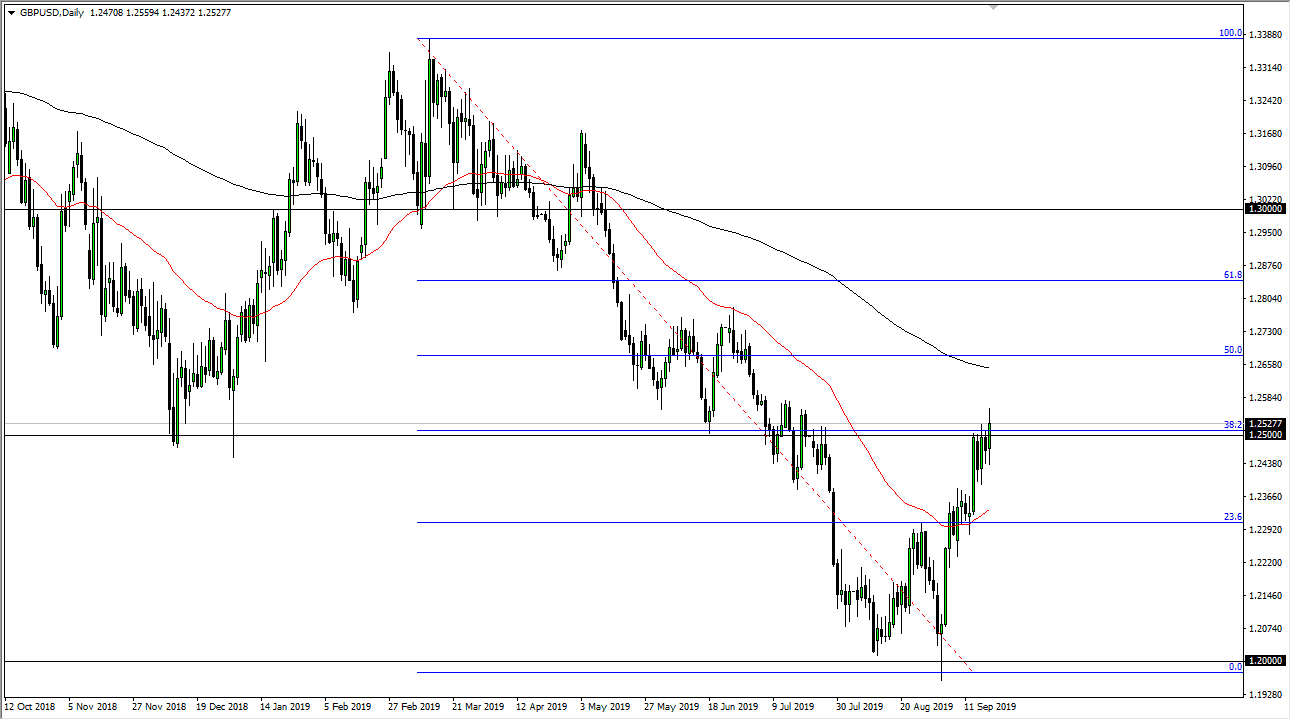

The British pound has enjoyed a nice rally over the last several weeks, breaking above the 1.25 level during the trading session on Thursday. At this point though, we are testing the 38.2% Fibonacci retracement level, and of course an area where we had seen the lot of noise previously. That being the case it makes sense that we will continue to see a lot of volatility in this area. Yes, it appears that the Europeans may be trying to soften their tone a bit, but at the end of the day the Brexit is still a major problem.

If we can break below the bottom of the last couple of days, then the market probably drops down towards the 1.23 level, possibly even the 1.2250 level, followed even further by the 1.20 level underneath. If we are to trying to go higher, there is a lot more resistance than there is support at this point. The noise carries all the way up to the 200 day EMA and the 50% Fibonacci retracement level at the very least. Frankly put, all we need is some type of bad headline to send this market right back down. That doesn’t necessarily mean that it will happen right away, but I do think at the very least the market needs to pullback in order to offer more value. The British pound really can’t be trusted until we get close to a deal, and although there’s been nicer words set over the last 24 hours, the reality is that the market has not seen a deal, so therefore it will be a while before any true buying of British pounds can happen. This is probably more or less a short-term covering situation.

If we did get a daily close above the 200 day EMA, then you could start to see a trend change, because even if you miss that much of it, it would still be very early in the cycle. Because of this, this market will probably be a very profitable market one way or another, but we need to wait for some type of significant signal. We have not received it yet and being patient is the key. All things being equal, we are still in a downtrend regardless of how parabolic things have been in the last few weeks. The noise surrounding the British pound continues to make this market difficult.