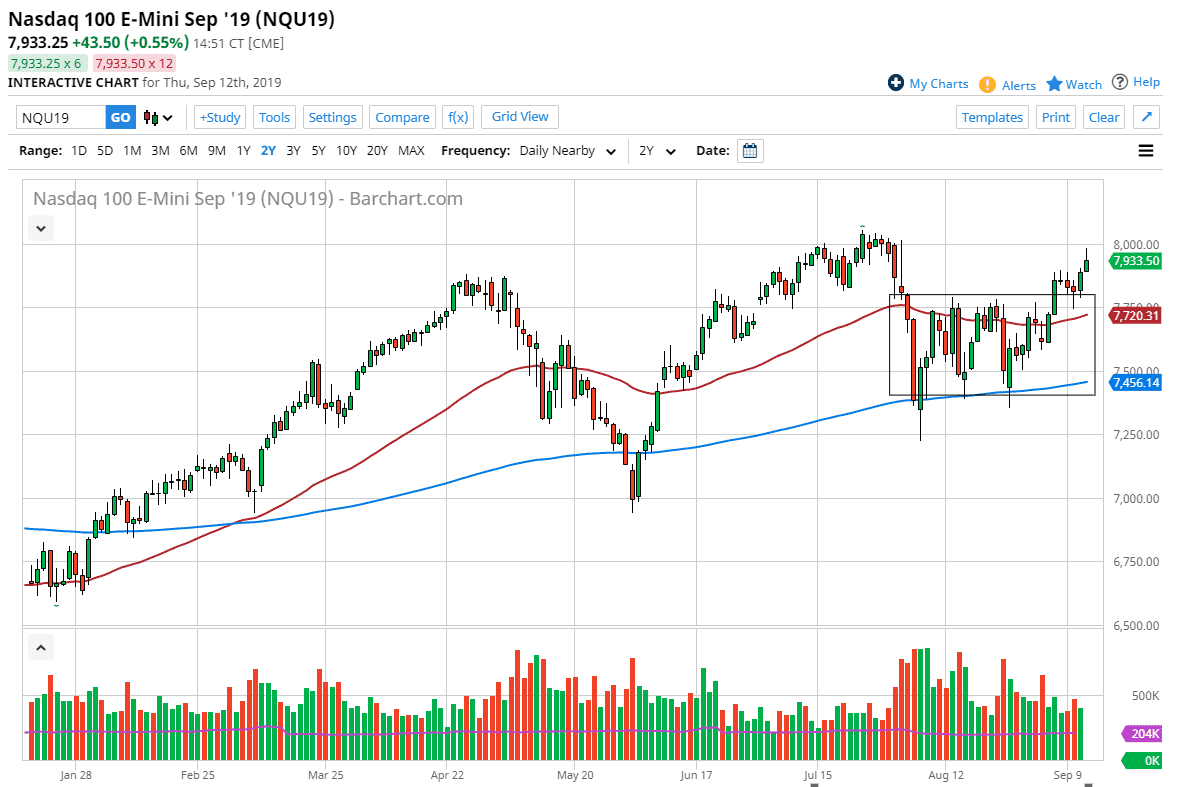

NASDAQ 100 traders sent the market towards the 8000 handle but ran into a bit of resistance as it pulled back significantly and lost about 60 points. That doesn’t necessarily mean that the market is ready to break down, but I think we are likely to see buyers underneath, especially near the 7800 level which was the top of the previous consolidation. We had gotten a bit ahead of ourselves, and as the ECB cut rates but perhaps maybe not as drastically as people thought, perhaps the massive “risk on” trade is waiting to see what happens with the Federal Reserve.

Regardless, it is a market that will continue to be bullish overall, because central banks around the world continue to do everything they can to keep equity markets higher. This will be especially true with the Federal Reserve next week, and they will do everything they can to keep stock markets from drifting lower, the NASDAQ 100 index being in that sphere of influence. The 50 day EMA which is painted in red on the chart is still support, so I think a pullback should offer value that you should be paying attention to.

The fact that we are going into the Friday session heading into the weekend could cause a little bit of a pullback, but I think in the end it will be considered to be value just waiting to happen. Otherwise, if we were to break down below the 50 day EMA then we could go down to the 200 day EMA which is painted in blue on the chart. The 7500 level would of course cause a lot of attention, and then the 7400 level as well as it is the bottom of the box.

To the upside, if we were to break above to a fresh, new high and quite frankly it wouldn’t take much to do that, then it would represent a frenzy of bullish pressure. The consolidation area that we had been in previously measured for a move to the 8200 region, so I do think it gives us a target longer term, but in the short term I think we have a lot of stuff to chew through in this general vicinity. Expect volatility but look at pullbacks as potential buying opportunities as this market will be very sensitive to the US/China trade talks as well. Recently, things have been a bit more conciliatory, so that of course has been helping.