Gold markets initially fell during trading on Wednesday but found enough support underneath to suddenly surge to a short-term fresh high. That being said, the breakout wasn’t exactly inspiring so it’ll be interesting to see whether or not we can get some type of momentum. In the short term, it’s very possible that we could continue to pull back as we head toward the jobs number. Remember, the jobs number is on Friday so the next day or so could be rather quiet in the financial markets.

That being said, there’s also the possibility that a headline crosses the wires that has people running for cover. The financial markets are on edge at all times now, and it seems like it’s only getting worse. In this environment, gold does fairly well as it is considered to be a safety play. Central banks around the world continue to ease monetary policy and that should continue to work in favor of gold markets.

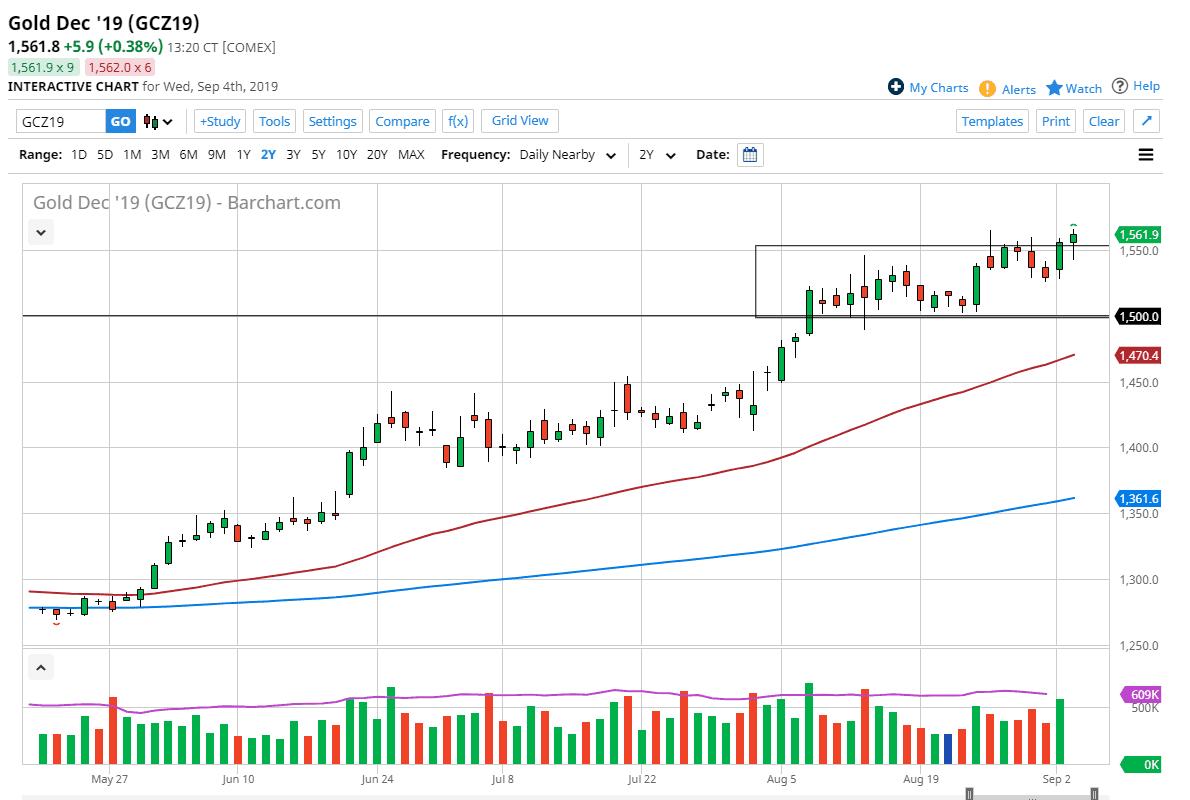

However, we have gotten a bit ahead of ourselves in some of the other precious metals markets, with a special attention paid to the silver market. With that in mind we could get a bit of a selloff over there which could have a bit of a “knock on effect” in this market. That should be thought of as a buying opportunity and both of those markets with special attention paid to the $1525 and $1500 levels below. The 50 day EMA is currently racing towards the $1500 level, so I think that will be an especially interesting place to find buying pressure. A break down below there opens up the door to $1450, where we had seen the top of a previous ascending triangle.

The alternate scenario is that we simply continue to go higher. That’s very possible, especially in this erratic environment that we find ourselves in. The US and China still are bickering at each other and that doesn’t seem like it’s going to end anytime soon. Central banks around the world continue to ease monetary policy and that seems to be more of a cyclical problem. In that environment, gold should do quite well over the longer-term but that doesn’t mean we will go straight up in the air. Look at pullbacks as opportunities to pick up gold “on the cheap” as it is most certainly in a significant uptrend at this point.