By the end of last week's trading, the GBP / USD fell from the 1.2581 resistance, a two-and-a-half month high, to the 1.2460 support, and stabilized earlier this week around 1.2485 at the time of writing. Despite the rebound, the pair's bullish correction is still a chance, especially if optimism persists about the imminent agreement between Brexit parties - the EU and Britain - on finding a formula to avoid a no-deal Brexit, which would be devastating to both sides.

Last week included the announcement of monetary policy for both the Bank of England and the Federal Reserve. The former maintained its monetary policy until the final decision on Brexit and then will determine its most appropriate policy. The Fed Reserve cut the US interest rate by a quarter point to counter the risks faced by the US economy, and the bank stressed that the pace of cuts is not taken into account the pressure from US President Trump, and that the bank is acting as deemed appropriate to the state of the economy. The consequences of the global trade war remain the biggest risks facing the US economy, especially with no strong indications that the conflict may be resolved soon.

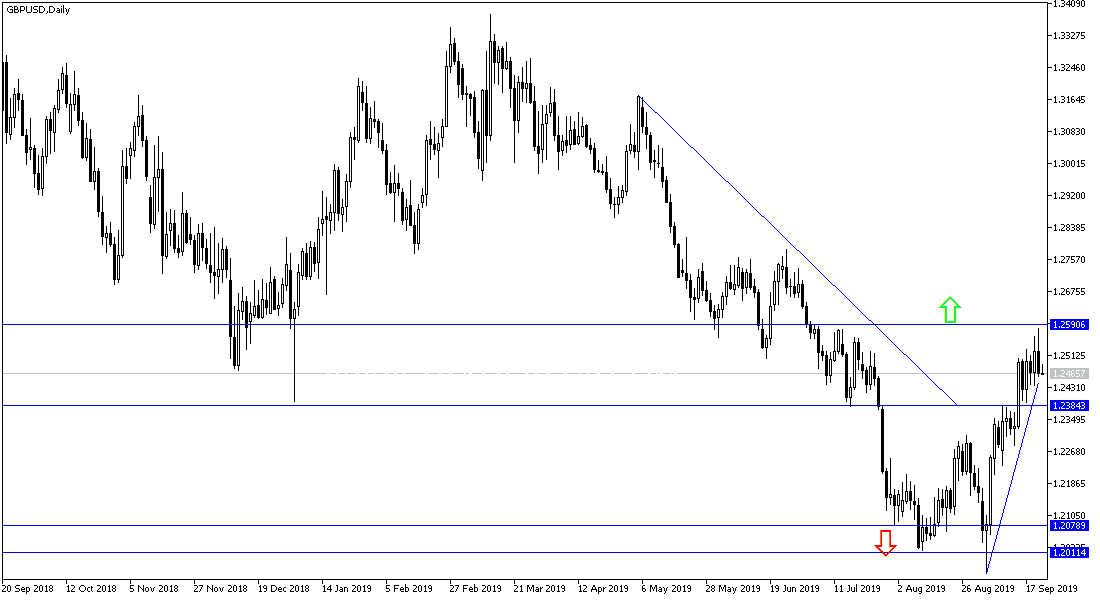

According to the technical analysis of the pair: Charting studies indicate that the GBP / USD may continue to rise steadily in the near term with the new bullish trend. A break of the 1.2581 resistance level recorded last week will support the move up to 1.2700 resistance and the RSI shows some decline after peaking in the middle of this month. The weekly chart is showing a strong rally from recent major lows, and that it may first reach the 1.3000 psychological top if a Brexit deal is agreed. At the moment, the nearest support levels are 1.2435, 1.2380 and 1.2300 respectively. Care should be taken to monitor Brexit developments, which has the most influence on the pound’s performance at this important time.

On the economic data front: Today's economic calendar has no significant economic data announcements from either the UK or the US. The pair may be influenced by Fed policy statements later in the day.