The Gold markets are very likely to be extraordinarily noisy during the trading session on Wednesday, as the Federal Reserve comes out with an interest rate decision. Not only that, but we will have the statement and the press conference that could move Gold all over the place. If the Federal Reserve looks likely to cut rates as expected, that could give a little bit of support for the gold market, but at this point it comes down to forward guidance and of course this size of the interest rate cut.

Markets are likely to react somewhat in a benign manner due to a 25 bps rate cut, but if they go “all out” and cut 50 bps, the Gold markets could really take off. However, I suspect that the 25 bps rate cut is so much more likely scenario, and then we will be waiting for how hawkish or dovish the Federal Reserve sounds. At this point, they have just done a Repo Operation, and that of course suggests that liquidity could become a problem between banks. If that’s going to be the case, it’s very likely that the Federal Reserve will more than likely sounded very dovish and talk about the idea of quantitative easing. Ultimately, this is my best case scenario so I do believe that the gold market will probably rally.

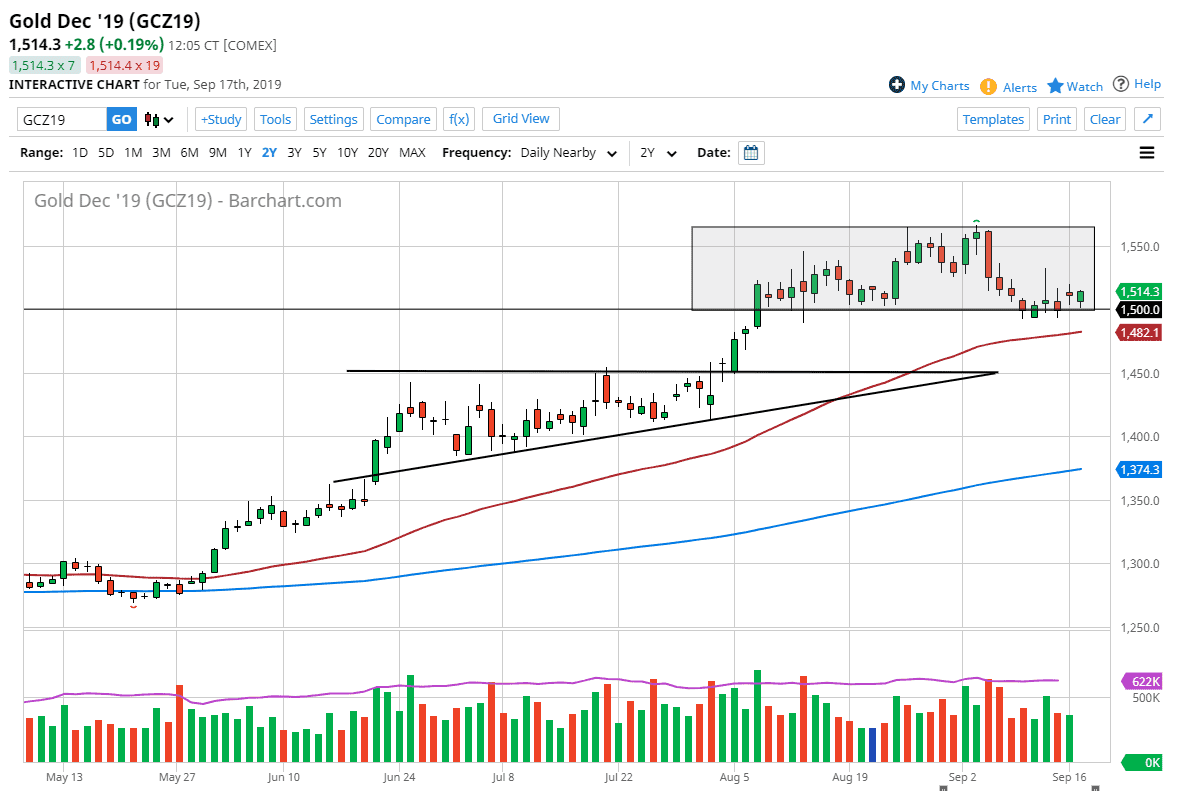

However, the 50 day EMA underneath could also offer support if we do end up falling down towards that level, just as the $1450 level could as well. That is the top of an ascending triangle, which of course is an area that would attract a lot of attention. Gold has been in an uptrend for some time, and if the Federal Reserve does anything to goose the market, gold should take off to the upside. In fact, it would take a serious misstep by the Federal Reserve to send gold markets to the downside. It seems very unlikely to happen though, because we have seen Jerome Powell make a few mistakes in the past, and one would have to think that he has learned his lesson not to disappoint Wall Street. At this point, I look at pullbacks as a nice buying opportunity at the first signs of a bounce. I’m a buyer of dips, but would also have to buy on a break out to the upside.