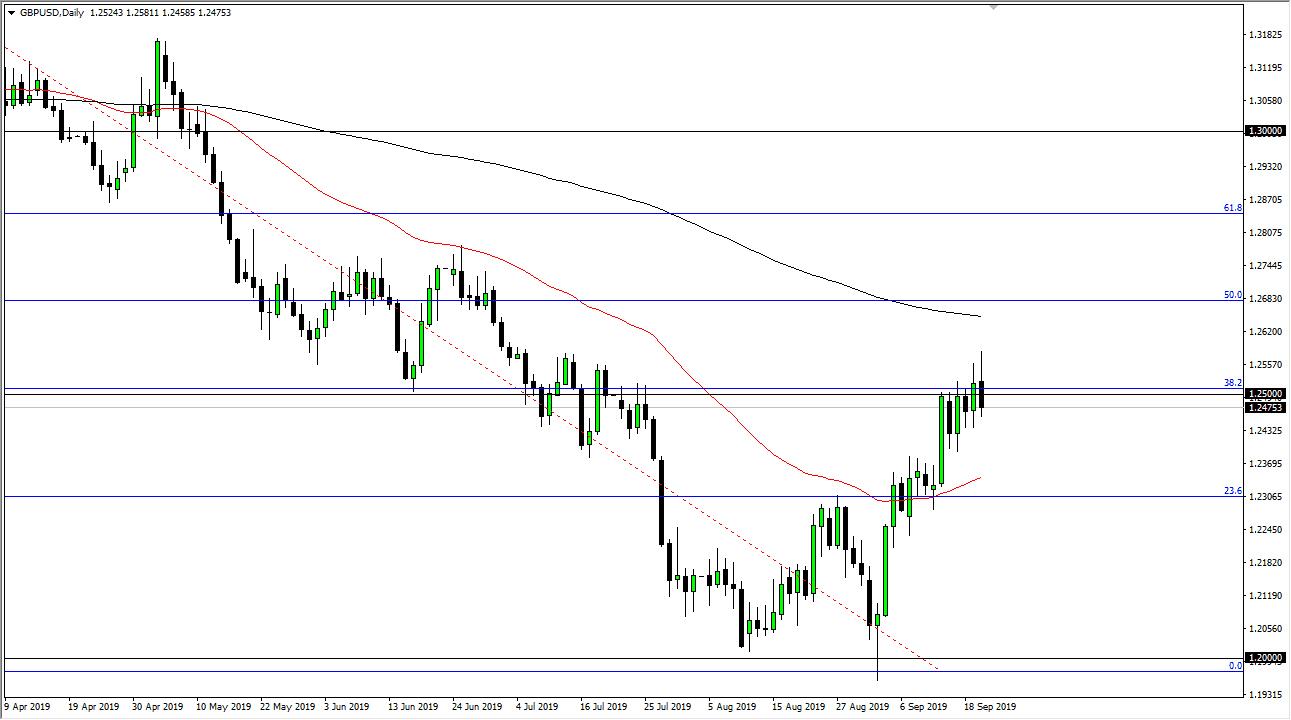

The British pound initially tried to rally during the trading session on Friday but gave back quite a bit of the gains. We continue to see a lot of selling pressure above the 1.25 GBP level, and now we are even starting to form something akin to a rising wedge, and it looks as if the market is starting to get a bit exhausted. This would make sense as we are at the 38.2% Fibonacci retracement level beyond the fact that it is the 1.25 GBP level.

Large, round, psychologically significant figure levels like this one will attract a lot of order flow, so it makes sense that the market runs out of momentum here. It has been a rather parabolic lately, so a bit of a pullback makes quite a bit of sense. Beyond that, the Brexit continues to cause major issues, so therefore it’s difficult to imagine a scenario where the British pound is something that people suddenly want to start buying hand over fist. At this point it’s likely that the move has essentially been more or less a “dead cat bounce”, or perhaps even more likely a bit of a short covering rally.

The 200 day EMA is currently just below the 50% Fibonacci retracement level and I see a ton of order flow between here and there. That being the case it’s likely that we will see sellers jump back into this market on rallies before we eventually break down significantly. Once we do get that breakdown it’s likely we go to the 50 day EMA which is pictured in red, hovering around the 1.23 GBP level currently.

After that, the market then goes down to the 1.20 level, and at this point it’s likely that we have to have a serious conversation about whether or not we can continue the downtrend. There is more than likely going to be a lot of headlines coming out of the UK over the next several days as far as Boris Johnson’s suspension of parliament and a whole host of other issues, so expect messy and sloppy trading but certainly there is a bro risk of a major selloff at any point with a headline. Beyond that, the US dollar has been strengthening in against several other currencies anyway, so this is a bit of a “double whammy.” Keep your position size relatively small.