Natural gas markets had a choppy session yet again during the trading day on Thursday as the markets may be a little bit overextended. That being the case, it’s possible that we may see a bit of a pullback, but that pullback now looks to be like an opportunity to pick up a bit of value. This is a market that is getting ready to try to turn the overall trend around, as the market has started to focus on the later part of the year, but maybe perhaps even more immediately, the fact that temperatures in the United States have been warmer than usual. That drives up demand for natural gas to cool housing, but we are also getting close to those cold months that tend to drive prices much higher. With that in mind my attitude toward natural gas has changed over the last couple of weeks.

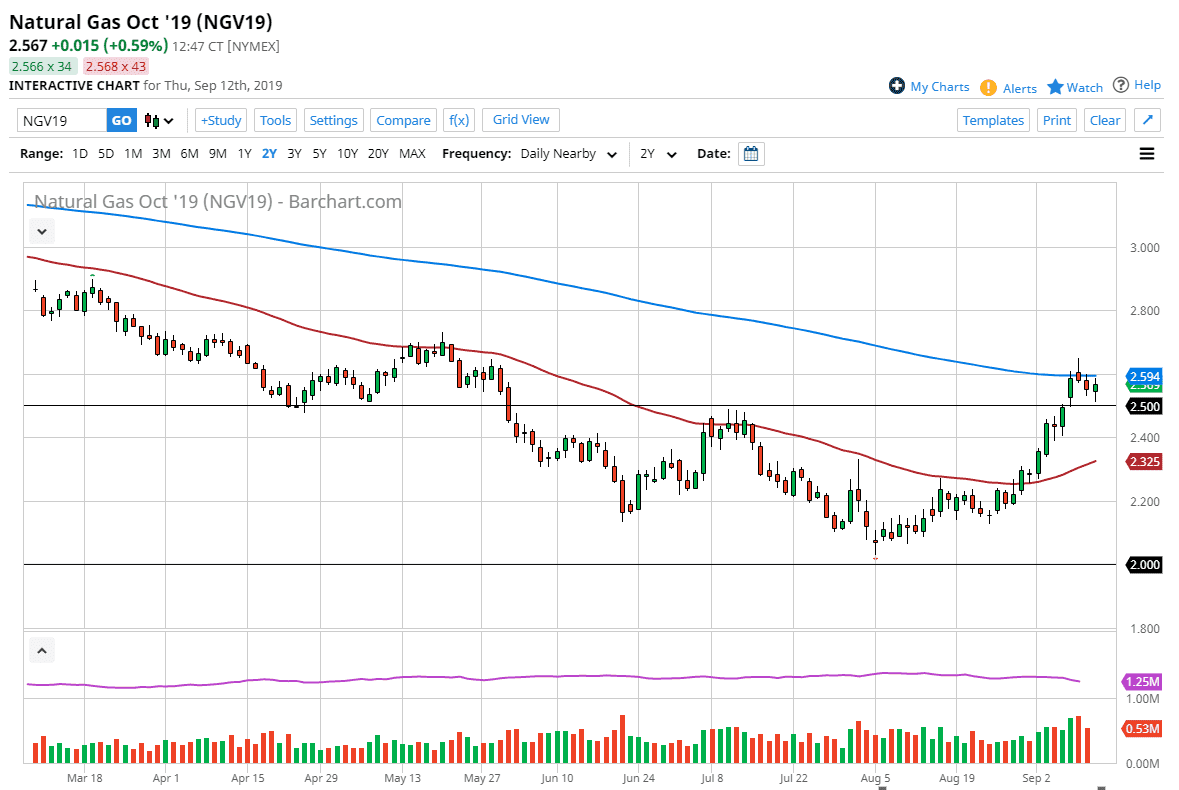

When I look at the chart I can see that the 200 day EMA offers a bit of resistance at the $2.60 level, and they think it’s possible that we could see a bit of selling pressure in this area, but that short-term pullbacks should end up offering a nice buying opportunity underneath. The $2.50 level could offer support so we probably have one of three potential trading environments about to present itself.

The first one of course is that the market simply continues to go higher. If we can break above the top of the shooting star from the Tuesday session then it seems that the natural gas markets would be ready to continue an impulsive move higher. However, I think we are just a bit early in the year for a huge rush higher. This brings into focus the second scenario: a pullback that offers a buying opportunity at lower pricing. I would like to see the market do this, and if we can break down below the $2.50 level it’s likely that we could go down to the $2.40 level, perhaps even the red 50 day EMA. The third scenario of course is simply that we go sideways and grind away, digesting the gains that we have recently seen. I don’t see a selling opportunity here and if we break down then I simply look to buy. If we grind sideways, then I look for that breakout. I believe that natural gas is going to be that straightforward.