Since the beginning of Thursday's trading, the most important of this week, the price of gold is moving in an upward movement, which reached the $1502 resistance at the time of writing. The price of the yellow metal suffered a recent setback and reached the $1484 support level, its lowest level in three weeks. Gold is set for a significant day today with the release of US inflation figures, which will determine the US Federal Reserve's monetary policy decisions next week, Gold’s performance will also be affected by the European Central Bank's announcement today of its plans to stimulate the slowing euro-zone economy.

The recent loss of the yellow metal due to the easing fears in the financial markets amid investors optimism of assurances from the parties to the World Trade War, the United States of America and China, to return to talks instead of continuing of imposing retaliatory tariffs between them.

The US dollar remains strong and the Fed, led by Jerome Powell, is confident of its performance, and that it is far from the expected recession, and the bank will act as needed while observing economic developments. The bank believes that the biggest risks facing the economy are Trump wars with global economies, and the Bank will not allow politics to interfere with the bank plans to maintain the country's economic growth. US inflation figures this week, along with the release of consumer prices, retail sales and producer prices, will provide a clearer view of the markets regarding expectations from the Federal Reserve’s meeting next week, as weak inflation continues to affect the bank's future plans for further tightening.

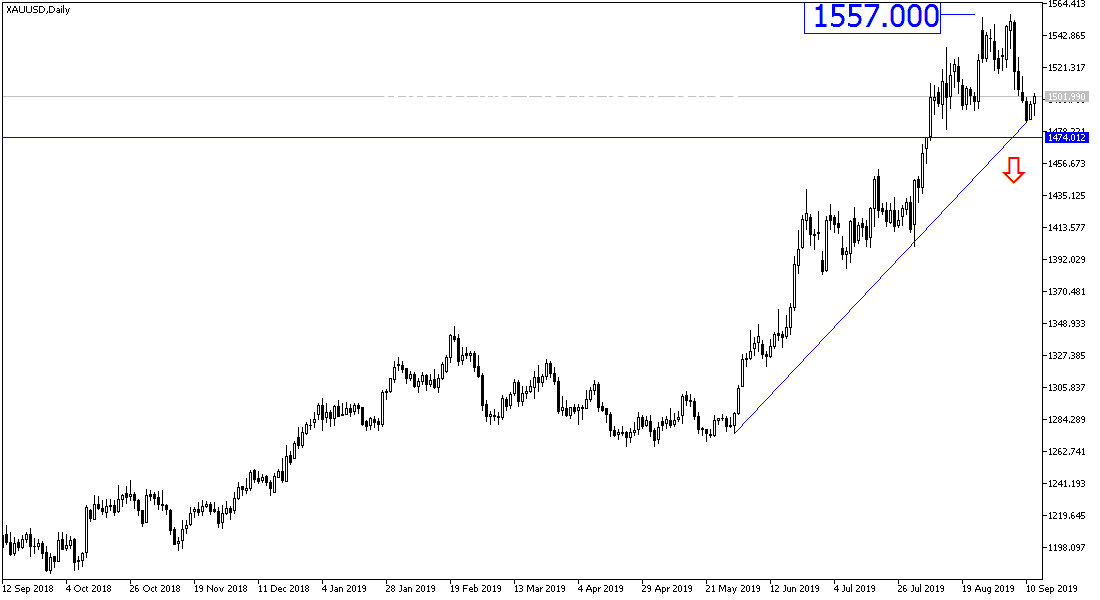

According to the technical analysis of gold: The $1500 psychological top is still the key to the strength of the pair's uptrend, and stability above that level as at the time of writing will support the return of price movement towards the 1511, 1525 and 1537 peaks, which will support the breach of it’s highest level in six years, which was recently recorded up to the top of $1557 at the beginning of this month's trading. On the downside, gold's closest support levels are currently at 1494, 1482 and 1475 respectively. I still prefer to buy gold from every bearish level.

Regarding the economic data today: Thursday is the most important on record for this week with the release of the US consumer price index, the ECB monetary policy decisions and the comments from Governor Draghi.