With the announcement of the results of the UK's GDP growth and manufacturing output, we have noticed negligence from the GBP / USD performance, as the Brexit developments are the most influential on the GBP trends. The British House of Commons is a burning arena between British Prime Minister Boris Johnson and the Labor-led opposition. The ferociousness of the last sessions concluded that Britain would not leave the EU without an agreement, either on October 31 or otherwise. Parliament also prevented Johnson from holding early elections at a time very sensitive to the country's future. The price moved up towards the 1.2383 resistance during yesterday's session before settling around 1.2340 at the time of writing and ahead of the release of the jobs report in Britain.

On Friday, the official US jobs report was released, and we saw a mixed result in fewer than expected new jobs, an increase in average hourly wages and steady unemployment in the country. In general, a strong US labor market continues to support the Fed's adherence to its monetary policy, which is closer to tightening. This is contrary to the desire of Trump, who believes that the policy of the Bank impede his economic plans. The Governor of the Bank stressed last Friday that the Bank decides what it deems appropriate for the economic situation of the country, and that they are ready to act as necessary and with no consideration to the Trump administration policy.

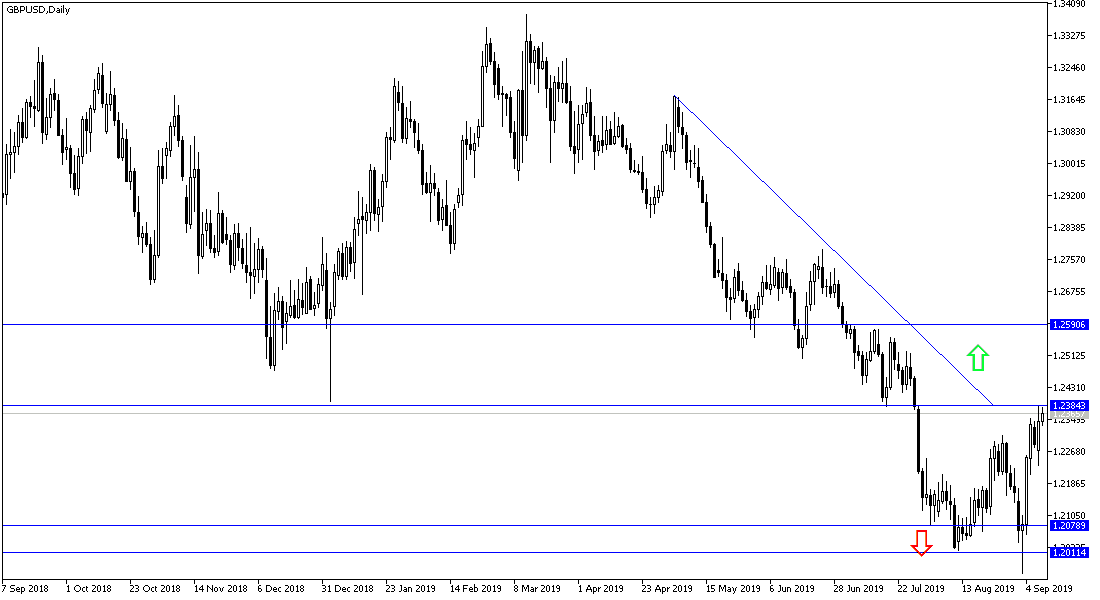

According to the technical analysis of the pair: The price of the GBP / USD will stick to its recent gains by trading above the resistance 1.2300 until the response of the European Union to the recent political events in Britain, and any positive development as to the desire of the European Union for a Brexit with a long-term trade agreement, would mean a stronger bullish momentum for the pair, and we may see resistance levels 1.2390, 1.2485 and 1.2620 respectively as soon as possible. These levels strengthen the break of the current downtrend. On the downside, any stability of the pair below the 1.2300 level will increase the bearish momentum to the 1.2245 and 1.2170 support levels and then to 1.2000 psychological support again.

On the economic front: The economic calendar on Monday will focus on the announcement of the change in British jobs, average wages and unemployment rate in the country. From the United States, we only have the announcement of the JOLTS numbers.