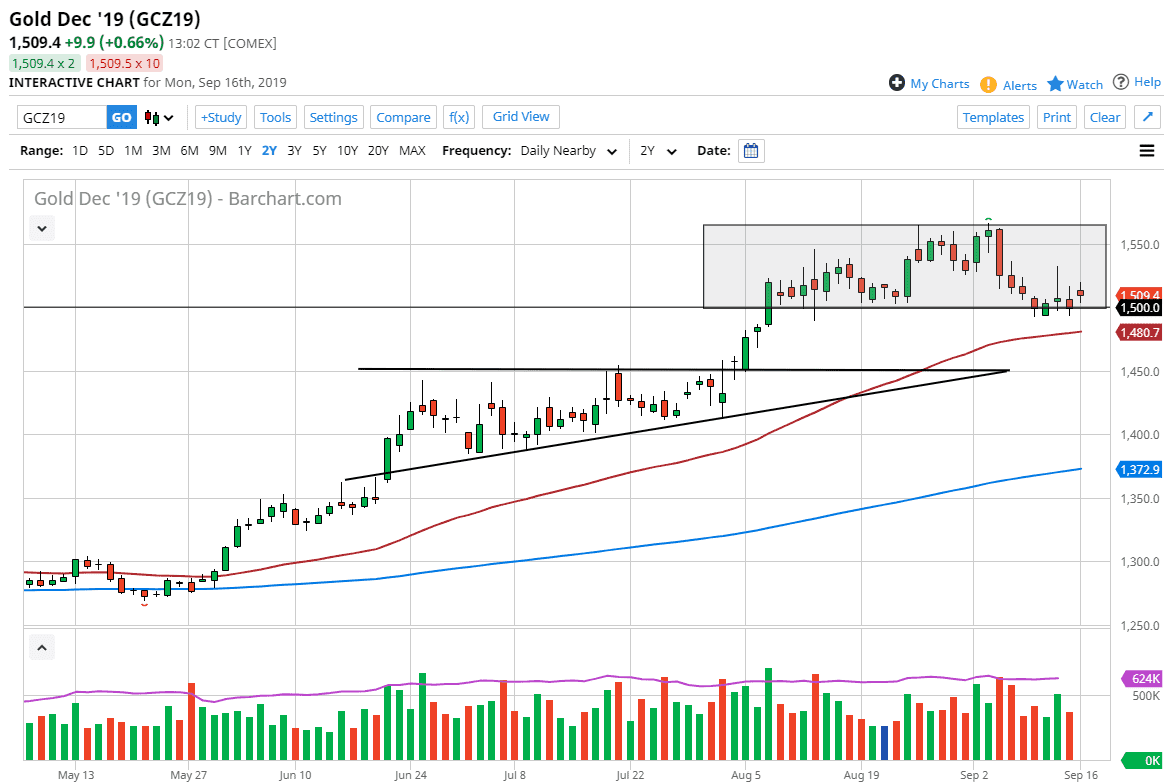

Gold markets gapped higher after the drone strike in Saudi Arabia against the oil refineries on Saturday. Gold markets offer a bit of a safety trade, and at this point it has been in a strong uptrend for quite some time. The $1500 level has offered support, which it was the bottom of the overall consolidation area. The $1600 level above will be resistance as we have bounced several times towards that area, and if we could break above there it’s likely that we could go much higher, with my longer-term target of 1800 being targeted, followed by the $2000 level.

The 50 day EMA is just below as well, and that of course offers a certain amount of dynamic support. Ultimately, the market breaking down below there would then go looking towards the $1450 level which is the top of an ascending triangle. All things being equal, I think there is more than enough support underneath to turn this market around. That being said, we could get a short-term pullback because it’s quite odd that we didn’t get more of a boost to the upside that we did. Because of this, I think we are going to continue to look for buying opportunities underneath, but I also recognize that if we were to break above the shooting star from Thursday, that would be an extraordinarily bullish sign.

One thing is for sure, I have no interest in shorting Gold, it’s just a matter of when I buy it. I like buying dips for value in a market that obviously is very strong longer-term. Overall, I think gold is in the beginning part of a massive bullish trend, not only because of all of the geopolitical concerns, but the fact that central banks around the world continue to cut interest rates. That obviously is very bullish for gold, as it destroys fiat currencies. Precious metals still continue to be a strong trend to the upside overall, but they had gotten ahead of themselves so it makes sense that we would have to pullback in order to build up the necessary momentum. With all of that, it’s likely that we continue to see a lot of volatility but longer-term traders will continue to push this market higher and towards the $2000 level, but it may take some time to get there.