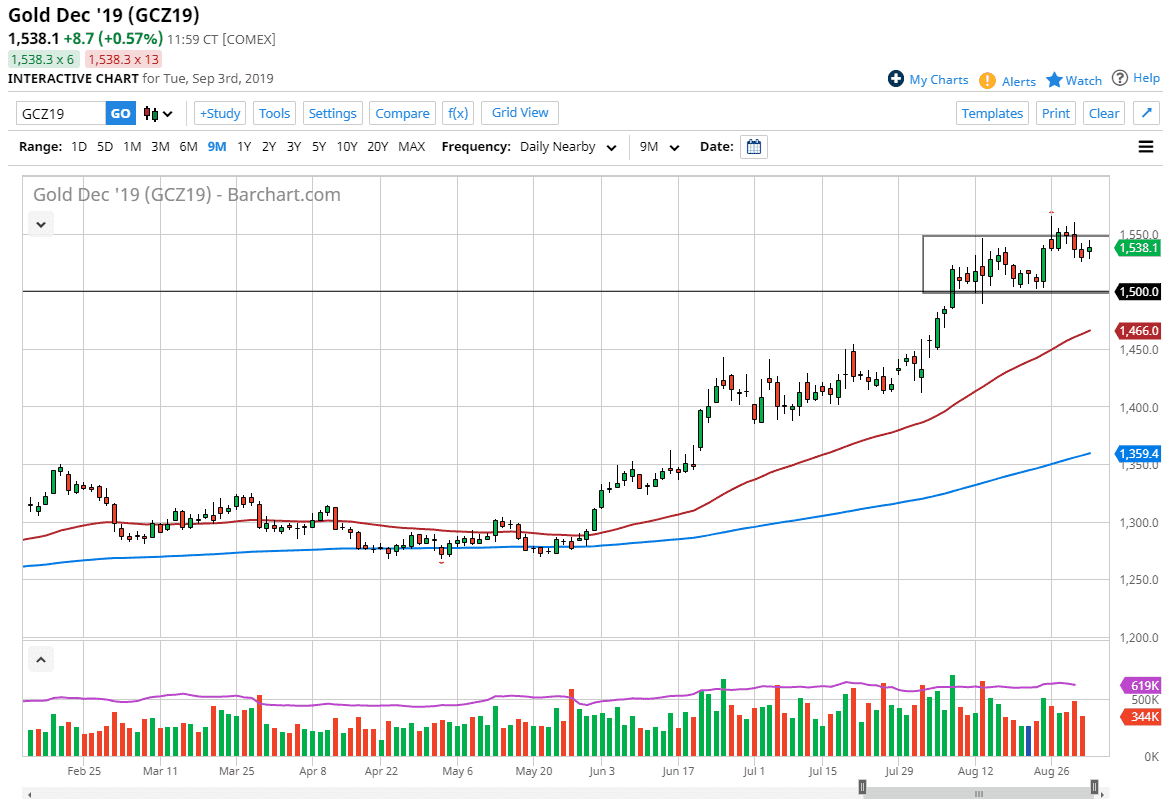

Gold markets have been somewhat quiet during the trading session on Monday, which isn’t a huge surprise considering that it was Labor Day in the United States. At this point, it looks very likely that we will continue the entire uptrend as we have broken above the $1500 level. At this point, we have rallied and broke above the $1500 level, and then pulled back to that area again, only to rally towards the $1550 level as well. At this point, I think it’s only a matter of time before we break out to the upside.

I still believe in the $1500 level underneath as massive support, as it is a large, round, psychologically significant figure. You can also make an argument for an ascending triangle that found the top at $1450 level that has not been retested yet. Furthermore, there is a 50 day EMA indicated that is between the two. In other words, I think there is plenty of support underneath to offer a buying opportunity but it’s going to come down to finding the right signal. I believe at this point it’s very likely that it continues to be a “buy on the dips” type of market, and therefore I think that selling is all but impossible, even though I do believe that we could get the occasional pullback. Furthermore, silver is parabolic at this point and the two markets do tend to move in tandem. Because of this I think we could see some type of massive selloff in silver that leads into selling in the gold market.

Regardless, there’s no interest whatsoever in trying to short this market, and therefore it’s likely that patience will be needed to take advantage of “value” as it presents itself. Ultimately, I think that the market continues to be very noisy but it obviously has a slant to the upside. Ultimately, I think that the market breaking below the $1450 level would be a sign that everything changes, but it’s very unlikely to happen in the short term. I believe the central banks around the world continuing to loosen monetary policy will continue to offer a lot of strength in this market. Beyond that, it’s very likely that global growth and just fear in general will continue to drive a lot of money around the gold market and other precious metals as well.