For four trading sessions in a row, the price of the GBP / USD stabilizes around the1.2500 resistance level, awaiting for stronger catalysts to complete the pace of the upward correction that pushed it towards the 1.2526resistance, the highest in two months. The current bullish stability is on for an important date today with the release of British inflation figures and the US interest rate data. Expectations are growing that the Fed will cut interest rates by a quarter-point to counter the risks facing the US economy, led by the global trade war, which has begun to have a negative impact on the economy.

US President Trump asks Jerome Powell, governor of the Federal Reserve, continuously, to implement bigger and bigger interest rate cuts. Last week, he insisted that the Fed should cut rates to zero - or less, as the ECB did. Almost all economists outside the administration see this idea as unwise, if not reckless. Negative interest rates reflect severe economic weakness - something that does not characterize the US economy, with its strong and steady growth, strong consumer spending, and unemployment near a half-century low.

On Brexit developments, British Prime Minister Boris Johnson is awaiting a court ruling on the legality of his suspension the British parliament’ work at a very sensitive time determining the fate of the country. The political struggle within the House of Commons concluded that Britain would not leave the EU without an agreement either on Oct. 31 or any other postponed date. Early elections will not be held at Johnson's will.

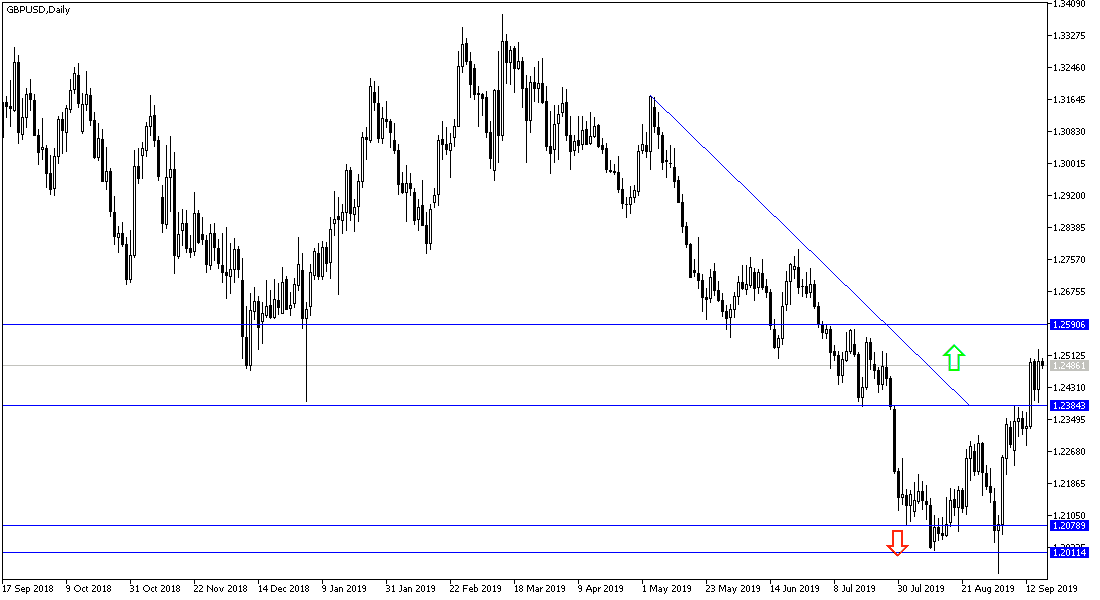

According to the technical analysis of the pair: On the GBP / USD daily chart, it seems clear that we are breaking the downtrend and the shifting towards the rise. Stability above 1.25 will spur performance and will strengthen the upward correction if it moves towards 1.2560, 1.2620 and 1.2710 respectively. I still prefer to sell the pair from every bullish rebound. On the downside, the closest support levels are currently at 1.2440, 1.2380 and 1.2290 respectively and the last level will restore the bearish strength again and negatively affect the bullish correction expectations.

On the economic data front: Today's economic calendar will focus first on the release of the UK consumer price index and producer prices. And from the United States of America building permits and housing starts. Then the Fed's monetary policy decisions and the remarks of its governor Jerome Powell.