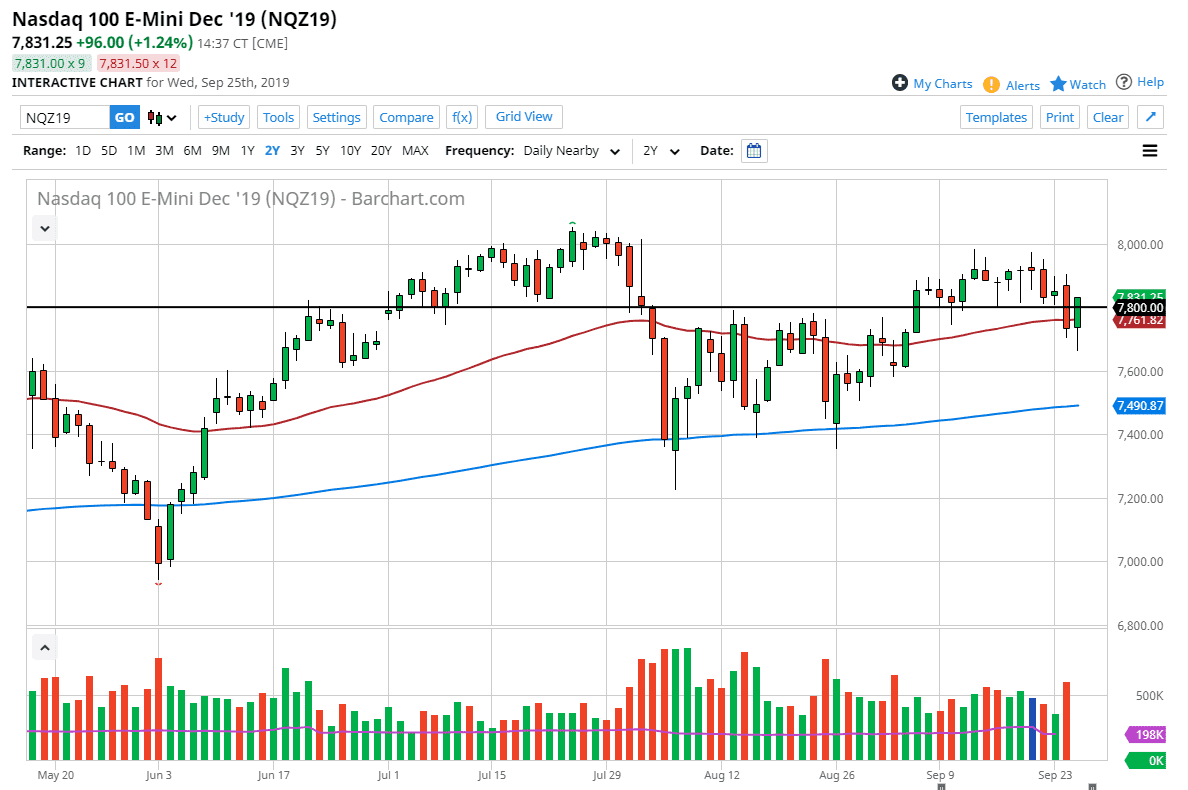

The NASDAQ 100 initially fell during the trading session and broke down quite drastically. However, a series of tweets and other nonsense across the newswires has thrown this market all around. With that being the case, the most important thing on this chart is the fact that the 50 day EMA has held, and of course the 7800 level has as well. This is a market that will continue to go higher, perhaps reaching towards the 8000 level given enough time. That being the case, it’s likely that the buyers will continue to return on short-term dips, as the market has been so bullish for so long. Beyond that, there is a lot of support underneath based upon the previous consolidation area.

If we were to reach towards the 8000 handle, a break above there would signify the next leg higher, as the recent consolidation suggests that we could go as high as 8200. After the noise during the previous session with the impeachment process, the reality is that stock markets have calmed down and have returned to somewhat normal behavior. Beyond that, when you look at the last 48 hours, we have essentially formed a major hammer, which shows just how much buying pressure there is underneath.

This doesn’t mean that we are going to break out to the upside right away, but it certainly means that there is a continued run towards the upside, as people are looking for some type of return in a low yield environment. The US stock indices continue to be where foreign traders are trying their money as well, so at this point it makes sense that we continue to see an upward tilt.

Having said that, if we were to break down below the candle stick for the day on Wednesday, it’s possible we could go to the 7600 level, followed by the blue 200 day EMA underneath. At this point though, it’s very likely that the buyers have come back with a purpose, and short-term pullbacks should continue to offer plenty of buying opportunities as the grind higher should continue. Ultimately, this is a market that has been very noisy as of late, but it certainly looks as if the negativity has gone to the side now that the market has digested the impeachment situation and now looks very likely to continue higher as we are miles away from an actual trial.