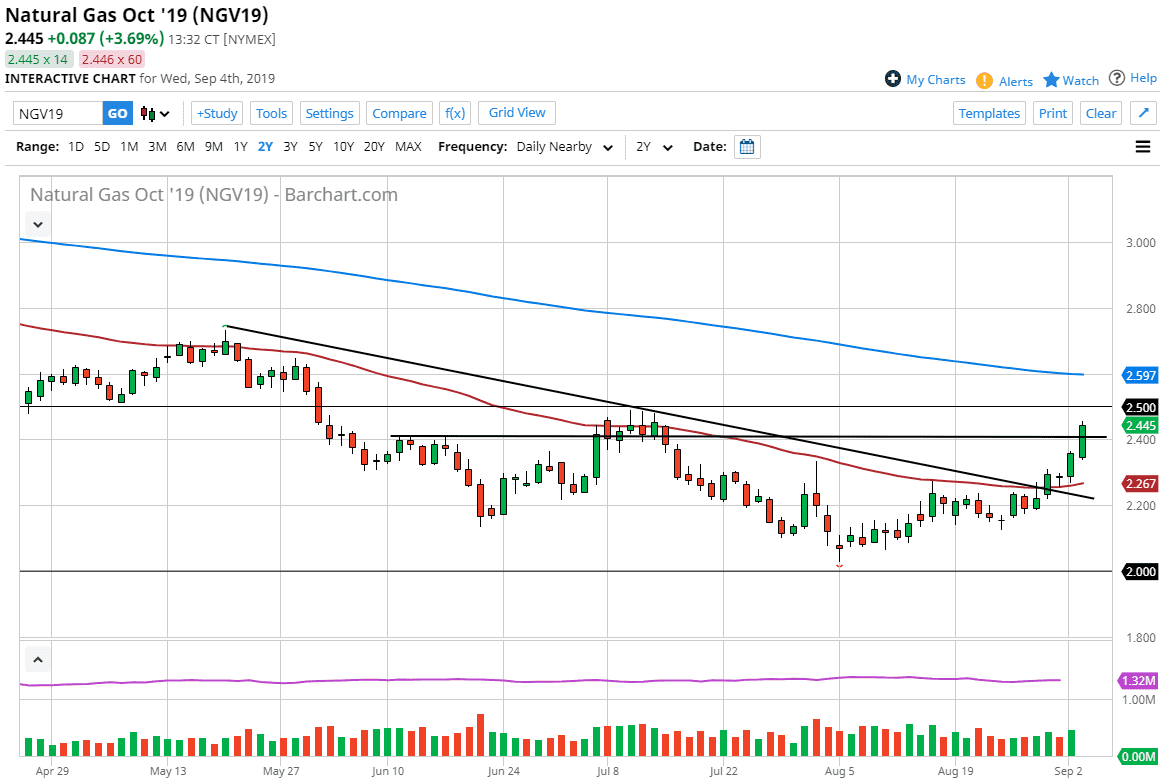

Hotter temperatures forecasted in the United States continues to drive natural gas prices higher, as we have broken above the $2.40 level for the first time since July. That being the case it looks as if we are going to test a major resistance barrier and psychological figure in the form of $2.50. At that point, I think that a lot of selling pressure will probably enter the market due to the round figure and the fact that anybody who has bought natural gas has fought the trend and gotten lucky. They will be more than willing to take their profits. That being said though, we are starting to get to that time of year where things roll over and change.

I anticipate one more flush lower and then we could start to build a leg higher for the winter months. We are currently trading the October contract, and it looks to me as if the market is simply having a nice bounce in what is a bigger consolidation and perhaps bottoming pattern. All things being equal, I think it’s only a matter time before this market rolls over but I would be a bit surprised to see it break down below the $2.20 level. I think there is a massive pullback coming, but the problem is it’s almost impossible to time something like this.

A break above the $2.50 level would be very strong, and it would bring the 200 day EMA into focus. Perhaps that’s where we stop and then roll over again to build up more momentum with the base. I think at this point it’s very likely that the market will continue to see choppy and ridiculous behavior as it tends to be a bit then this time a year as well.

Having broken the trend line to the upside, this does signify the first shot across the bow so to speak for the market to leave the downtrend. That being said, you will more than likely get another opportunity to pick up natural gas at lower levels as natural gas markets are full of supply and will continue to be for decades. That doesn’t mean you won’t get the occasional seasonal push higher, which is what I think we are getting relatively close to seeing. At this point, I am flat and waiting to see a pullback that shows signs of support to start buying.