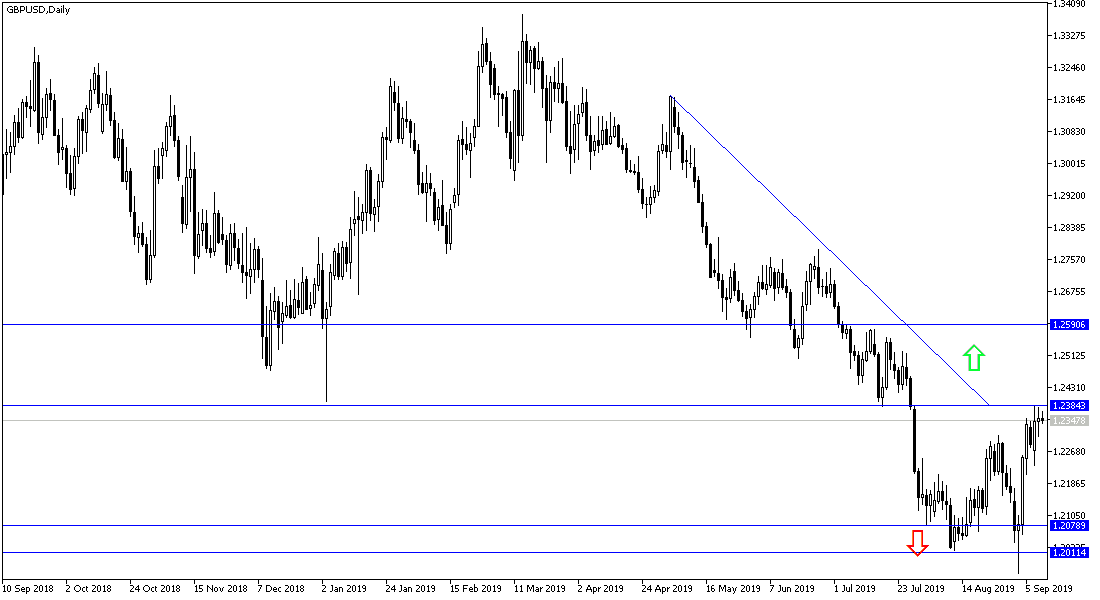

On the daily chart, and for three trading sessions in a row, the price of GBP / USD attempts to break above the 1.2384 resistance level to confirm the strength of the recent performance. That is a strong summit to face, which confirms that the bulls are struggling with the loss of sufficient momentum to complete the uptrend correction pace. The work of the British parliament was suspended for five weeks after fierce rounds between Boris Johnson and the opposition, which legally concluded that Britain would not leave the EU without an agreement either on the Oct. 31 deadline or after that. There would be no early elections as Johnson wanted as the time does not allow that to happen. The ball is now in the European Union (EU) court whether or not they will accept what the British government has reached to, or stick to their position.

A series of important UK economic data came out with positive and better than expected results, also contributed, along with the optimism of Brexit, to the pair's recent gains. Investors and economists are watching carefully the EU's reaction and whether they will renegotiate with Johnson or stick to their position, one of the two tracks will determine the future of the pound until the official exit date from the EU on October 31.

The US economy is far from recession, according to Federal Reserve Governor Jerome Powell and recent US economic data.

According to the technical analysis of the pair: Stopping the correction of the GBP / USD means that a new momentum is needed to complete the performance or prepare to return to the downside. Any new Brexit developments will be the strongest influencer of the pair's performance. For now, as long as the move is above 1.2300 resistance, the bullish momentum will remain intact and may strengthen if it moves towards the resistance levels at 1.2390, 1.2485 and 1.2600 respectively. The negative response from the European Union to the recent events in Britain will weaken the pair again and may move towards the support areas at 1.2320, 1.2245 and 1.2180 respectively, which negatively affect the expectations of the upward correction and support the return to the downtrend.

On the economic data front, the economic calendar today will focus on the US data, the main and core producer price index along with crude oil inventories. There are no significant UK data releases today.