head of the Bank of England's monetary policy decisions, the GBP / USD pair is trying to hold to gains around the 1.2500 resistance, which supports a break of the downtrend. The pair is stable around the 1.2475 level at the time of writing. Expectations are sure that the Bank of England may keep interest rate at 0.75% and the asset purchase plan valued at £ 435bn, unchanged. The Bank Policy members voting is expected to be unanimous at 9-0-0, awaiting to see the path of Brexit, whether it will be with or without a deal, and determine its monetary policy accordingly.

Yesterday, the US central bank announced another cut in the US interest rate as expected, hence the rate reached 2.00%. External risks continue to negatively affect the country's economic outlook. In particular, there are no strong signs of a radical end to the trade dispute between the world's two largest economies. The Fed's economic outlook suggests that participants in the meeting are divided over the future of interest rates. Seven participants expect another rate cut before the end of the year, five expect rates to remain unchanged, and five expect rates to rise. The US central bank reiterated that it will act as necessary to maintain economic growth, with a strong labor market and inflation near its 2 percent target.

The Brexit parties - the European Union and Britain - are now trying to find ways to get out of the crisis, the negotiation developments will have a strong impact on sterling's performance in the coming days.

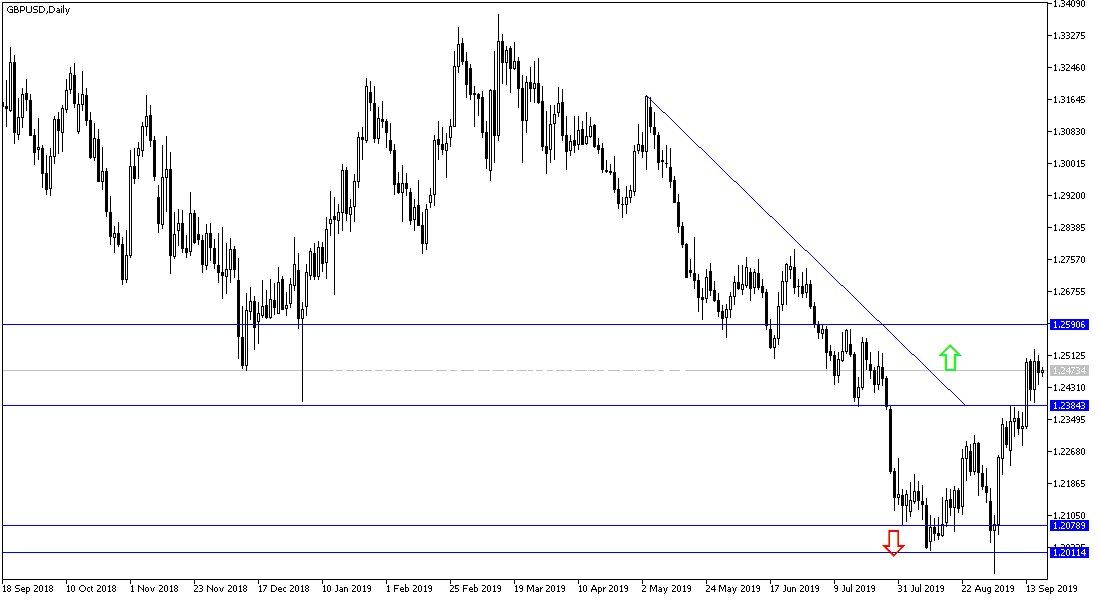

According to the technical analysis for the pair: Stability of the GBP / USD above 1.2500 resistance gives a momentum for the upward correction and the momentum will increase if it moves towards the resistance levels at 1.2560, 1.2620 and 1.2710 respectively. Despite the optimism, I still prefer to sell the pair from every bullish rebound, as the future of Brexit remains uncertain, and the continuing dispute between the two parties means an exit without a deal. If the downtrend is completed, the nearest support will be at 1.2440, 1.2380 and 1.2290 respectively, and the last level will restore the bearish strength and then we will see stronger lows.

On the economic data front: Today's economic calendar will focus first on UK retail sales, followed by the Bank of England's monetary policy decisions and the vote of the members of the Bank's policy. From the United States, jobless claims, the Philadelphia Industrial Index, current account and then existing home sales.