Keep in mind that there will be some electronic trading today but it’s also Labor Day in the United States so it’s very unlikely to have a huge move unless of course there was a shock over the weekend due to headlines. There is that possibility as more tariffs are expected to be levied against Chinese goods, but the Chinese have already suggested that they weren’t going to retaliate, so that may mitigate some of that fear. All things been equal though, we have an entire three days for rhetoric to spill to the headlines so it’s hard to tell where we will end up on Tuesday.

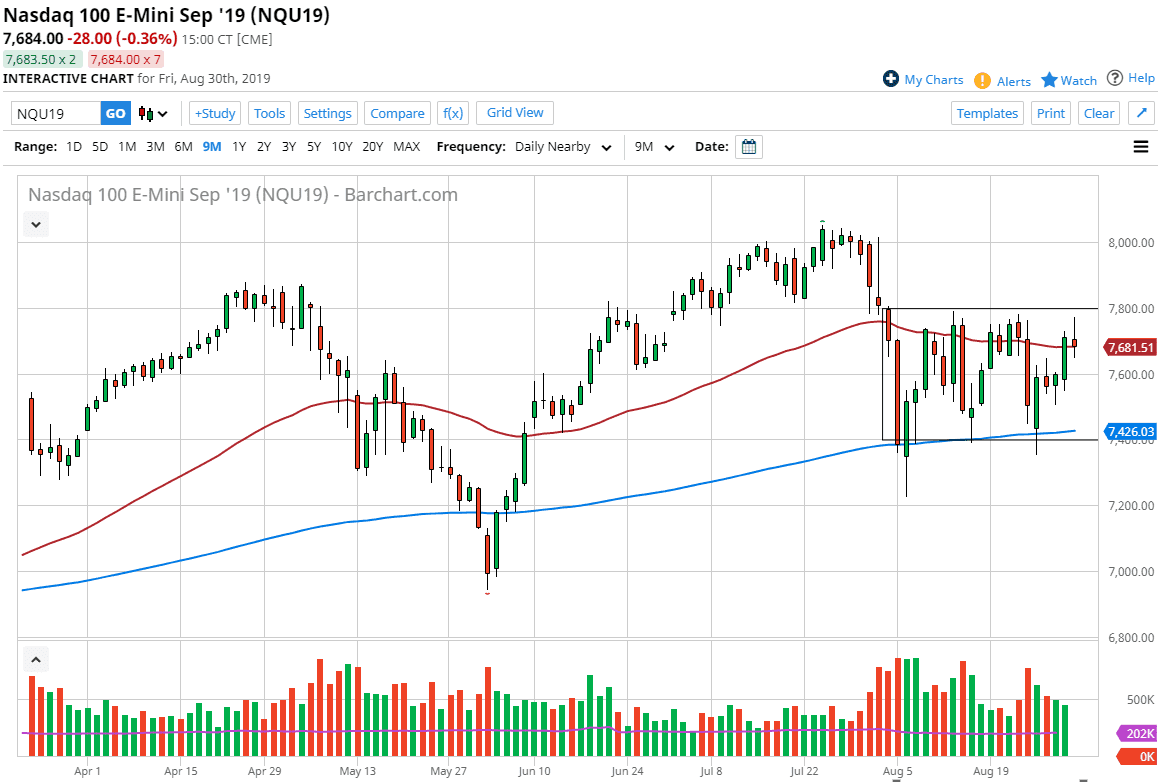

This article will focus on the technical analysis only, because that’s the only thing I have to work with right now. We are currently forming a neutral candle stick which is essentially a shooting star at the end of the day at the 50 day EMA, so it’s likely that we will see quite a bit of noise in this area. If we pull back from here and I think we probably will, we will go down to the 7600 level, perhaps even down to the 7400 level after that.

The alternate scenario of course is that we break above the 7800 level, and if we do clear that area it’s likely that we then go to the 8000 handle. At this point, that is a very huge target that will continue to weigh upon the market, and therefore I don’t think we break above the 8000 handle this there’s some type of really good news out there. Beyond that, Labor Day will bring traders back from vacation for the Tuesday session, but we also have the jobs number on Friday. With that being the case I think it’s good to be difficult to anticipate a lot of anything beyond choppiness and noise between now and then. I think overall we probably stay within the consolidation box that I have drawn, but again it’s only a matter of time before Trump or Xi says something to throw the market into a conniption. The question of course is will it be positive, or will it be negative? That’s the environment we find ourselves in. From a technical standpoint, it makes sense that we continue to go back and forth as we await some type of clarity, which doesn’t seem to be calming.