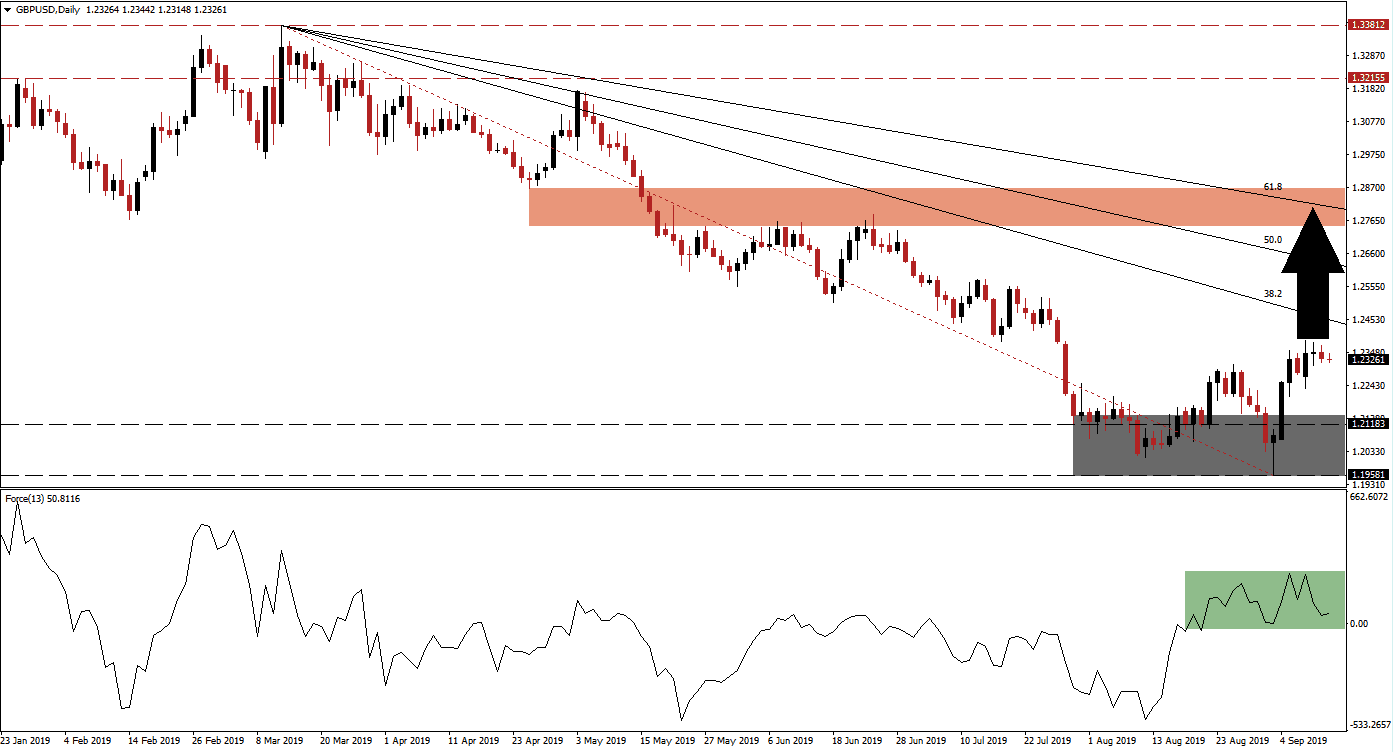

As the risk of a no deal Brexit appears to be averted for the time being, the GBP/USD was able to recover to the upside. This has resulted in a second breakout above its support zone, marked by the grey rectangle in the chart. Price action is now approaching its 38.2 Fibonacci Retracement Fan Resistance Level and bullish momentum is expected to be strong enough for a breakout above it. The higher high following the second breakout resulted in another bullish trading signal. The first breakout was reversed and a lower low was created at 1.19581. This was countered by a higher high with an expansion in bullish momentum. The 38.2 Fibonacci Retracement Fan Resistance Level will dictate price action moving forward from a technical perspective.

