Despite the resumption of the British-EU dialogue sessions on determining the Brexit path, the GBP/USD has stopped the correction which pushed it towards the 1.2505 resistance level, its highest level in seven weeks, and failed to penetrate it in the last two trading sessions, which was normal. That pushed the pair back to 1.2407 support at the time of writing. British Prime Minister Johnson and the president of the European Commission (EC) have agreed to intensify dialogue and negotiation sessions on a daily basis to reach an agreement to avoid a no-deal Brexit on Oct 31st. Johnson has suspended the work of the parliament not to hinder his goal of getting out of the bloc on schedule and in anyway, today, there is an important court ruling that would determine the legality of his action. The cancellation of the measure means renewed political conflict between the new British government and the opposition after heated sessions before the suspension of parliament, which ended with an agreement that Britain would not leave the union without an agreement either on Oct. 31 or on a delayed date. Early elections will not be held at Johnson's will.

Besides monitoring the developments of Brexit. The pair will react strongly to the US Federal Reserve's announcement of monetary policy decisions on Wednesday amid speculation that the central bank will follow the European Central Bank and cut interest rates by a quarter-point to counter risks to the strength of the US economy.

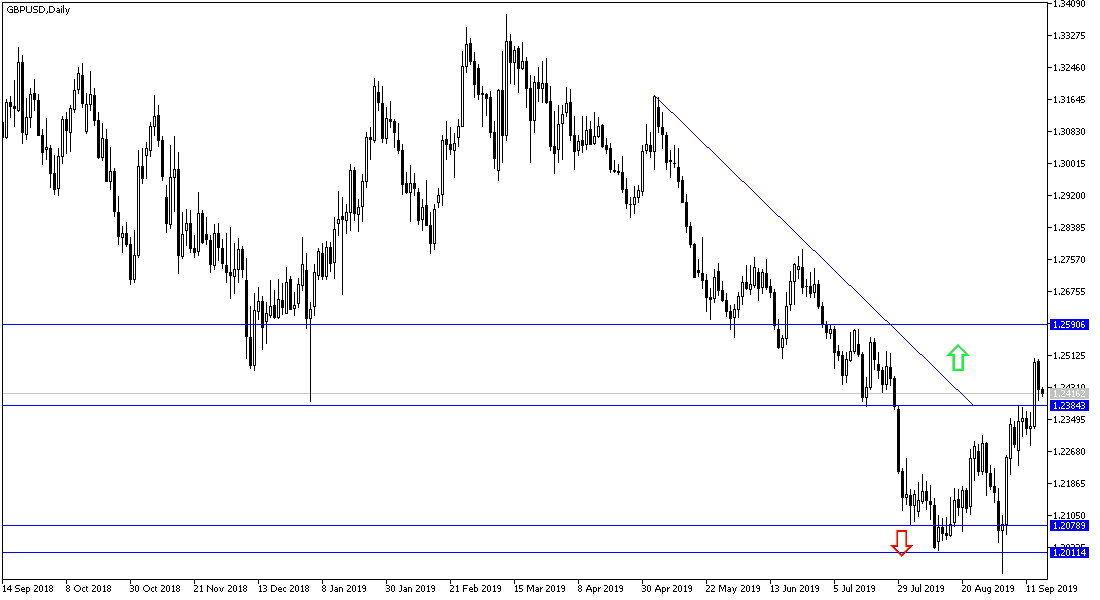

According to the technical analysis of the pair: the recent upward correction of the GBP / USD will strengthen again if the price to stabilize above the 1.2500 resistance, because it stimulates the move up. And as shown on the daily chart below, by move above that level, there will be a break of the downtrend, and would start a new stage which will be stronger if the upward correction completed to the resistance levels at 1.2560, 1.2620 and 1.2700 respectively. At the moment, the nearest support is currently at 1.2380 and 1.2300 and the last level will restore the bearish strength again and negatively affect the bullish correction expectations.

On the economic data front: The economic calendar has no important UK economic data for the second consecutive day. From the US, industrial production, capacity utilization and the NAHB housing market index will be released.