Despite recent US dollar gains, the price of gold continues its gains, which tested the $1,535 resistance, the highest since September 5, and was stable around that level at the time of writing. The recent gains were reinforced by the renewed concern over the failure of US-China trade talks and consequently retaliatory measures by both sides, as the prolonged conflict between the world's two largest economies threatening the future of global economic growth, and are beginning to show signs in the Eurozone. On the other hand, the Brexit reappeared, as the country's Supreme Court ruled that British Prime Minister Boris Johnson's decision to suspend the work of Parliament could be revoked, and the Parliament may return to its normal sessions from today, which complicates matters for Johnson to get the country out of the Union on 31 October.

The US dollar is vulnerable to comments from US Federal Reserve monetary policy officials this week, and since gold is one of the most important safe havens for investors in times of uncertainty, growing global tensions mean more purchases of gold. The opportunity is open to test stronger record levels, which could surpass six-year highs set earlier this month.

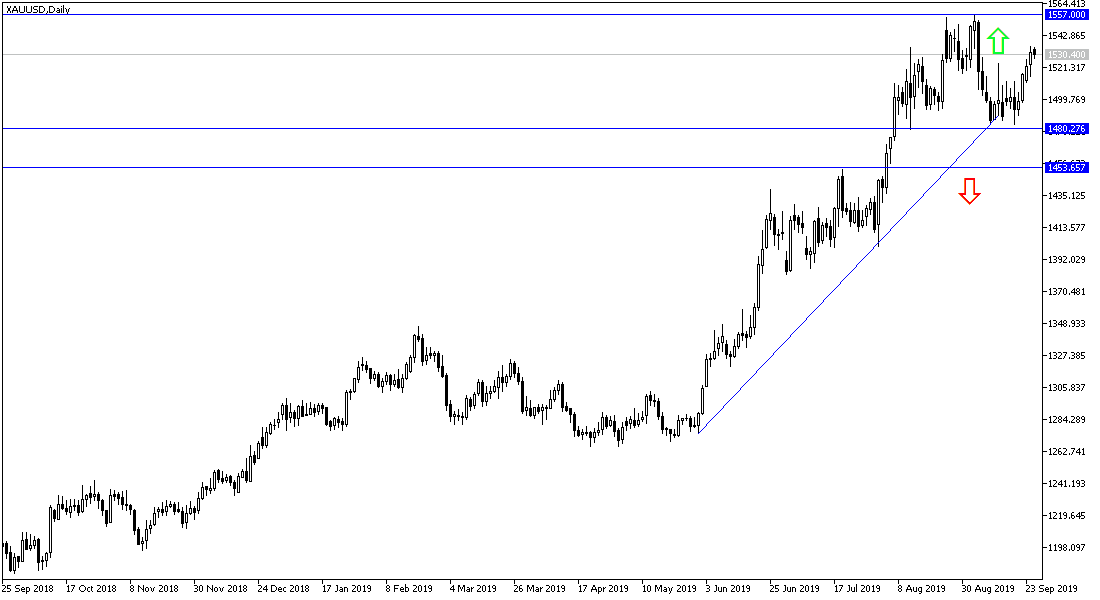

According to the technical analysis of gold: As I expected in the recent technical analysis, the stability of the gold around and above $1500 psychological resistance will continue to stimulate investors to buy more gold, and reached the levels we expected previously. At the moment, the nearest levels of resistance for gold are 1538, 1548 and 1560 respectively. The nearest buying levels are currently gold at 1521, 1515 and 1505 respectively. Continued global trade and geopolitical tensions makes the trading strategy continues to be buying from every low level.

On the economic data front today: The economic calendar today has no important European or British data and will focus on the announcement of new US home sales as well as statements by some members of the Board of Directors of the Federal Reserve Policy. Any shift in their tone toward the future of the bank's policy could directly affect the performance of the US dollar.