Recent hopes for a smooth Brexit outlook evaporated, and the GBP / USD pair lost most of its recent gains. Yesterday's session plunged from the 1.2500 resistance level, which was boosting the pair's strength, to the 1.2347 support, the lowest level in two weeks, amid the worst daily performance for the pair since the beginning of this month's trading. The strength of the US dollar, coupled with British political tensions after the reinstatement of the British Parliament bu the ruling of the country's Supreme Court, which saw Boris Johnson's decision as invalid and illegal, contributed to the pair's losses. The heated confrontation between Johnson and the opposition made him say that the House of Commons should step aside and let the government take care of Brexit as per the will of the people, or work to isolate him from his post.

"Our priority is to prevent the kingdom from leaving the EU without a deal and when we feel otherwise we will withdraw confidence from the current government," said Jeremy Corbyn, leader of the opposition on a television program. The government of Boris Johnson is a minority government, and therefore unable to make any progress in parliament, and the opposition seems determined to keep him hostage even after October 31, the official date of Brexit. The Brexit deal remains the only sure way to achieve significant and sustainable gains for the pound against other major currencies, primarily the US dollar.

For economic news, the US Commerce Department released a report showing that US new home sales rebounded strongly in August after a sharp decline the previous month. New home sales rose 7.1 percent to an annual rate of 713,000 homes in August after falling 8.6 percent to an average of 666,000 in July. Economists had expected new home sales to jump 3.9 percent to 660,000 from the 635,000 reported last month.

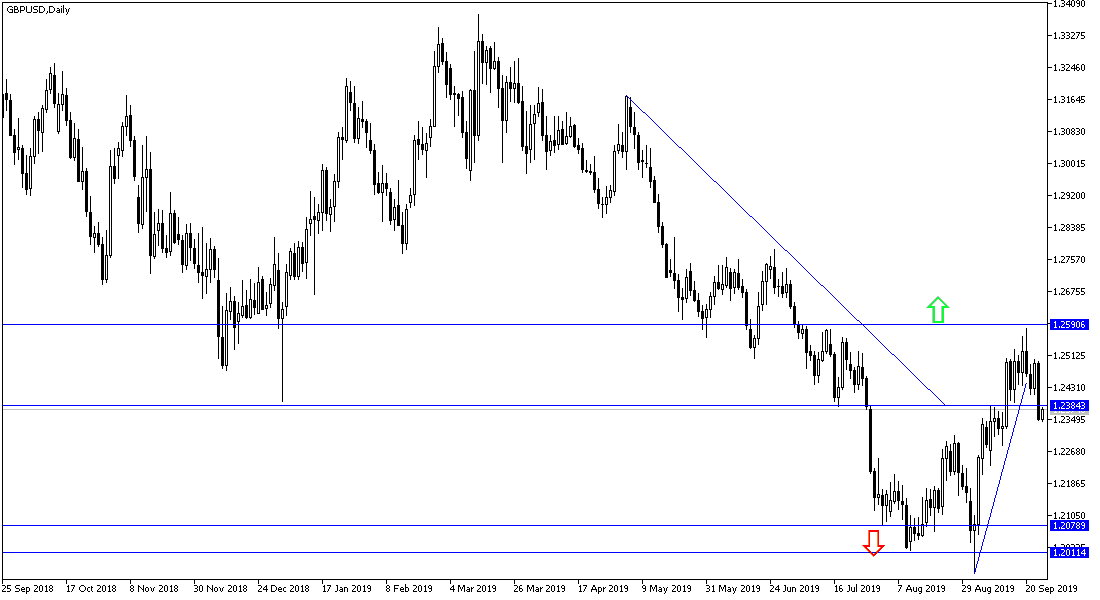

According to the technical analysis of the pair: The GBP / USD price approaching the 1.2300 support will restore the strength of the downtrend again and end expectations of the latest correction up. Bears will target 1.2218 and 1.2030 support over the long term. The bulls are hoping to bounce back to 1.2560 and 1.2750 peaks if confidence in a positive Brexit future returns.

On the economic data front today: From Britain there will be comments from Bank of England Governor Mark Carney. From the United States, there will be announcement of the most important figures; the country's GDP growth, jobless claims and pending home sales, followed by remarks by Federal Reserve Governor Jerome Powell.