Gold markets broke down rather significantly during the trading session on Thursday as we continue to see a lot of volatility around the world. Gold markets sold off in reaction to more of a “risk on” move as the US and China are set to continue talking, showing signs of reconciliation in the early hours. That being said though, it’s very likely that there is some disappointment coming down the road.

The Americans and Chinese are light years away from any type of trade agreement, and it’s very likely that will continue to be the case. However, any signs of moving forward is typically reacted to quite positively by traders around the world and that will of course drive down the value of gold, as the “safe haven” aspect of it suddenly doesn’t have as much appeal.

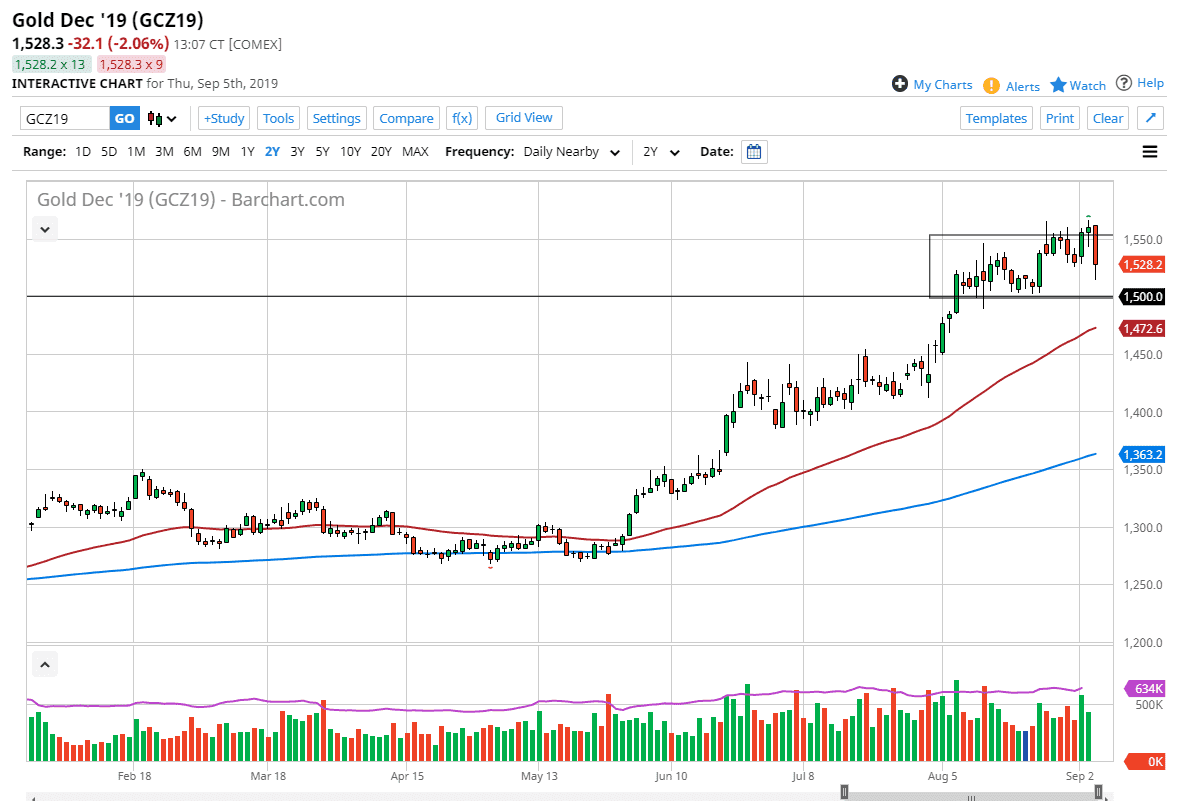

Ultimately, this is a market that continues to see bullish pressure but it was overdone, and it makes quite a bit of sense that we have seen this massive pullback. This is a very negative looking candle stick for the day on Thursday, and that does suggest that perhaps there is more downside to go. That being said though, it’s very likely that the $1500 level will offer a certain amount of support, and not only based upon the psychology of the large, round, psychologically significant handle, but the fact that the 50 day EMA is screaming towards that area does make quite a bit of sense for bulls to get back involved. Ultimately, we also have the $1450 level underneath offer them quite a bit of support as it is the top of the ascending triangle that sent this market higher to begin with. All things being equal I do think that we will get a short-term pullback and I think that short-term pullbacks should be thought of as a potential buying opportunity in a market that has further to go.

While we did get a bit of a “risk on” move during the day on Thursday, the reality is that central banks around the world continue to loosen monetary policy, and that will drive this market higher. With that in mind, I look at a pullback as an opportunity to pick up value, and not an opportunity to start shorting. Longer-term, I believe that the market probably goes looking towards $1600, perhaps even higher than that towards the $1800 level, possibly even the $2000 level after that.