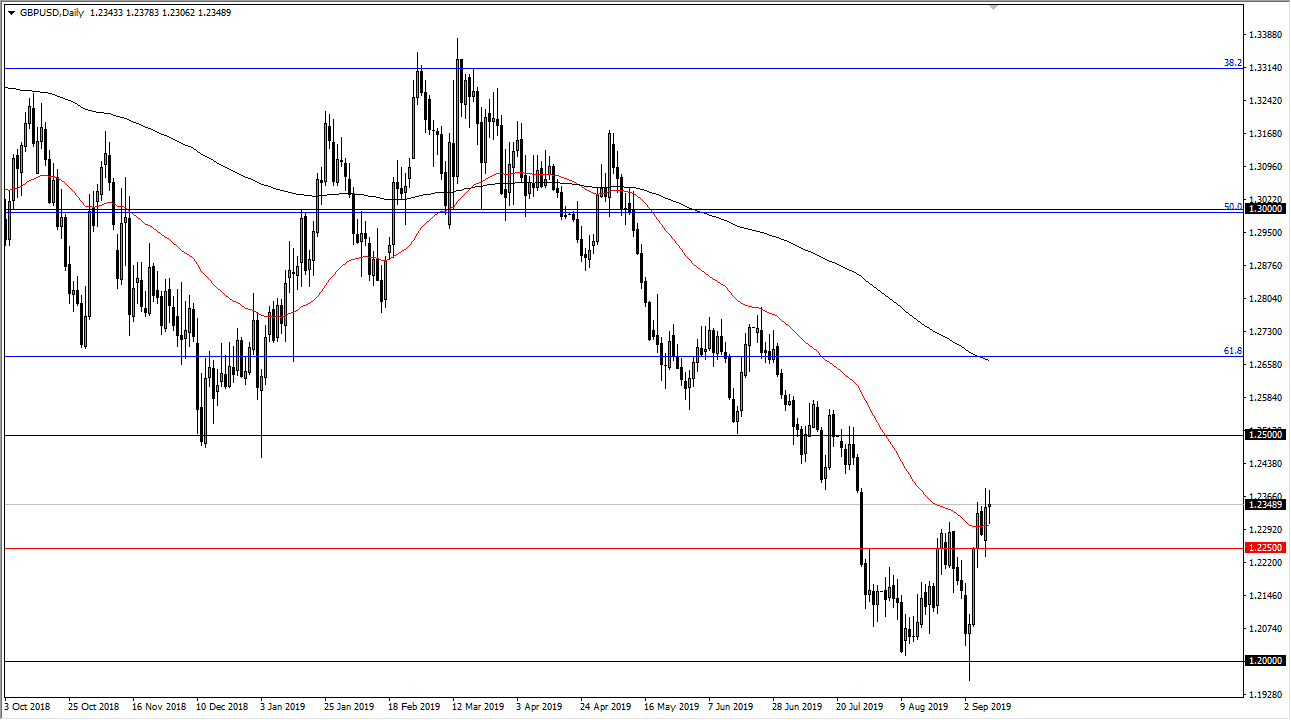

The British pound went back and forth during the trading session on Tuesday, as we continue to see volatility everywhere. Beyond that, we also have the problem out there involving the Brexit that could come into play, and as we have to worry about what comes next. With that in mind, the reality is we have no idea what comes next. As long as that’s going to be the case, I feel that the British pound will be difficult to own. Overall, the British pound should be thought of as being a bit overextended right now, and even if we were to rally from here, I find it very hard to believe that we will get above the 1.25 level.

In fact, I look at the 1.25 level as essentially the “ceiling” in the market until we get through some time and more importantly, get some details when it comes to the Brexit. I anticipate that we will get another major flush lower, and then perhaps start to stabilize. It’s that stabilization timeframe that will be crucial, which could send this market much higher longer term. Until we get that, I don’t think that the British pound has much of a future as far as buyers are concerned.

With all of that being said it should also be noted that the US dollar is favored due to the high yield found in America, especially when it comes to European bonds. The European situation is tenuous at best, and at this point it’s likely that even if the British decide to stay within the European Union, that rally will also be sold as there are a ton of zombie banks in the EU to worry about, recession, and a whole host of other situations such as negative yielding bonds that has money flowing out of the continent. In other words, even with all of the uncertainty in the Brexit situation, staying in the European Union isn’t necessarily a recipe for success anymore either. We need to see some type of massive flush lower, stabilization, and then you may see value hunters coming back into the market.

That being said, I fade rallies that show signs of exhaustion, especially if we break towards the 1.25 level that I see not only is a large, round, psychologically significant figure, but also a structurally important level that will be backed up by the 200 day EMA heading towards it.