What is the Fibonacci Retracement Fan?

The Fibonacci Retracement Fan is a different visualization of the Fibonacci retracement sequence which outlines important support and resistance levels in technical analysis. Those levels warrant a closer look and offer entry and exit levels for trades together with other aspects of the analysis.

The Force Index, a next generation technical indicator, confirmed the breakout as well as the high high in the GBP/USD with a push above the 0 center line as well as a high high of its own; this is marked by the green rectangle. While bulls are currently in control of price action, the expansion has slowed down as price action is narrowing the gap to the 38.2 Fibonacci Retracement Fan Resistance Level. The next level to watch is for this currency pair to eclipse its current intra-day high of 1.23843 from where a breakout is expected of the Force Index can record a higher high of its own.

What is the Force Index?

The force index is considered a next generation technical indicator. As the name suggests, it measures the force behind a move. In other words, forex traders will get a better idea behind the strength of bullish or bearish pressures which are driving price action. The indicator consist of three components (directional change of the price, the degree of the change and the trading volume). This creates an oscillator which in conjunction with other aspects of technical analysis provides a good indicator for potential changes in the direction of price action. It subtracts the previous day closing price from today’s closing price and multiplies it by the volume. Strong moves are supported by volume and create the most accurate trading signals.

A successful breakout above the 38.2 Fibonacci Retracement Fan Resistance Level, confirmed by the Force Index, opens the way to the upside into its 61.8 Fibonacci Retracement Fan Resistance Level which is currently located inside of the 1.27450 to 1.28655 resistance zone, marked by the red rectangle. The increase in bullish momentum for the British Pound due to most recent Brexit developments coupled with the expected interest rate cut by the US Fed has created a fundamental scenario which favors an extension of the breakout.

What is a Breakout?

A breakout occurs if price action moves above a support or resistance zone. A breakout above a support zone could signal a short-term move, such as a short-covering rally which occurs when forex traders exit short positions and realize trading profits, or a long-term move such as the start of a trend reversal from bearish to bullish. A breakout above a resistance zone signals strong bullish momentum and an extension of the existing uptrend.

Volatility is likely to remain elevated as key fundamental events play out and important resistance levels are approached. The extension of the breakout in the GBP/USD above its support zone will remain intact as long the Force Index remains above 0 and price action can remain above the 1.22098 level. This level represents the intra-day low the day following the breakout. A push above the 38.2 Fibonacci Retracement Fan Resistance Level is expected to result in new net long positions which can move the GBP/USD into its next resistance zone.

What is a Resistance Zone?

A resistance zone is a price range where bullish momentum is receding and bearish momentum is advancing. They can identify areas where price action has a chance to reverse to the downside and a resistance zone offers a more reliable technical snapshot than a single price point such as an intra-day high.

GBP/USD Technical Trading Set-Up - Breakout Extension

Long Entry @ 1.23150

Take Profit @ 1.27600

Stop Loss @ 1.22000

Upside Potential: 445 pips

Downside Risk: 115 pips

Risk/Reward Ratio: 3.87

In the event that the Force Index contracts below 0 and if this move can be sustained, bears will take control of price action. A fundamental development in regards to Brexit is the most likely catalyst for a breakdown. A drop in the GBP/USD below the 1.22098 level will further drive price action to the downside which is then expected to lead this currency pair back into its support zone. The 1.19581 intra-day low, which represents the bottom range of the support zone, should be closely monitored in a breakdown event. Given the fundamental environment, any potential breakdown may be limited to the top range of the support zone at 1.21183.

What is a Breakdown?

A breakdown is the opposite of a breakout and occurs when price action moves below a support or resistance zone. A breakdown below a resistance zone could suggest a short-term move such as profit taking by forex traders or a long-term move such as a trend reversal from bullish to bearish. A breakdown below a support zone indicates a strong bearish trend and the extension of the downtrend.

GBP/USD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.21800

Take Profit @ 1.21200

Stop Loss @ 1.22100

Downside Potential: 60 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 2.00