During the session on Wednesday Gold markets rallied slightly after initially dropping lower, hovering around the $1500 level. This is a market that looks very likely to find buyers in this area, especially as we are starting to reach towards the Friday session, as the European Central Bank will come into focus. There is an interest rate decision waiting to happen, and it’s very likely that we are going to continue to see a lot of volatility until we get there. However, it’s going to be a relatively tight range but the world is essentially looking towards the ECB meeting with the idea of quantitative easing coming. At this point though, the question is going to be how much is coming?

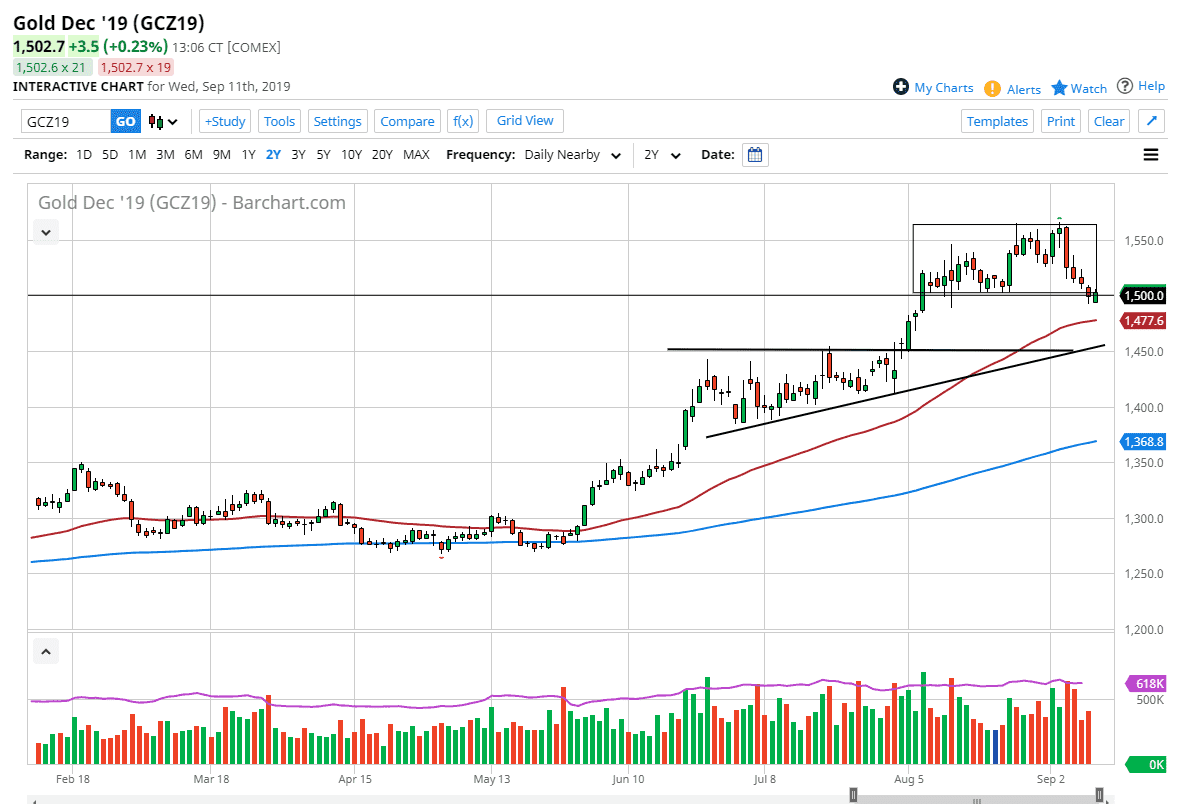

Looking at this chart, the 50 day EMA is just below the $1475 level so it’s very likely that we will continue to see support there, as well as the top of the ascending triangle that I have marked on the chart. In other words, there are plenty of places where the buyers could come back into this market, as we have been in a huge uptrend and central banks around the world are looking to cut interest rates going forward. In other words, it’s the perfect environment for precious metals to rise based upon a lack of yield across the world.

Beyond that, there are a lot of concerns out there that should continue to throw money at the precious metals markets, and of course Gold is the first place most traders will look to. With that being the case I think that it’s only a matter of time before this market rallies again. In fact, I’m not concerned about gold until we break significantly below the $1450 level, something that doesn’t look very likely to happen. All things being equal, the $1550 level has been resistance, and it will probably continue to be so. Looking at the chart, I don’t have any concerns whatsoever in the trade, but I do recognize that timing might be a bit crucial. Looking at the value of gold, we have run up pretty high recently, but given enough time it’s likely that we will continue to see a lot of volatility. We have recently seen a little bit of a call mean effect to the US/China trade relations, but it’s only a matter of time before that flares up as well.