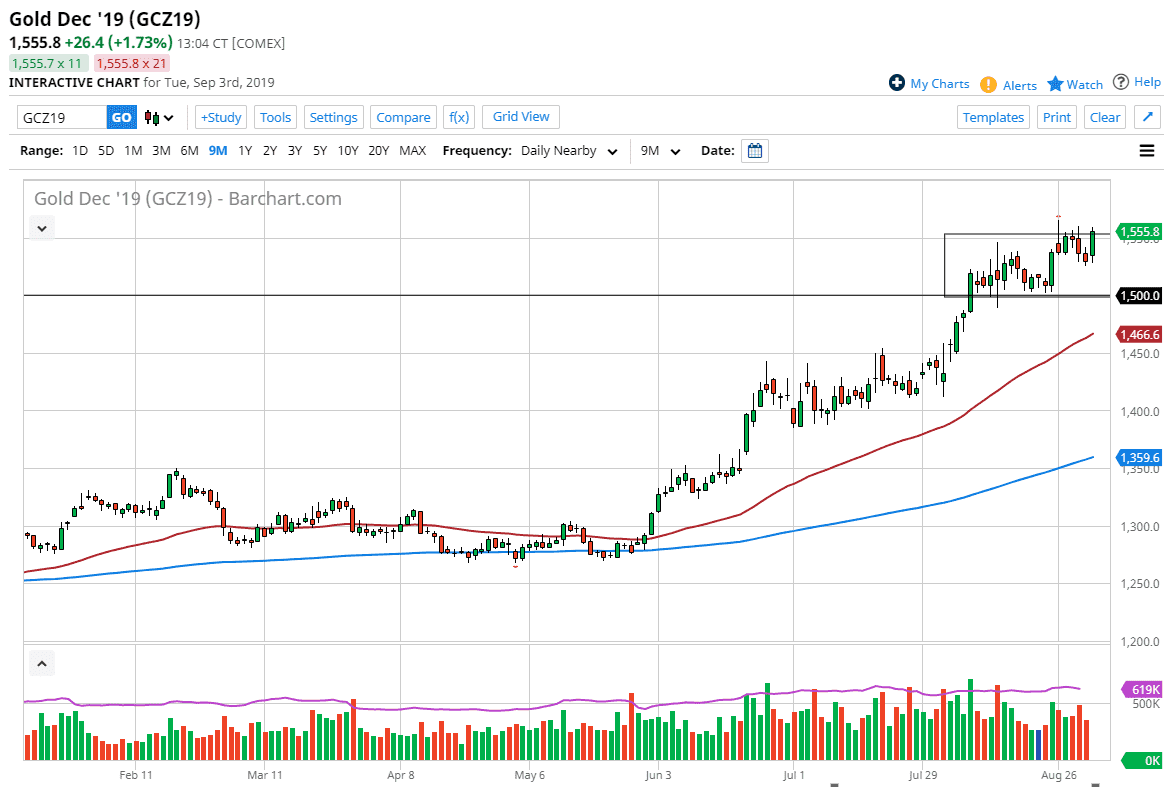

Gold markets rallied significantly during the trading session on Tuesday as traders came back to work. We are testing the highs again, so that’s something worth paying attention to as it signifies a perhaps we are going to break out to the upside again. The candle is showing signs of closing at the time, and that seems like a very bullish signal as well. The fact that we have recovered the losses of the last couple of days shows that the market will continue to see buying pressure, as short-term pullbacks will continue to show plenty of value going forward.

The $1500 level underneath should offer plenty of support, as it is a large, round, psychologically significant figure, and of course has previously offered support. If we can break down through there, then it’s likely that we will go down to the 50 day EMA, possibly even the $1450 level, which is the top of the ascending triangle that had formed previously. By doing so, the market is likely to attract a lot of attention if we do get down there. That being said though, it’s very unlikely to happen anytime soon, at least not unless something significant happens.

Remember, central bankers around the world continue to talk about cutting interest rates and loosening monetary policy in general. This puts upward pressure on the gold market as we continue to see a lot of money flowing into precious metals overall. While the gold market has been rather strong, it’s nothing compared to what we have seen in the silver market. With that being the case, one should recognize that perhaps silver could pull back and if it does, that could put downward pressure on this market. However, I look at that as a nice value opportunity and will without a doubt be willing to buy gold as the US/China trade conditions continue to get worse, and the economic slowdown continues to strengthen. With all that being said it’s very difficult to imagine a scenario that I am willing to short this market, so I am simply looking for value and look at pullbacks as gold “going on sale” and will treat it as such. I think that we are going to go looking towards the $1600 level, possibly even the $1800 level after that as the momentum certainly has made itself known.