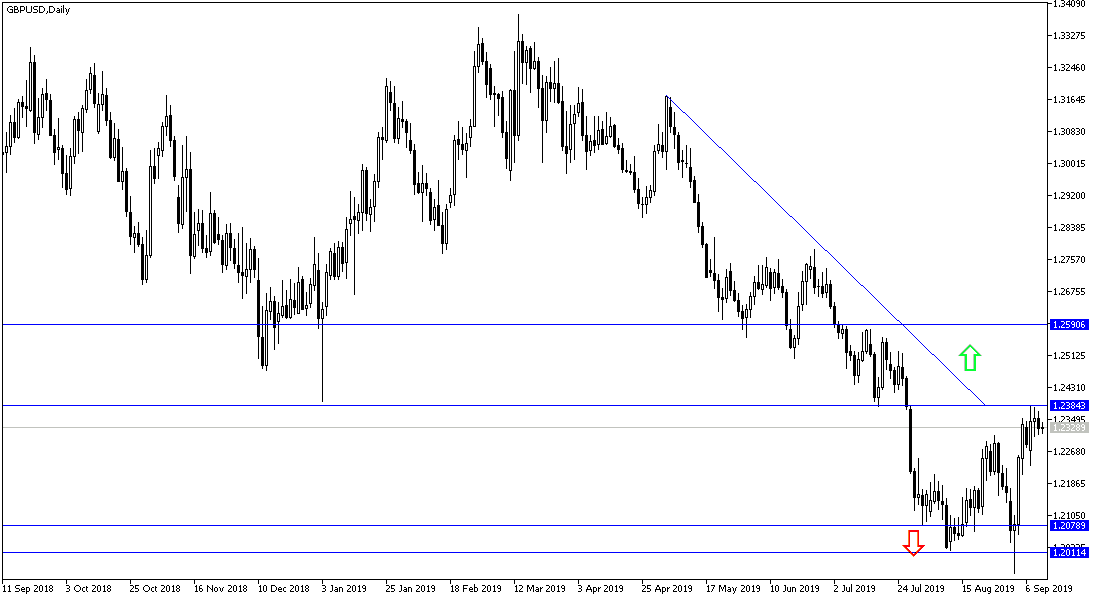

The technical outlook for GBP/USD remains unchanged. The pair still needs to breach the 1.2385 resistance it tested recently before settling around 1.2322 at the time of writing, to have a stronger correction chance. The dollar has gained momentum from the ceasefire in the trade war with China. Now the focus has shifted to the agenda of trade talks between the world's two largest economies. China has shown goodwill after it offered the White House an offer to buy agricultural goods ahead of talks aimed at easing the trade war, which is scheduled for next month. The report came as China unveiled a list of US products that will they will exempt from tariffs it announced earlier this year in response to US tariffs for alleged unfair trade practices and intellectual property theft.

Before that, investors sold the dollar against other major currencies on concerns about the impact of the trade war on the US economy and the Fed's interest rate outlook. But the recent positive mode is in favor of the US currency.

At the Brexit front the UK Parliament was suspended until mid-October and the new British Prime Minister, Boris Johnson, became handcuffed by the opposition and “rebels” from within his party. A Scottish court ruled on Wednesday that parliament's suspension was illegal, although the case would be fully resolved in an appeal at the country's Supreme Court next week.

According to the technical analysis, a fresh consolidation area for the GBP / USD on the daily chart warns of a strong move in one direction, and the nearest move will be bearish if it moves below the 1.2300 support level, and may move towards the support areas of 1.2300, 1.2245 and 1.2180 respectively in case of any negative Brexit developments and if the US inflation figures came in better than expected. On the upside, the pair still needs to breach through the resistance at 1.2390 to get stronger momentum that could lead the pair to the peaks of 1.2440 and 1.2600 respectively, and the last level will consolidate the strength of the uptrend. The Brexit still has the strongest influence on the Sterling against the other major currencies.

On the economic front, today's economic calendar does not contain any significant UK economic data. From the US, there is the CPI announcement and jobless claims.