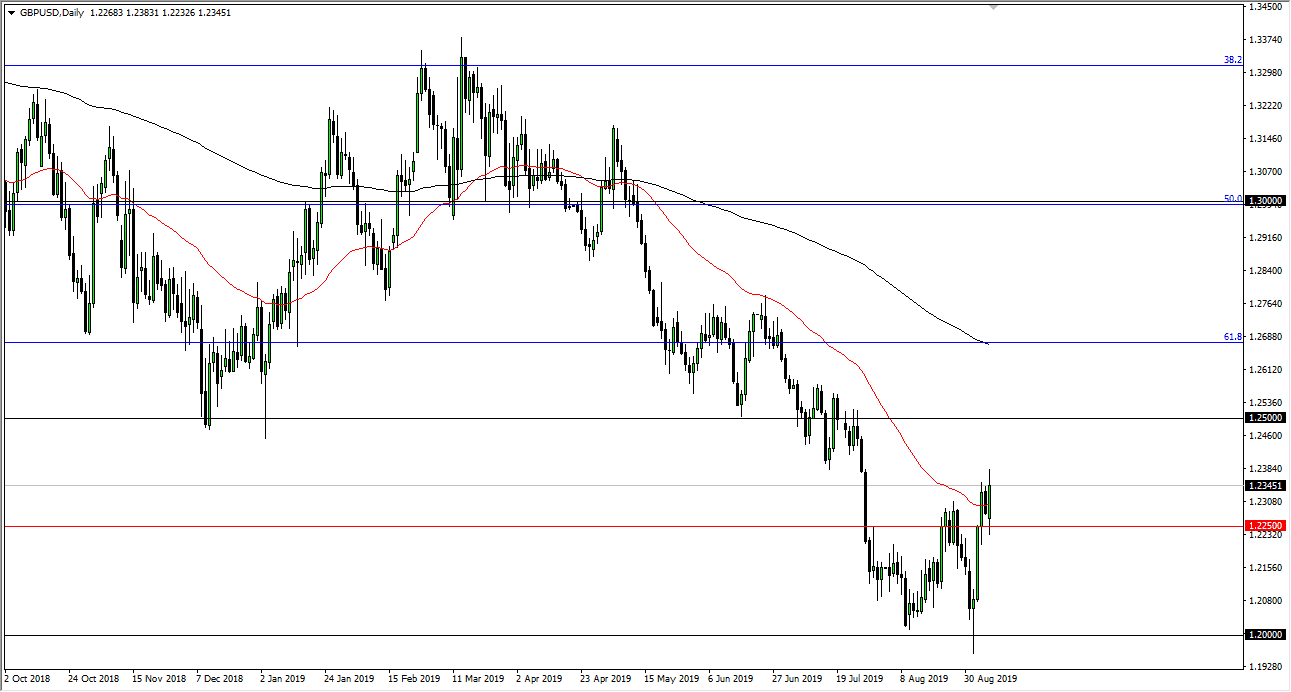

The British pound went back and forth during the trading session on Monday, as we continue to dance around the 50 day EMA. This makes quite a bit of sense, considering that the Brexit is still an absolute nightmare and a complete mess. With all that being said, it’s likely that the markets will have to deal with some type of nonsense coming out of either London or Brussels, and as a result I suspect it’s only a matter time before the British pound rolls over. The 1.25 level above is the place I’m looking at to start selling, because there are plenty of reasons to expect the structural problems there to cause major damage.

With that being the case, you should also recognize that the drama surrounding Boris Johnson will continue to cause issues unless there’s some bit of magic. There is a lot of uncertainty when it comes to the Brexit, and that will continue to cause major issues. Markets hate Brexit drama, because it’s never-ending. Uncertainty is one of the worst things you can have attached to an asset and the British pound certainly has plenty of it.

I suspect that most of what we have been seen has been short term short selling being covered, but longer-term traders are still very negative on the outlook for the British pound. To the downside, the 1.20 level would of course be very crucial, as it is a major round number and the area that we have bounced from. Ultimately, if we break down below the hammer from several sessions ago at that level, then it opens up the floodgates to the 1.18 handle, and then possibly the 1.15 level after that.

Keep in mind that the US dollar is considered to be a “safety currency”, and that is a perfect reason to think that it will continue to strengthen against the British pound, at least until the Brexit is done. Right now, we don’t even know if there’s going to be a Brexit. The nonsense continues in the United Kingdom, and that will continue to make the British pound a very difficult currency to own. On the other hand, you get more stability out of the greenback so it makes quite a bit of sense that it should continue to strengthen overall. The downtrend continues to be the best way to look at this market, but you may need to be patient.