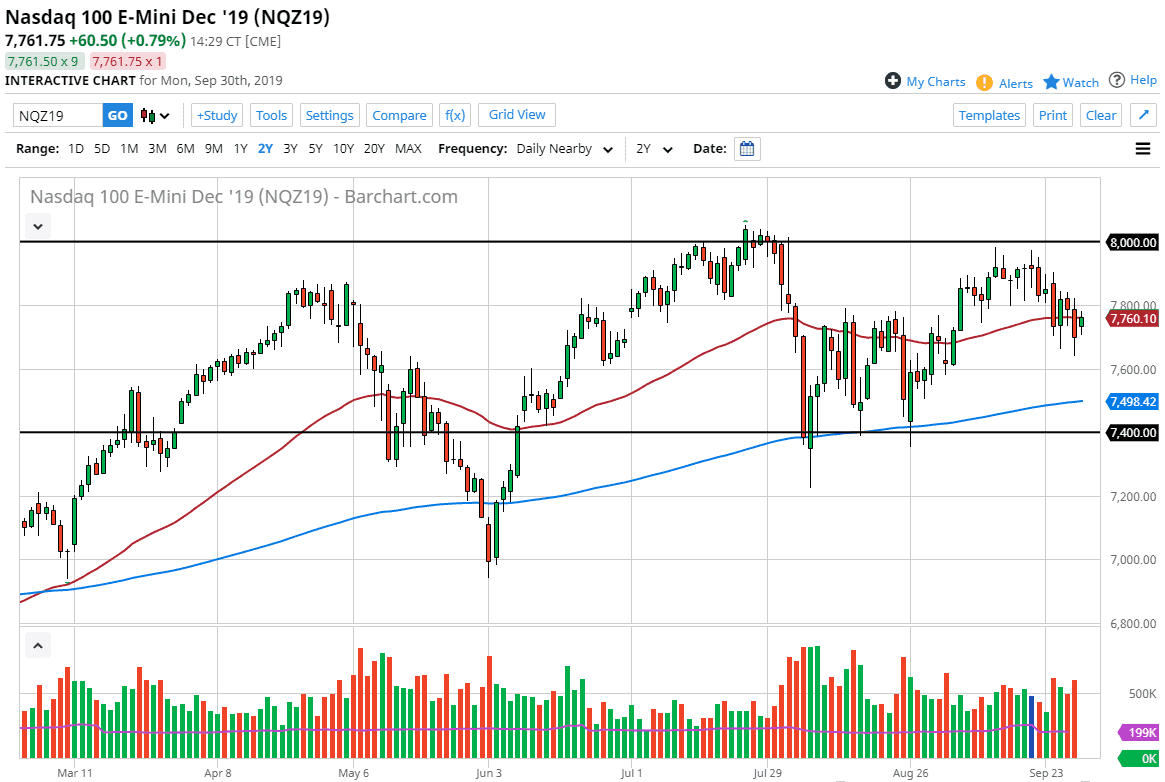

The NASDAQ 100 has been slightly bullish during the trading session after gapping higher on Monday, dancing around the 50 day EMA. I think there is a lot of support underneath, and you could also make an argument for a bit of a bullish harami being form, so if we can break above the 7800 level, it’s likely that the market could go towards the 8000 handle. A break above that level offers an opportunity to reach towards those highs again, but at this point I think that the market is likely to simply bounce around and grind higher.

If we were to break down below the lows on Friday though, that opens the door to the 7600 level, and then possibly the 200 day EMA after that. The 200 day EMA is currently at the 7500 level. Underneath there, the 7400 level also offers a certain amount of resistance as well. I think that overall the markets are range bound, perhaps even in the 600 point range when you look at the bigger picture. One thing is for sure though, this is a market that does struggle to find clear direction, so you will need to keep your position size relatively small.

Looking at this chart, we are currently sitting above a rather significant support area based upon the previous consolidation range, but at this point I wouldn’t necessarily call it a “hard floor”, but it certainly looks as if somewhere in that area we could see a lot of buyers. Ultimately, this is a market that is going to simply chop around and wait for some type of catalyst. I suspect that lots of noise and volatility will continue to be a mainstay in the US stock markets, as we simply have no real clear direction as to where we are going next. That being said though, this index is a bit more sensitive to the US/China trade situation, as so much of that is technology-based. Ultimately, the longer-term range bound traders will probably continue to love this market but right now we are essentially at “fair value”, meaning that we could move in either direction, but I think that longer-term we still have more upward pressure than down. A break above the seven 800 level will have me buying, and perhaps even holding my nose. To the downside, if we break down below the candle stick from Friday, then I’d be a seller and looking for the 200 day EMA.